In 2009, we met with Senior Facility Managers of four U.S. national laboratories to discuss a major limitation in the way they summarized their capital needs. As with most large organizations, they expressed capital needs in terms of deferred maintenance projects—things that needed to be fixed as determined by condition assessment (inspection or prescribed schedule). To put these needs in perspective, they computed a facility condition index (FCI), which is the ratio of deferred maintenance (D.M) costs to the replacement value of a building or portfolio.

Several years later, following the acquisition of Whitestone Research by CBRE Inc., it quickly became clear that major healthcare organizations around the world oftentimes employ a similar FCI based approach to their capital planning and prioritization decisions.

FACILITY CONDITION INDEX BREAKDOWN

According to a well-known scale developed initially for educational facilities in 1991, a facility is considered in poor condition if its FCI exceeds 90%. The shortcomings of the FCI approach are well-known, as results are not easily compared with alternative condition assessment approaches, and it does not contemplate methodologies for determining replacement values. These choices can become highly political for an organization that uses, as many do, the FCI as a key policy metric.

The basic concern of the laboratory facility managers was that the FCI did not represent the true condition of the facility in terms of safety, security, mission relevance, and other criteria that actually guide their decisions. FCI is also not a forecast or leading indicator that demonstrates consequences of alternative actions. These concerns led to a series of small projects that would eventually define a new approach to summarizing facility condition and prioritizing capital expenditures.

The new method, Risk Scanning, meets three requirements identified in our original meeting. The process must not rely on expensive inspections, must incorporate multiple (customizable) criteria, and the outcomes must be expressed as a simple monetary value.

This approach has universal applicability for laboratories and for large, corporate occupiers. In addition, we have found this approach to be particularly relevant for healthcare organizations today, given the extraordinary economic and regulatory pressures that have become a reality for the industry.

RISK SCANNING

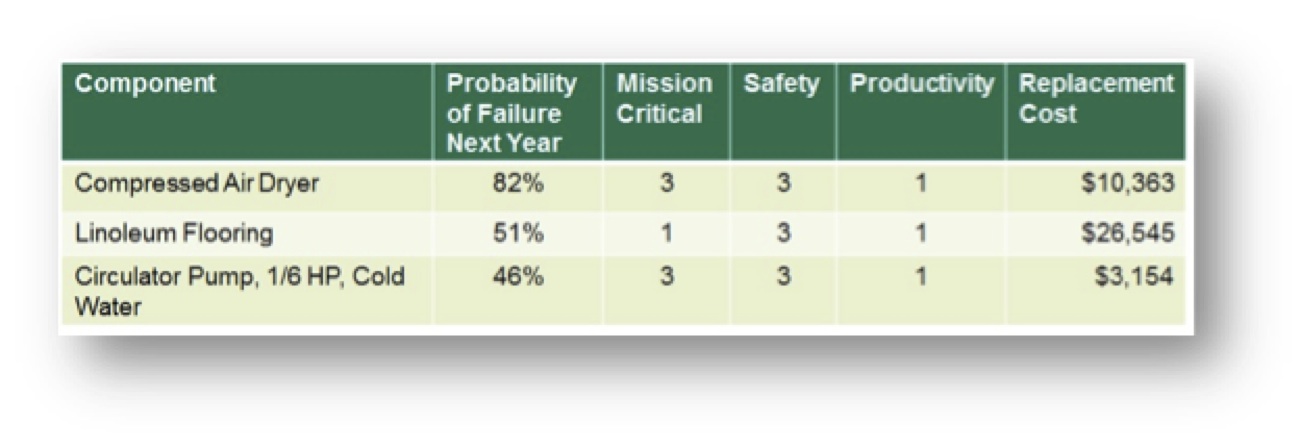

Risk Scanning assumes that buildings or other assets can be reduced to an inventory of components (roof, HVAC equipment, plumbing fixtures, etc.). Each component has a “survivor” curve that relates its age to the likelihood of its failure in the future, little different than an actuarial calculation for an insurance policy. And each component, should it fail, could have consequences for the building operation. Below, Figure 1 illustrates how this data could be used as a simple sort by probability of failure, consequence of failure, or replacement cost.

A more useful view of this data combines knowledge of the probability of failure and the potential consequences as the Risk Facility Managers implicitly consider when scheduling repairs. For example, a new light bulb in a closet would be low risk (low likelihood of failure, low impact on safety, security, mission, etc.), while a roof or electrical panel, far beyond their expected service life would be a high risk. Individual component risk ratings can be aggregated into risk maps by building, consequence type, or aggregated at the portfolio level.

