Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

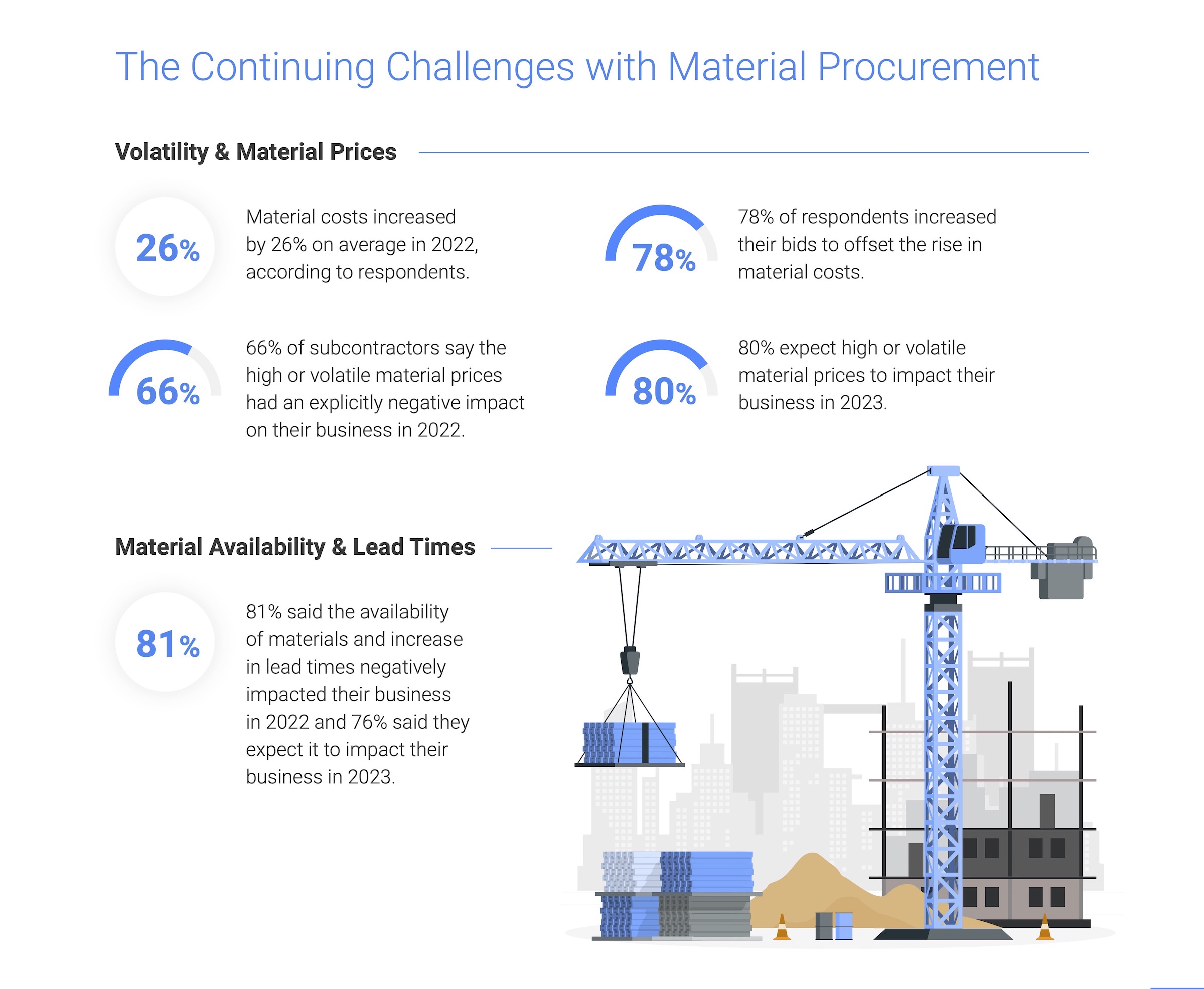

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

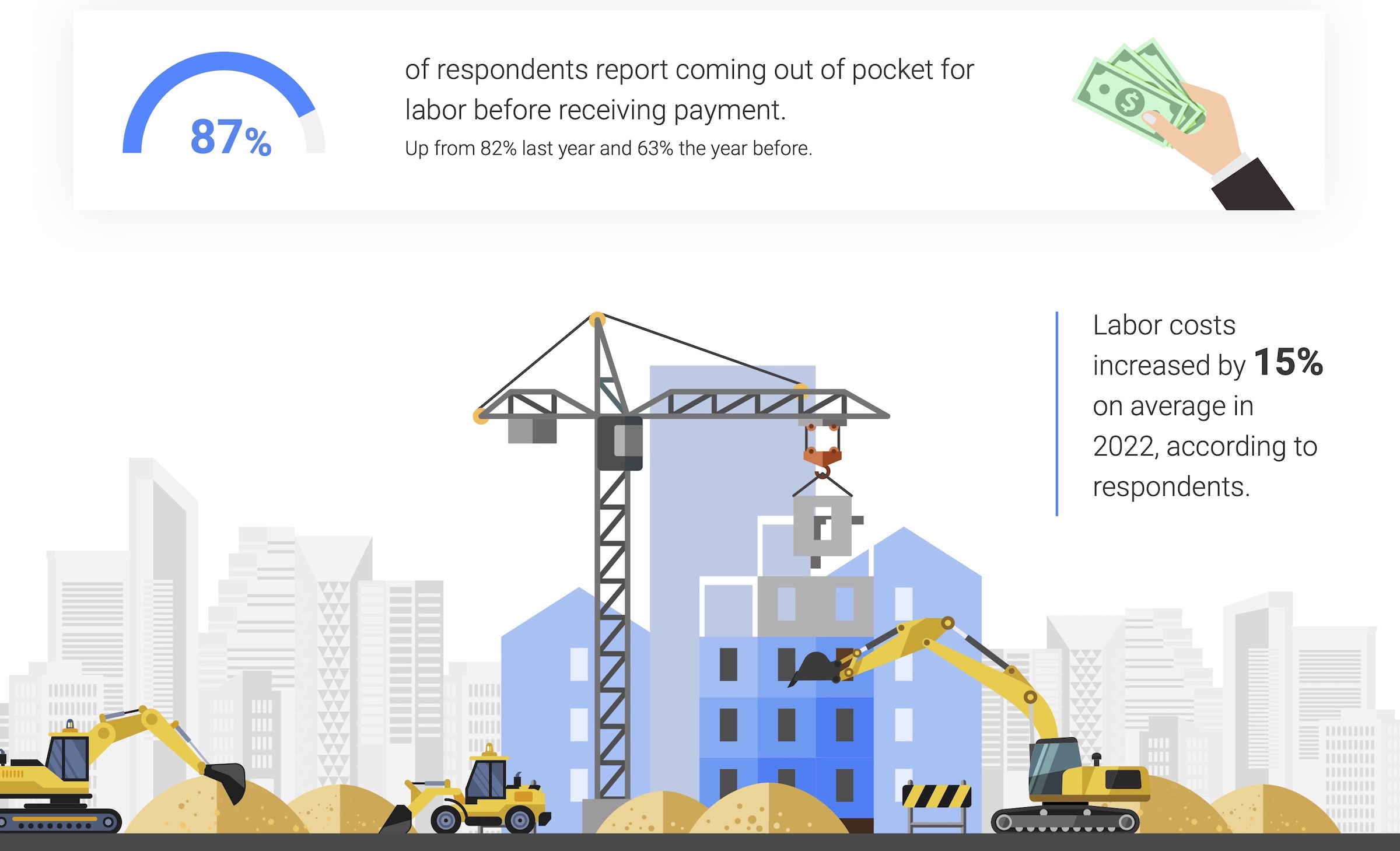

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

MFPRO+ News | Sep 24, 2024

Major Massachusetts housing law aims to build or save 65,000 multifamily and single-family homes

Massachusetts Gov. Maura Healey recently signed far-reaching legislation to boost housing production and address the high cost of housing in the Bay State. The Affordable Homes Act aims to build or save 65,000 homes through $5.1 billion in spending and 49 policy initiatives.

AEC Tech | Sep 24, 2024

Generative AI can bolster innovation in construction industry

Jeff Danley, Associate Technology and Innovation Consultant at Burns & McDonnell, suggests several solutions generative AI could have within the construction industry.

Mixed-Use | Sep 19, 2024

A Toronto development will transform a 32-acre shopping center site into a mixed-use urban neighborhood

Toronto developers Mattamy Homes and QuadReal Property Group have launched The Clove, the first phase in the Cloverdale, a $6 billion multi-tower development. The project will transform Cloverdale Mall, a 32-acre shopping center in Toronto, into a mixed-use urban neighborhood.

3D Printing | Sep 17, 2024

Alquist 3D and Walmart complete one of the nation’s largest free-standing, 3D-printed commercial structures

Walmart has completed one of the largest free-standing, 3D-printed commercial structures in the US. Alquist 3D printed the almost 8,000-sf, 20-foot-high addition to a Walmart store in Athens, Tenn. The expansion, which will be used for online pickup and delivery, is the first time Walmart has applied 3D printing technology at this scale.

Retail Centers | Sep 17, 2024

Thinking outside the big box (store)

For over a decade now, the talk of the mall industry has been largely focused on what developers can do to fill the voids left by a steady number of big box store closures. But what do you do when big box tenants stay put?

Government Buildings | Sep 17, 2024

