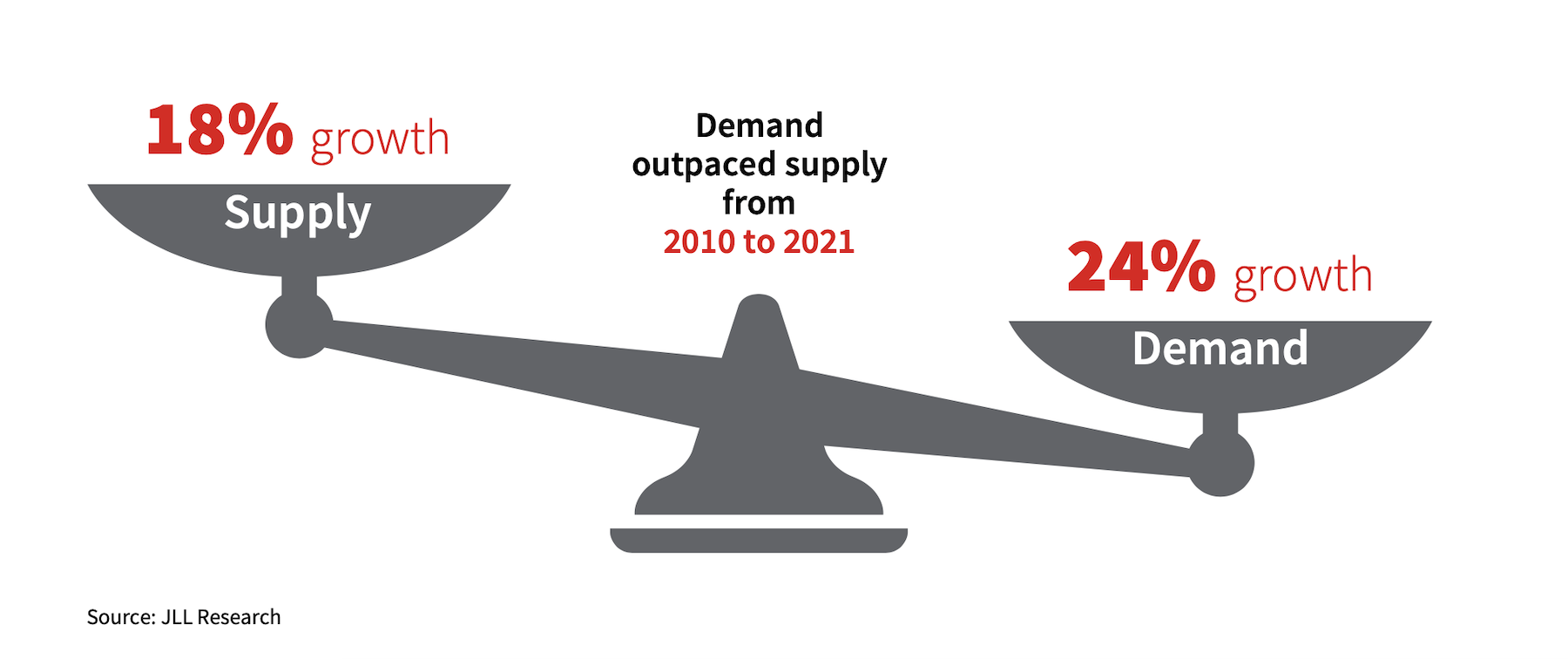

From 2010 through 2021, total U.S. industrial inventory grew by 18 percent. Over that same period, demand grew by 24 percent, driven by a surge in ecommerce that was exacerbated by the coronavirus pandemic.

“These events were defining moments that shed light on the fact that there is not enough supply to meet rapidly increasing demand in the industrial market,” states JLL in its research report “The Race for Industrial Space.”

This scarcity in industrial space has led to the sector’s lowest vacancy rate on record, from Los Angeles and Salt Lake City, to Columbus, Ohio, and New Jersey.