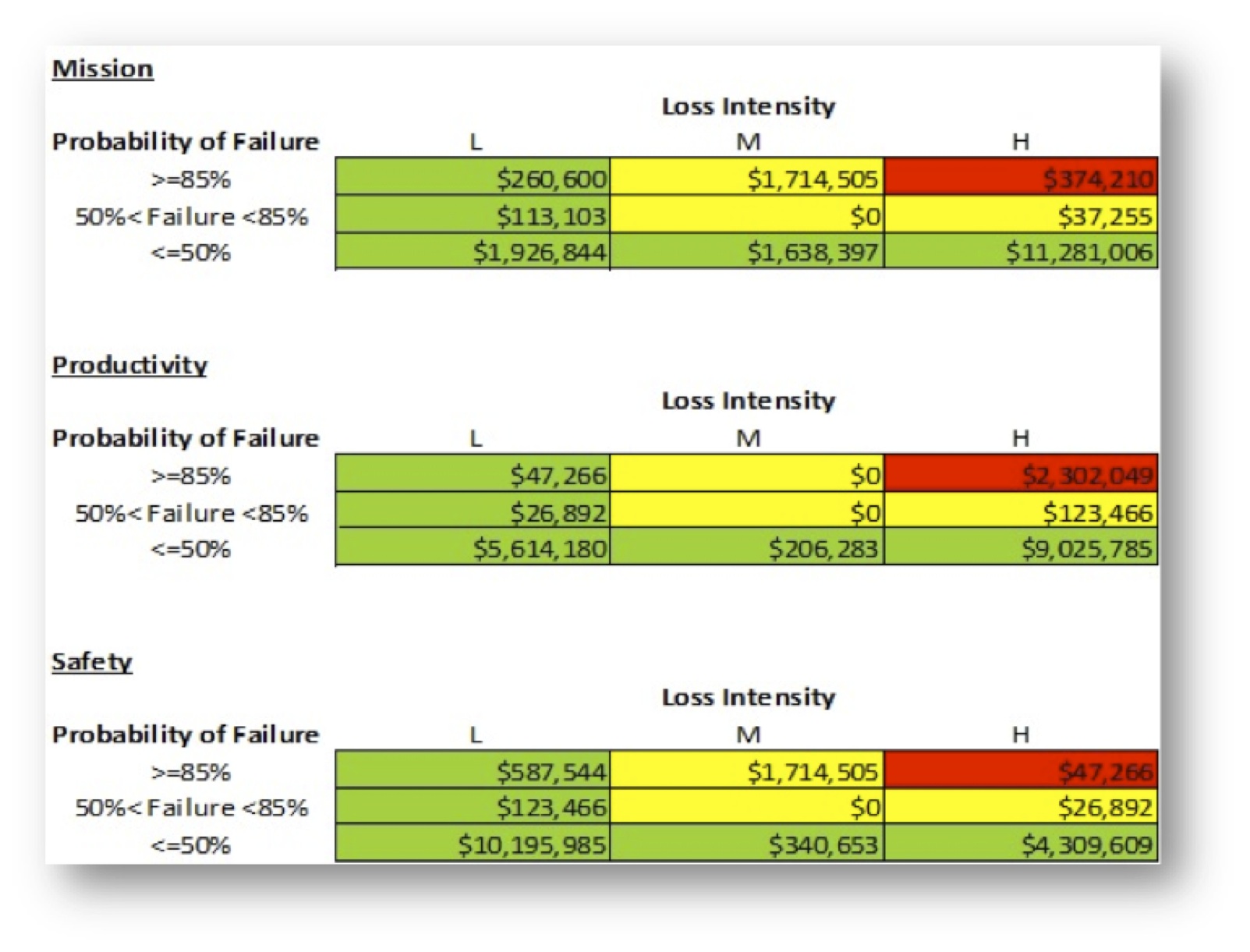

Another example is a risk scan of a data center built in 1980, as shown in Figure 2. Risk is summarized by three consequences or threats of failure – mission, productivity and safety. The “Loss Intensity” is the measure (low, medium, high) of the impact of failure. Each cell in the tables is the sum of the replacement value of each component. For instance, in the first table there are high risk (red) components with replacement values totaling $374,210.

