Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

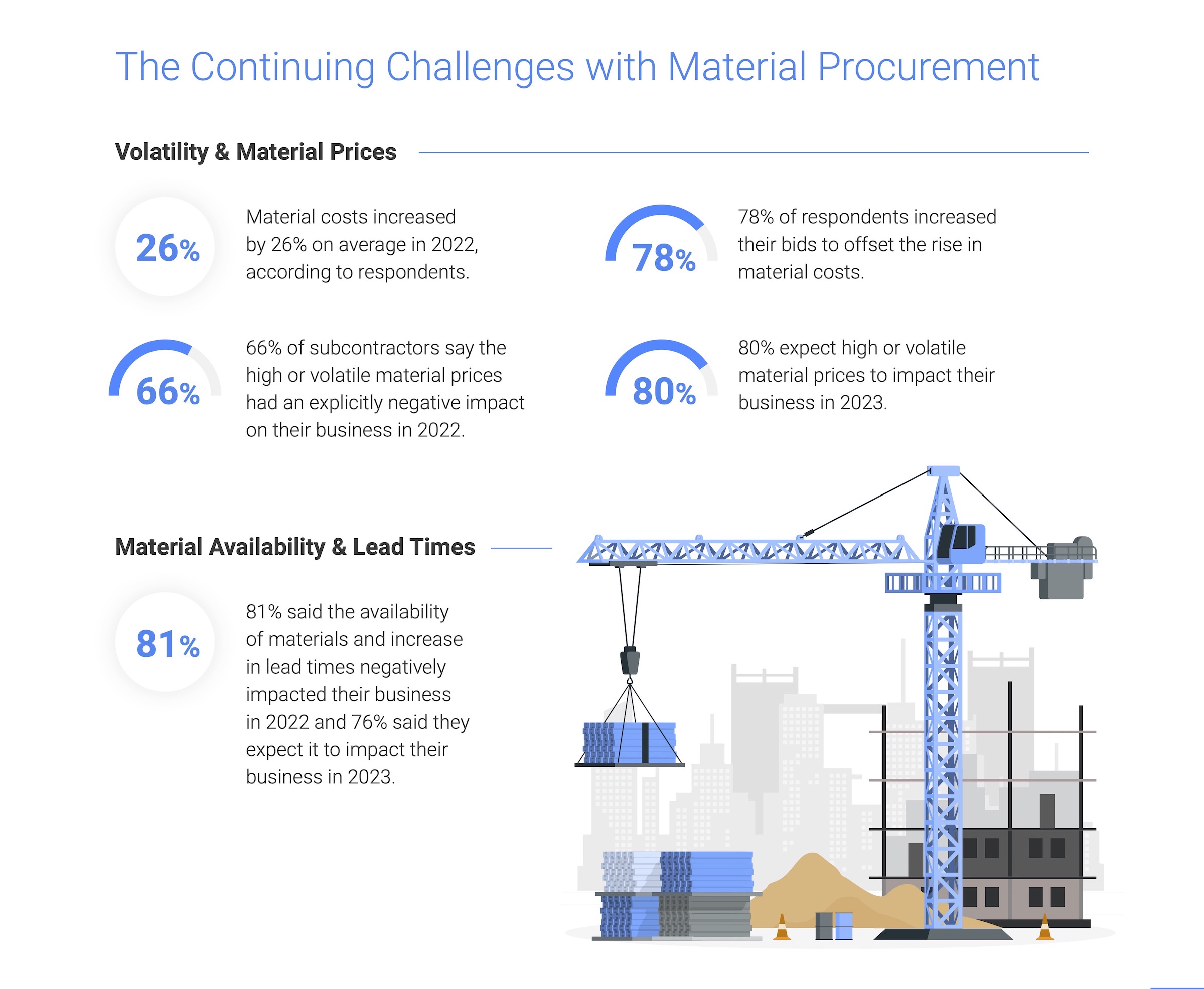

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

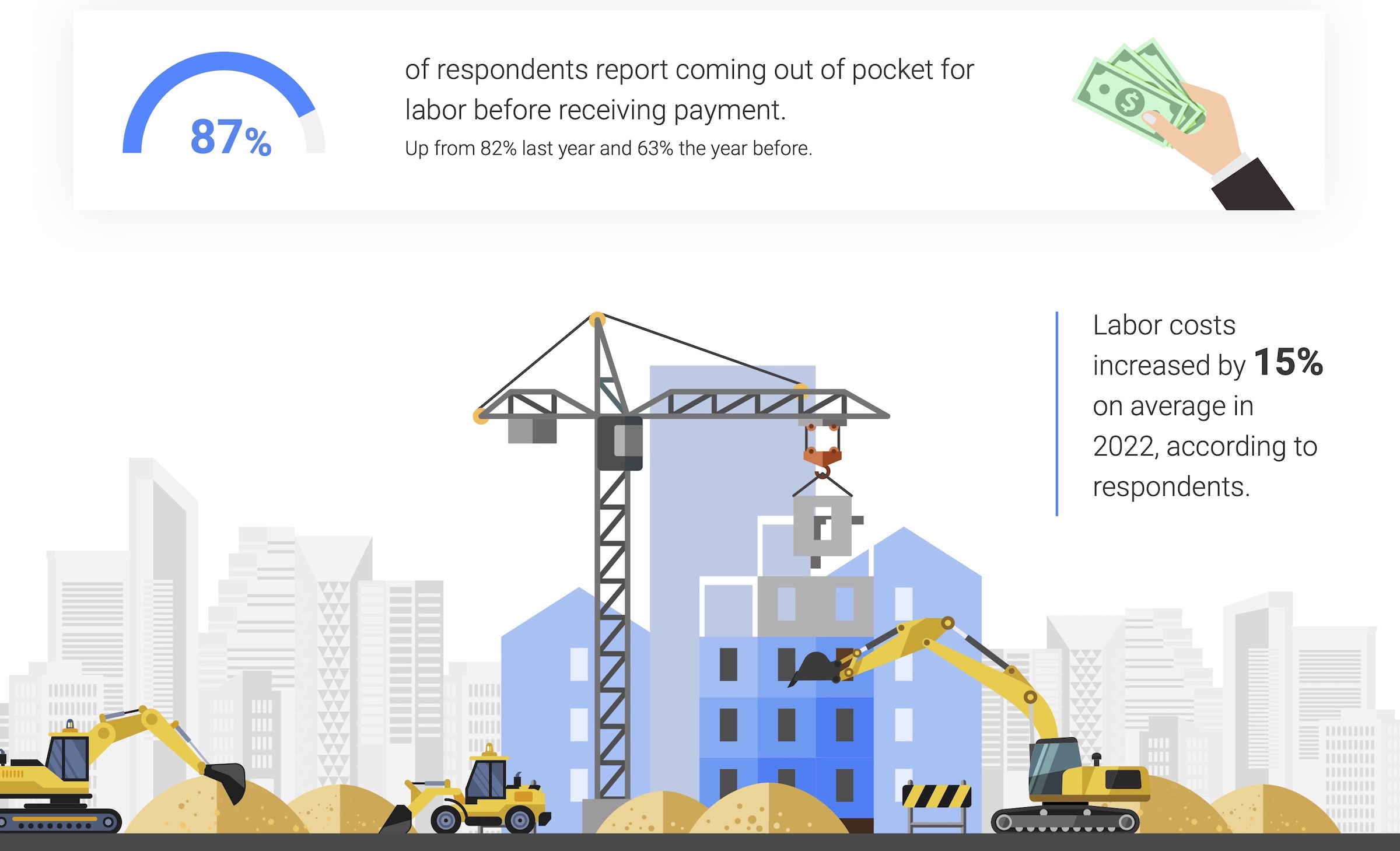

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

Giants 400 | Feb 1, 2024

Top 40 Restaurant Construction Firms for 2023

Swinerton, Shawmut Design and Construction, Gray Construction, CM&B, and Andersen Construction top BD+C's ranking of the nation's largest restaurant general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Luxury Residential | Feb 1, 2024

Luxury 16-story condominium building opens in Chicago

The Chicago office of architecture firm Lamar Johnson Collaborative (LJC) yesterday announced the completion of Embry, a 58-unit luxury condominium building at 21 N. May St. in Chicago’s West Loop.

Products and Materials | Jan 31, 2024

Top building products for January 2024

BD+C Editors break down January's top 15 building products, from SloanStone Quartz Molded Sinks to InvisiWrap SA housewrap.

Giants 400 | Jan 29, 2024

Top 140 Office Core and Shell Architecture Firms for 2023

Gensler, Stantec, Page Southerland Page, Perkins&Will, and NBBJ top BD+C's ranking of the nation's largest office core and shell architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 80 Workplace Interior Construction Firms for 2023

STO Building Group, HITT Contracting, Clune Construction, Hensel Phelps, and JRM Construction Management top BD+C's ranking of the nation's largest workplace interior and interior fitout general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 100 Office Core and Shell Construction Firms for 2023

Turner Construction, AECOM, DPR Construction, Clark Group, and Clayco top BD+C's ranking of the nation's largest office core and shell general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Industrial Facilities | Jan 29, 2024

How big-ticket, government-funded investments in industrial developments are affecting private construction companies

Large sums of money remain in bank accounts for government-funded programs like the CHIPS Act, the Infrastructure Investment and Jobs Act, and the Inflation Reduction Act. But with opportunities come challenges.

Senior Living Design | Jan 24, 2024

Former Walgreens becomes affordable senior living community

Evergreen Real Estate Group has announced the completion of Bellwood Senior Apartments. The 80-unit senior living community at 542 25th Ave. in Bellwood, Ill., provides independent living options for low-income seniors.

AEC Tech | Jan 24, 2024

4 ways AEC firms can benefit from digital transformation

While going digital might seem like a playground solely for industry giants, the truth is that any company can benefit from the power of technology.