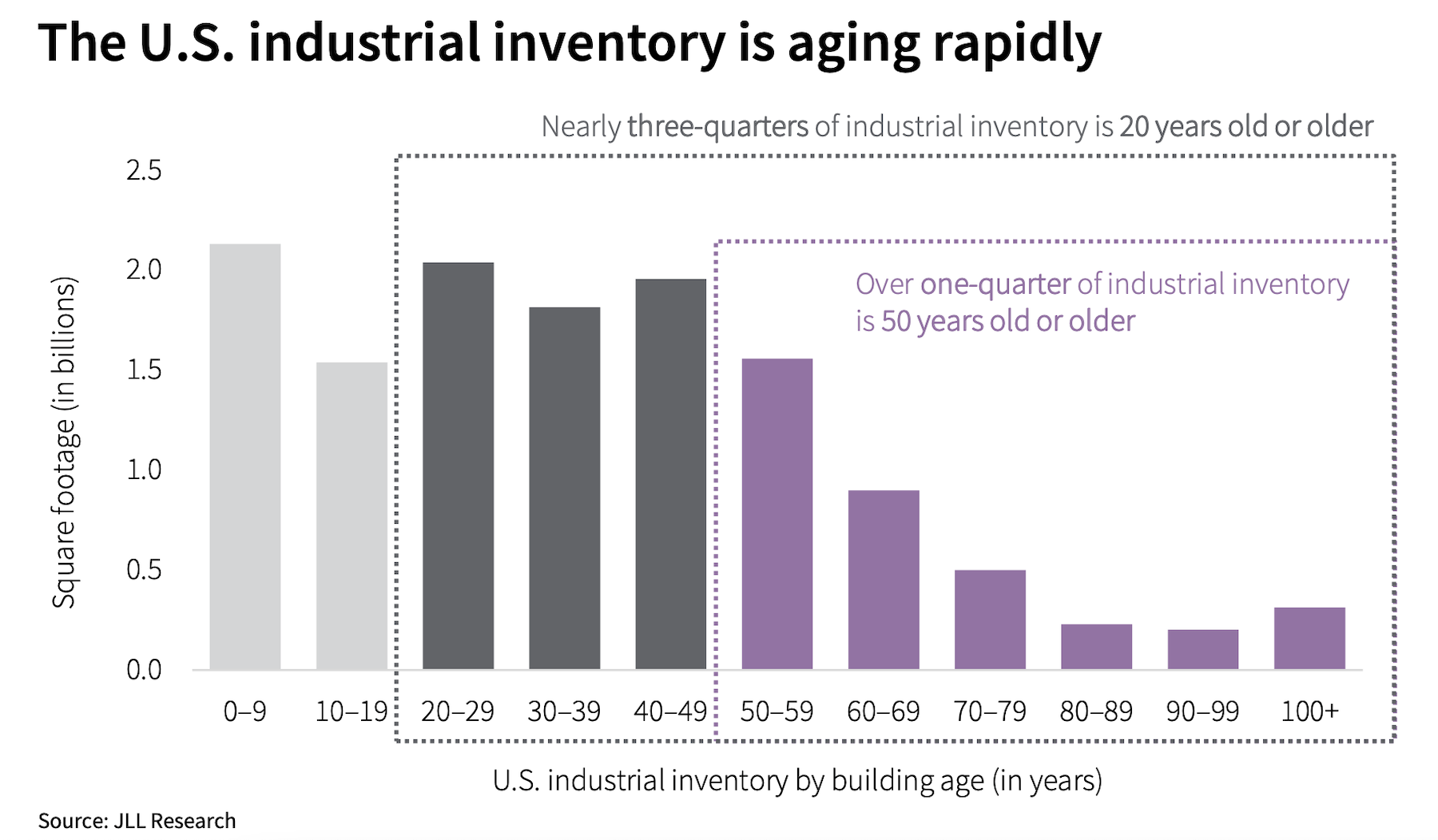

Part of the problem is the sector’s aging warehouses: nearly three-quarters of industrial inventory is 20 years old older, and more than one-quarter is 50 years or older. Owners are scrambling to adapt older, smaller, and less functionally sophisticated facilities within urban centers at a time when demand for Class A space is at its peak, with almost 70 percent of newly modernized inventory pre-leased upon delivery.

Space shortages have also led to accelerating rent growth. The average asking rents per square foot rose by 37 percent between 2016 and 2021.

BIGGER BUILDINGS IN VOGUE

JLL has identified nearly 100 proposed, under-construction, or existing adaptive reuse or replacement projects across a dozen markets. Distressed malls and vacant big-box stores are among the buildings getting industrial makeovers.