Figure 2: Dashboard showing risk by consequence

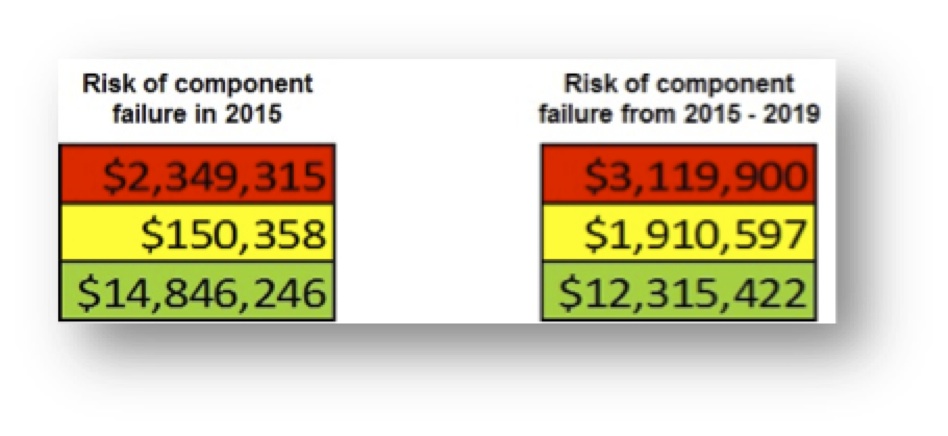

One way to represent overall risk is to sum across the individual tables in Figure 2, by risk category (red = high, yellow = moderate, green = low) to produce a single risk column, as shown in Figure 3. This shows that the costs to replace components rated high risk in 2015 for any reason (mission, productivity, or safety) were $2,349,315. Note that some components are high risk for multiple reasons.

The calculation of the column can be modified for different purposes. The ratings from the dashboard could be weighted to reflect management priorities. The likelihood of failure, and consequent migration of risk ratings, could be estimated for a range of years, as shown for the period 2015-2019.

COMPARING THE FCI WITH RISK SCANNING

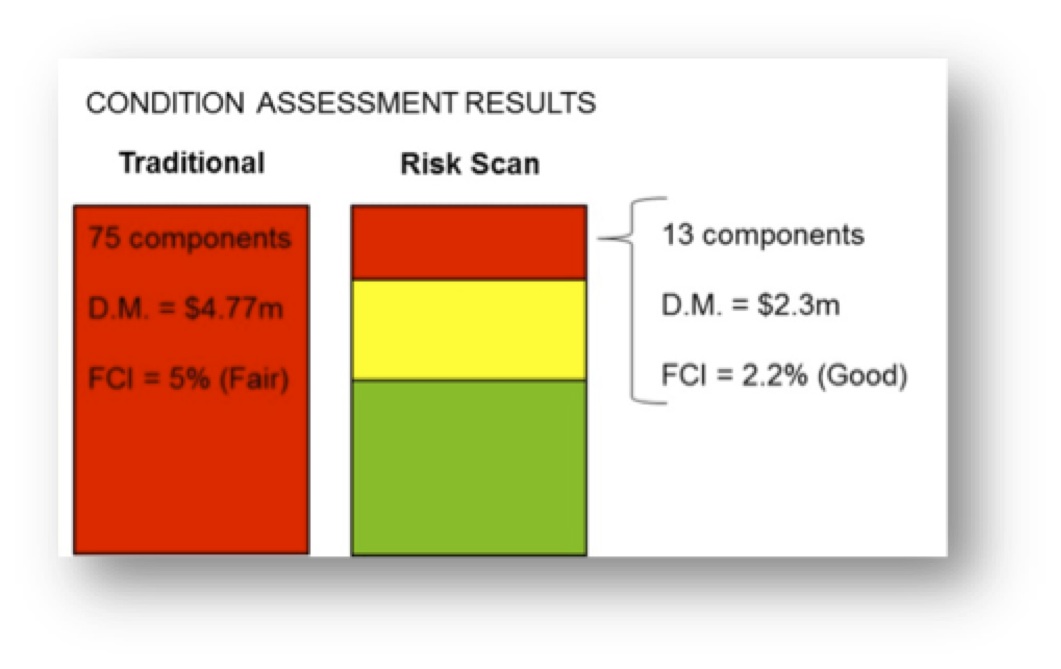

The data center example provides a useful comparison of the output from a simple condition assessment with the additional data provided by Risk Scanning.