OSHA’s proposed heat standard published in Federal Register

The Occupational Safety and Health Administration (OSHA) has published a proposed standard addressing heat illness in outdoor and indoor settings in the Federal Register. The proposed rule would require employers to evaluate workplaces and implement controls to mitigate exposure to heat through engineering and administrative controls, training, effective communication, and other measures.

Codes and Standards | Sep 17, 2024

New California building code encourages, but does not mandate heat pumps

New California homes are more likely to have all-electric appliances starting in 2026 after the state’s energy regulators approved new state building standards. The new building code will encourage installation of heat pumps without actually banning gas heating.

Codes and Standards | Sep 17, 2024

ASHRAE’s first group of certified decarbonization professionals announced

ASHRAE recently announced its inaugural cohort of Certified Decarbonization Professionals (CDPs). Individuals who earned this designation demonstrate competency to assess, analyze, and develop effective and sustainable strategies to reduce or eliminate the life-cycle carbon footprint of buildings.

Mass Timber | Sep 17, 2024

Marina del Rey mixed-use development is L.A.’s largest mass timber project

An office-retail project in Marina del Rey is Los Angeles’ largest mass timber project to date. Encompassing about 3 acres, the 42XX campus consists of three low-rise buildings that seamlessly connect with exterior walkways and stairways. The development provides 151,000 sf of office space and 1,500 sf of retail space.

Education Facilities | Sep 16, 2024

Hot classrooms, playgrounds spur K-12 school districts to go beyond AC for cooling

With hotter weather occurring during the school year, school districts are turning to cooling strategies to complement air conditioning. Reflective playgrounds and roads, cool roofs and window films, shade structures and conversion of asphalt surfaces to a natural state are all being tried in various regions of the country.