Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

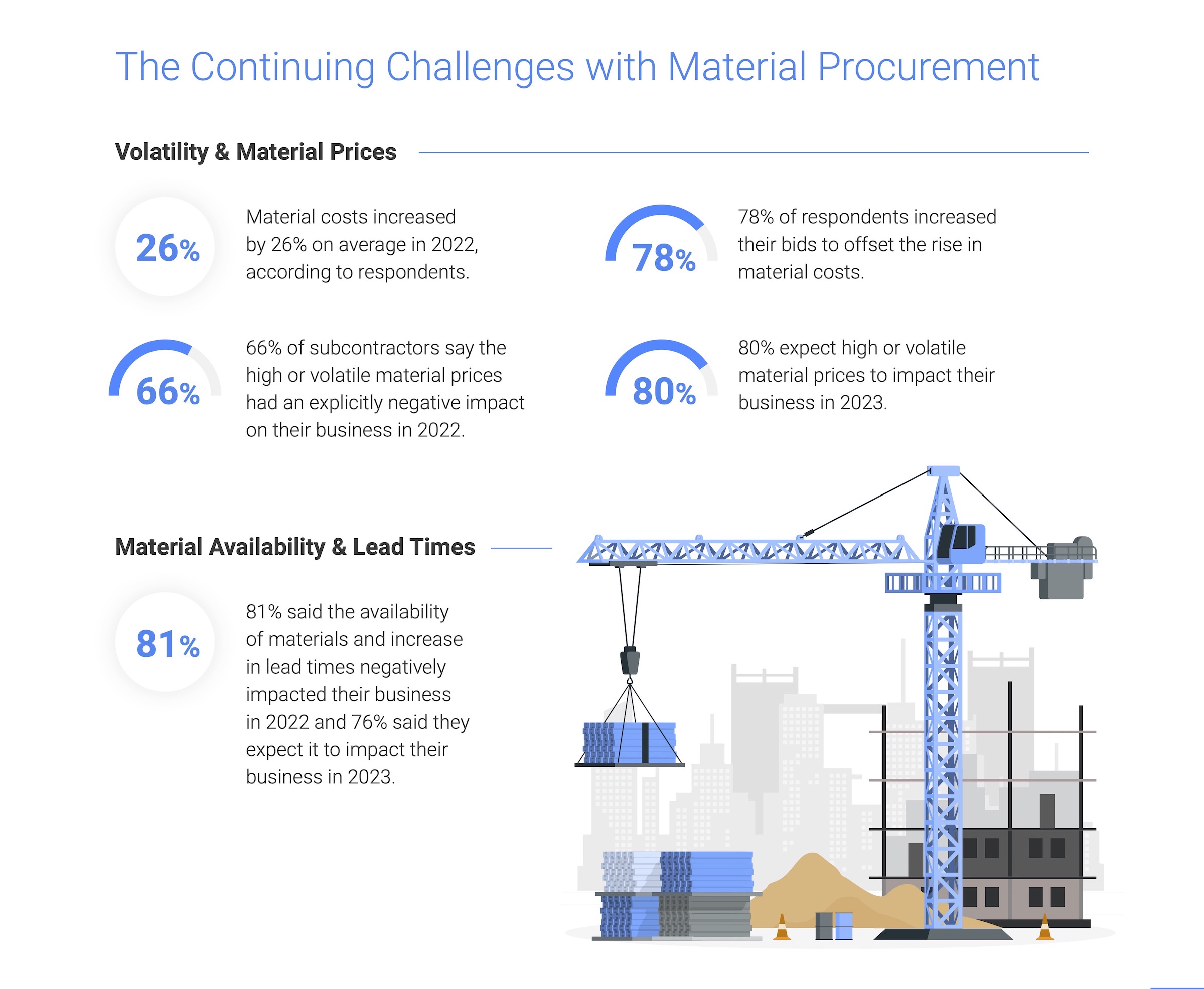

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

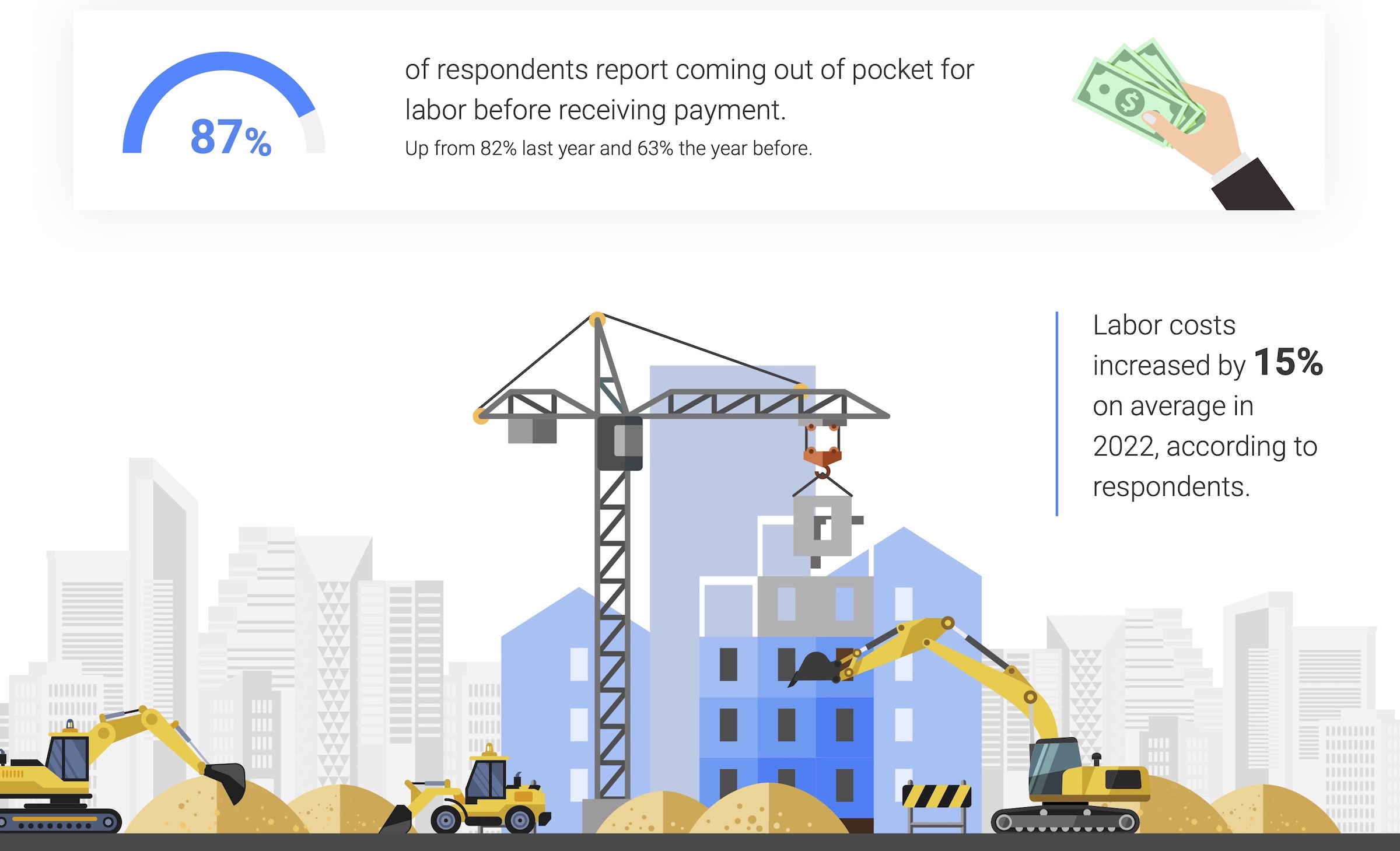

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

Government Buildings | Oct 10, 2023

GSA names Elliot Doomes Public Buildings Service Commissioner

The U.S. General Services Administration (GSA) announced that the agency’s Public Buildings Service Commissioner Nina Albert will depart on Oct. 13 and that Elliot Doomes will succeed her.

Higher Education | Oct 10, 2023

Tracking the carbon footprint of higher education campuses in the era of online learning

With more effective use of their facilities, streamlining of administration, and thoughtful adoption of high-quality online learning, colleges and universities can raise enrollment by at least 30%, reducing their carbon footprint per student by 11% and lowering their cost per student by 15% with the same level of instruction and better student support.

MFPRO+ News | Oct 6, 2023

Announcing MultifamilyPro+

BD+C has served the multifamily design and construction sector for more than 60 years, and now we're introducing a central hub within BDCnetwork.com for all things multifamily.

Giants 400 | Oct 5, 2023

Top 115 Healthcare Construction Firms for 2023

Turner Construction, Brasfield & Gorrie, JE Dunn Construction, DPR Construction, and McCarthy Holdings top BD+C's ranking of the nation's largest healthcare sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.

Regulations | Oct 4, 2023

New York adopts emissions limits on concrete

New York State recently adopted emissions limits on concrete used for state-funded public building and transportation projects. It is the first state initiative in the U.S. to enact concrete emissions limits on projects undertaken by all agencies, according to a press release from the governor’s office.

Architects | Oct 4, 2023

Architects and contractors underestimate cyberattack risk

Design and construction industry firms underestimate their vulnerability to cyberattacks, according to a new report, Data Resilience in Design and Construction: How Digital Discipline Builds Stronger Firms by Dodge Construction Network and content security and management company Egnyte.

Giants 400 | Oct 2, 2023

Top 50 Data Center Construction Firms for 2023

Turner Construction, Holder Construction, HITT Contracting, DPR Construction, and Fortis Construction top BD+C's ranking of the nation's largest data center sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.