A conventional facility condition assessment using a life cycle cost model indicated that 75 components had exceeded their service life. The costs of replacing these would be $4,771,159. Considering this amount to be deferred maintenance (D.M.), the FCI would be 5% (given $100 million replacement value). This would be summarized as a building in “fair” condition.

A Risk Scan of the component inventory indicates that 13 components are at high risk, and the costs of replacing these would be $2,349,315. This is less than half the costs of replacements by a simple service life-assessment. An FCI based on high risk components would be 2.2%, indicating a building in “good” condition.

In this case, with the additional information provided by Risk Scanning, the facility would be considered in better condition than with the simple condition assessment. Moreover, the risk scan would provide a rating for all components—including those not yet considered as deferred maintenance—as a basis for anticipating future needs and prioritization.

CONCLUSION

The Risk Scanning approach uses well-known risk analytics applied to pre-existing facility data to provide a richer view of facility condition more consistent with actual management decision making. In practice, limited funding is directed to those repairs and replacements that address corporate priorities, such as safety, security, and mission achievement. For healthcare systems, this approach can provide critical insight for decision-making about capital deployment where actionable criteria are not established or where data is limited.

About the Authors

Peter Lufkin is Senior Managing Director and Luca Romani is Senior Analyst with CBRE Whitestone.

Related Stories

Student Housing | Dec 7, 2022

Cornell University builds massive student housing complex to accommodate planned enrollment growth

In Ithaca, N.Y., Cornell University has completed its North Campus Residential Expansion (NCRE) project. Designed by ikon.5 architects, the 776,000-sf project provides 1,200 beds for first-year students and 800 beds for sophomore students. The NCRE project aimed to accommodate the university’s planned growth in student enrollment while meeting its green infrastructure standards. Cornell University plans to achieve carbon neutrality by 2035.

Office Buildings | Dec 6, 2022

‘Chicago’s healthiest office tower’ achieves LEED Gold, WELL Platinum, and WiredScore Platinum

Goettsch Partners (GP) recently completed 320 South Canal, billed as “Chicago’s healthiest office tower,” according to the architecture firm. Located across the street from Chicago Union Station and close to major expressways, the 51-story tower totals 1,740,000 sf. It includes a conference center, fitness center, restaurant, to-go market, branch bank, and a cocktail lounge in an adjacent structure, as well as parking for 324 cars/electric vehicles and 114 bicycles.

Multifamily Housing | Dec 6, 2022

Austin's new 80-story multifamily tower will be the tallest building in Texas

Recently announced plans for Wilson Tower, a high-rise multifamily building in downtown Austin, Texas, indicate that it will be the state’s tallest building when completed. The 80-floor structure will rise 1,035 feet in height at 410 East 5th Street, close to the 6th Street Entertainment District, Austin Convention Center, and a new downtown light rail station.

Geothermal Technology | Dec 6, 2022

Google spinoff uses pay-as-you-go business model to spur growth in geothermal systems

Dandelion Energy is turning to a pay-as-you-go plan similar to rooftop solar panel leasing to help property owners afford geothermal heat pump systems.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mixed-Use | Dec 6, 2022

Houston developer plans to convert Kevin Roche-designed ConocoPhillips HQ to mixed-use destination

Houston-based Midway, a real estate investment, development, and management firm, plans to redevelop the former ConocoPhillips corporate headquarters site into a mixed-use destination called Watermark District at Woodcreek.

Office Buildings | Dec 5, 2022

How to foster collaboration and inspiration for a workplace culture that does not exist (yet)

A building might not be able to “hack” innovation, but it can create the right conditions to foster connection and innovation, write GBBN's Chad Burke and Zachary Zettler.

University Buildings | Dec 5, 2022

Florida Polytechnic University unveils its Applied Research Center, furthering its mission to provide STEM education

In Lakeland, Fla., located between Orlando and Tampa, Florida Polytechnic University unveiled its new Applied Research Center (ARC). Designed by HOK and built by Skanska, the 90,000-sf academic building houses research and teaching laboratories, student design spaces, conference rooms, and faculty offices—furthering the school’s science, technology, engineering, and mathematics (STEM) mission.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Giants 400 | Dec 1, 2022

Top 50 Parking Structure Architecture + AE Firms for 2022

Choate Parking Consultants, Gensler, Clark Nexsen, and Solomon Cordwell Buenz top the ranking of the nation's largest parking structure architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.