Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

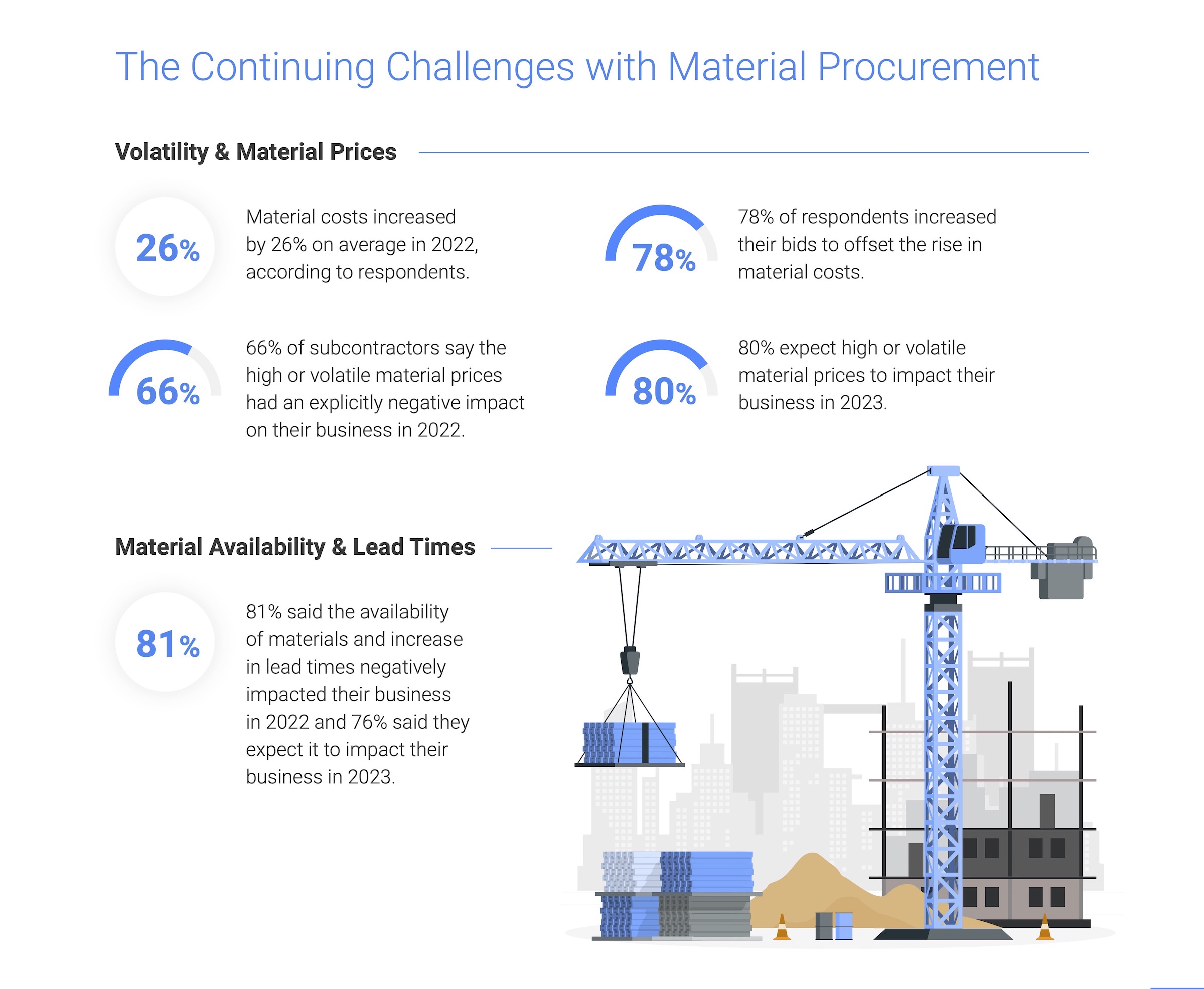

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

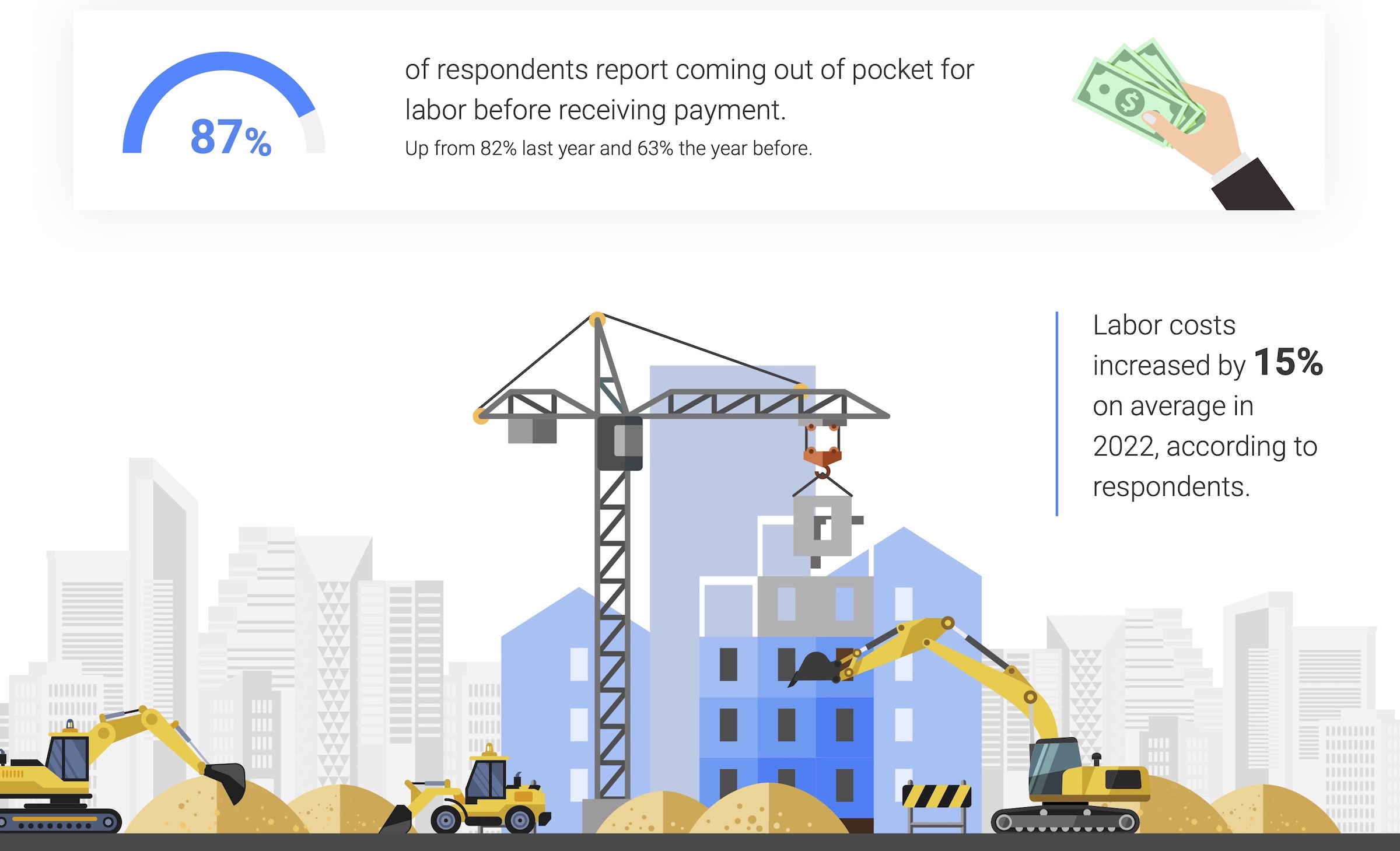

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

Laboratories | Sep 12, 2022

Lab space scarcity propels construction demand in life sciences sector

In its 2021 Life Sciences Real Estate Outlook, JLL predicted that access to talent would be a primary concern for an industry sector that had been growing by leaps and bounds. A year later, talent still guides real estate decisions. But market conditions of a different sort were cooling the biotech field: namely, investors that have soured on startups which underperformed after going public. What this means for new construction and renovation going forward is unpredictable, as the drivers behind life sciences’ surge are still palpable.

| Sep 12, 2022

Staff at New York City architecture firm is first in U.S. to unionize

Staff at New York City architecture firm is first in U.S. to unionize.

| Sep 12, 2022

San Antonio’s new courthouse aims to provide safety and security while also welcoming the public

The San Antonio Federal Courthouse, which opened earlier this year, replaces a courthouse that had been constructed as a pavilion for the 1968 World’s Fair.

Giants 400 | Sep 9, 2022

Top 25 Casino Contractors + CM Firms for 2022

The Yates Companies, W.E. O'Neil Construction, Alberici-Flintco, and PCL Construction Enterprises top the ranking of the nation's largest casino contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Sep 9, 2022