In denser urban areas where land is less available and more expensive, multistory warehouses are popular. One such example is 2505 Bruckner Boulevard, a former movie theater site on 20 acres in New York City that is being converted into a two-story, 1.1-million-sf warehouse with 28- to 32-ft clear heights. JLL states that occupiers of these multistory buildings “who value proximity to customers” are willing to pay top-of-market rents.

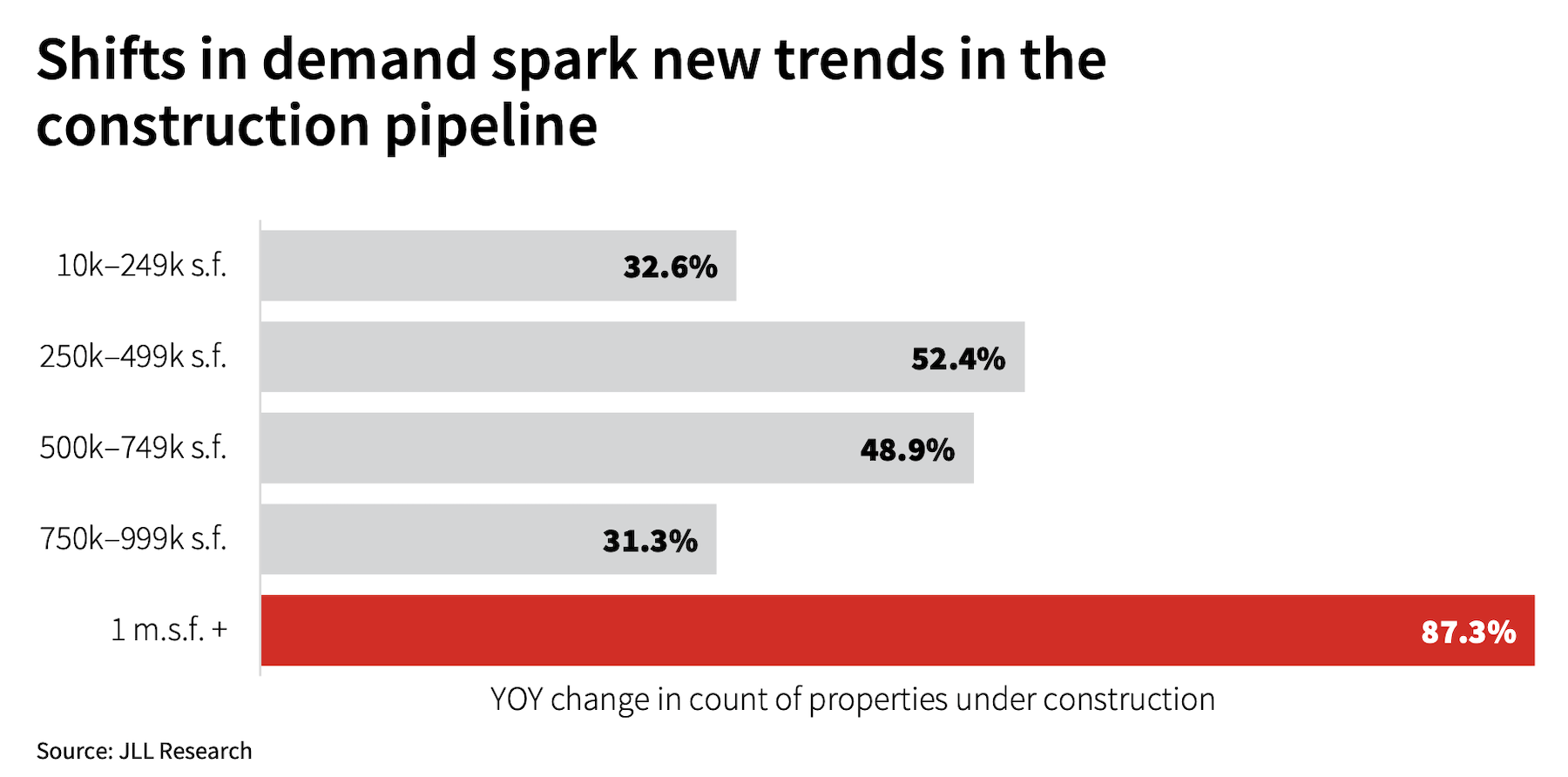

While smaller-warehouse developments still account for 60 percent of projects under construction, JLL estimates an 87 percent year-to-year increase in the number of 1-million-sf plus projects being built. “The high cost of land and the economies of scale from building larger structures make big-box facilities an easier fit,” says JLL.

