Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

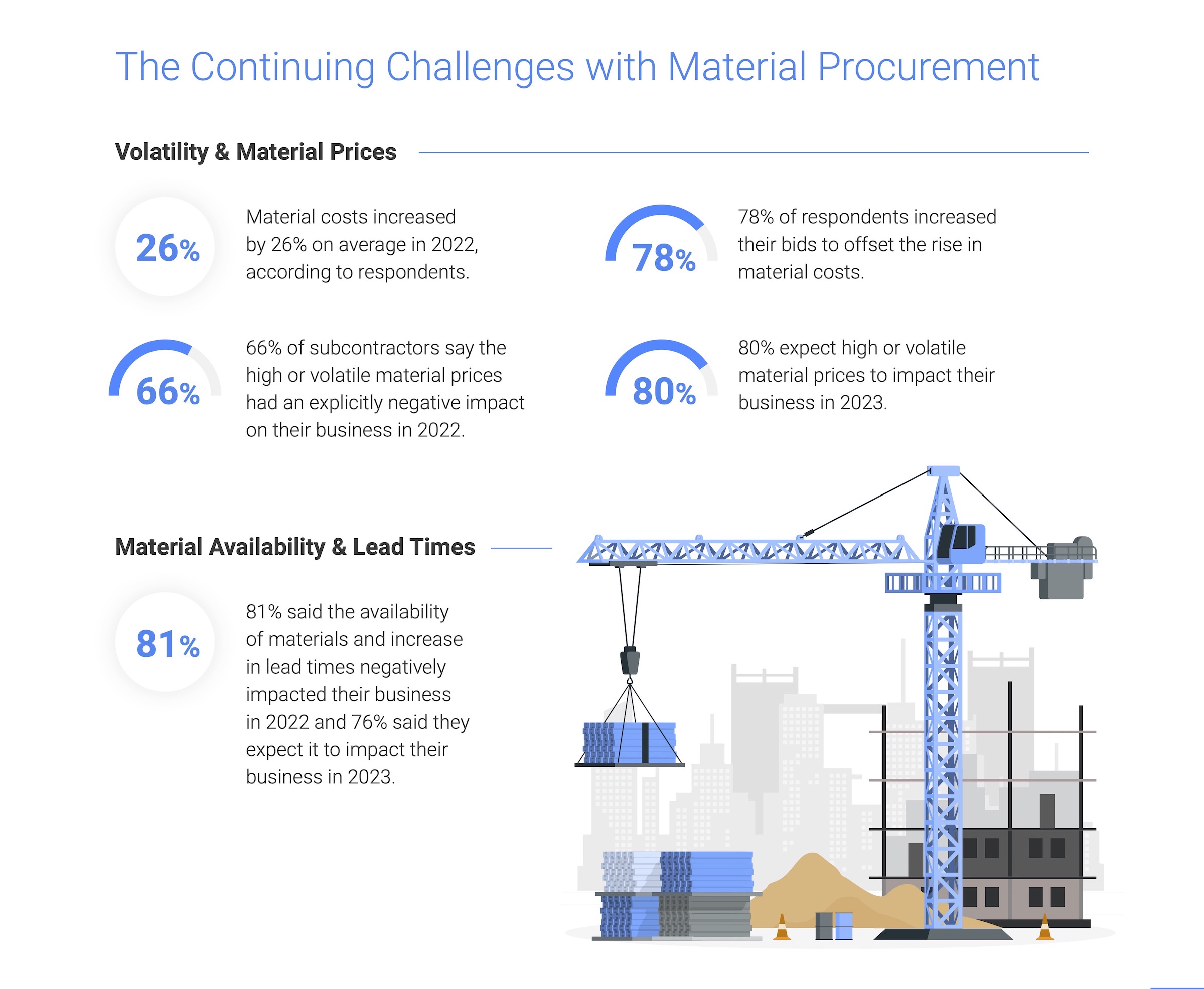

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

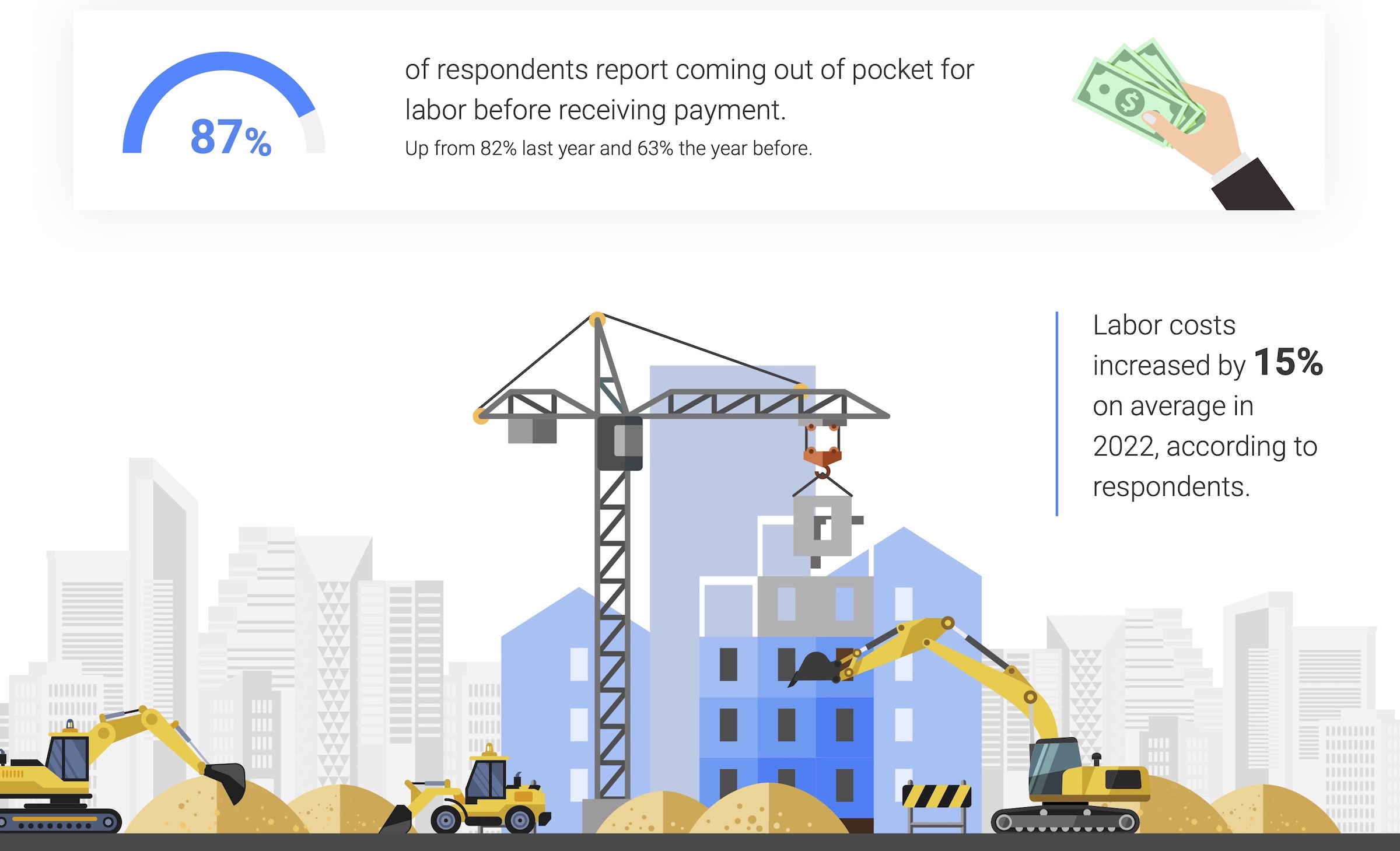

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Feb 16, 2012

TLC Engineering for Architecture opens Chattanooga office

TLC Engineering for Architecture provides mechanical, electrical, structural, plumbing, fire protection, communication, technology, LEED, commissioning and energy auditing services.

| Feb 16, 2012

Summit Design + Build begins build-out for Emmi Solutions in Chicago

The new headquarters will total 20,455 sq. ft. and feature a loft-style space with exposed masonry and mechanical systems, 15 foot clear ceilings, two large rooftop skylights and private offices with full glass partition walls.

| Feb 16, 2012

Highland named president of McCarthy Building Companies’ California region

Highland moved into this new role in January 2012 following a six-month transition period with Carter Chappell, the company’s former president, California region.

| Feb 16, 2012

Big-box retailers not just for DIYers

Nearly half of all contractor purchases made from stores like Home Depot and Lowe's.

| Feb 16, 2012

4.8-megawatt solar power system completed at Jersey Gardens Mall

Solar array among the largest rooftop systems in North America.

| Feb 15, 2012

Fourth-generation Ryan to lead Ryan Companies AE team

Ryan leads a team of eight architects, four civil engineers, two landscape architects and two virtual building specialists in their efforts to realize their customer’s vision and needs through Ryan’s integrated project delivery system.

| Feb 15, 2012

NAHB sees gradual improvement in multifamily sales for boomers

However, since the conditions of the current overall housing market are limiting their ability to sell their existing homes, this market is not recovering as quickly as might have been expected.

| Feb 15, 2012

Skanska secures $87M contract for subway project

The construction value of the project is $261.9 M. Skanska will include its full share, $87 M, in the bookings for Skanska USA Civil for the first quarter 2012.

| Feb 15, 2012

Code allowance offers retailers and commercial building owners increased energy savings and reduced construction costs

Specifying air curtains as energy-saving, cost-cutting alternatives to vestibules in 3,000-square-foot buildings and larger has been a recent trend among consulting engineers and architects.

| Feb 15, 2012

Englewood Construction announces new projects with Destination Maternity, American Girl

Englewood’s newest project for Wisconsin-based doll retailer American Girl, the company will combine four vacant storefronts into one large 15,000 square-foot retail space for American Girl.