Top 90 Hospitality Sector Contractors + CM Firms for 2022

AECOM, Suffolk Construction, STO Building Group, and The Yates Companies top the ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 9, 2022

Top 80 Hotel Sector Contractors + CM Firms for 2022

AECOM, Suffolk Construction, STO Building Group, and Swinerton top the ranking of the nation's largest hotel and resort sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

| Sep 9, 2022

Add sand shortage to supply chain woes

As if it wasn’t enough to have lumber, windows, doors, and metal pipe in short supply, you can add sand, which is theoretically plentiful on Earth, to the list of construction materials that can be hard to come by.

Senior Living Design | Sep 8, 2022

What’s new with AQ: The top trends in active adult living

Today's 55-or-better buyers are ready to design their lives and their homes as they see fit. With so much growth on tap, builders and developers must stay apprised of trends related to home, environment, and culture of 55+ communities.

| Sep 8, 2022

The Twin Cities’ LGBTQ health clinic moves into a new and improved facility

For more than 50 years, Family Tree Clinic has provided reproductive and sexual health services to underserved populations—from part of an old schoolhouse, until recently.

| Sep 8, 2022

U.S. construction costs expected to rise 14% year over year by close of 2022

Coldwell Banker Richard Ellis (CBRE) is forecasting a 14.1% year-on-year increase in U.S. construction costs by the close of 2022.