The Sun Belt leads in new industrial development. Some 26 million sf have been delivered in Dallas-Fort Worth, 47 percent of which was pre-leased. More than two-thirds of the 20 million sf in industrial deliveries in Atlanta were pre-leased. Other Sun Belt markets like Houston, Memphis, and Phoenix are also seeing high levels of warehouse deliveries in their markets.

Yet, despite this construction activity, “demand and commodity pricing show no signs of slowing down in the near term,” says JLL. Last year, total costs to build a new warehouse rose 21 percent, according to JLL’s analysis of Bureau of Labor Statistics data. This dynamic “will enable general contractors to justify passing their increased costs to investors and end users.”

JLL concludes that rents for industrial space will increase more than 8 percent nationally this year, “and could be accelerated by year-end.” Vacancies will remain below the 4 percent threshold, as the imbalance of supply and demand continues through at least 2023. Projects are taking longer to build because of supply-chain delays, and land prices are peaking.

JLL predicts an “increased focus” on urban logistics sites in highly dense infill markets. JLL also foresees more adaptive reuses and conversions in urban centers.

As demand for larger buildings increases, older-generation buildings will be reimagined to accommodate end users with newer-aged features like electric vehicle parking, higher clear heights, increased truck radius maneuvering, and other reconfigurations to meet distribution needs.

Related Stories

Data Centers | Oct 1, 2024

10 biggest impacts to the data center market in 2024–2025

While AI sends the data center market into the stratosphere, the sector’s accelerated growth remains impacted by speed-to-market demands, supply chain issues, and design innovation necessities.

Warehouses | Sep 27, 2024

California bill would limit where distribution centers can be built

A bill that passed the California legislature would limit where distribution centers can be located and impose other rules aimed at reducing air pollution and traffic. Assembly Bill 98 would tighten building standards for new warehouses and ban heavy diesel truck traffic next to sensitive sites including homes, schools, parks and nursing homes.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Codes and Standards | Sep 3, 2024

Atlanta aims to crack down on blighted properties with new tax

A new Atlanta law is intended to crack down on absentee landlords including commercial property owners and clean up neglected properties. The “Blight Tax” allows city officials to put levies on blighted property owners up to 25 times higher than current millage rates.

Industrial Facilities | Aug 28, 2024

UK-based tire company plans to build the first carbon-neutral tire factory in the U.S.

ENSO, a U.K.-based company that makes tires for electric vehicles, has announced plans to build the first carbon-neutral tire factory in the U.S. The $500 million ENSO technology campus will be powered entirely by renewable energy. The first-of-its-kind tire factory aims to be carbon neutral without purchased offsets, using carbon-neutral raw materials and building materials.

Industrial Facilities | Jul 24, 2024

Industrial construction slows, but demand remains strong

California and Arizona remain the most sought-after markets for development and operations, says CommercialEdge’s latest report.

Great Solutions | Jul 23, 2024

41 Great Solutions for architects, engineers, and contractors

AI ChatBots, ambient computing, floating MRIs, low-carbon cement, sunshine on demand, next-generation top-down construction. These and 35 other innovations make up our 2024 Great Solutions Report, which highlights fresh ideas and innovations from leading architecture, engineering, and construction firms.

Industrial Facilities | Jun 8, 2024

8 ways to cool a factory

Whichever way you look at it—from a workplace wellness point of view or from a competing for talent angle—there are good reasons to explore options for climate control in the factory workplace.

Building Tech | May 21, 2024

In a world first, load-bearing concrete walls built with a 3D printer

A Germany-based construction engineering company says it has constructed the world’s first load-bearing concrete walls built with a 3D printer. Züblin built a new warehouse from a single 3D print for Strabag Baumaschinentechnik International in Stuttgart, Germany using a Putzmeister 3D printer.

Industrial Facilities | May 9, 2024

Another new industrial facility breaks ground in hottest market for this sector

The Brickyards on Ellsworth in Mesa, Ariz., will eventually have eight buildings.