Following President Trump’s signing of the historic Coronavirus Aid, Relief, and Economic Security (CARES) Act, SBA Administrator Jovita Carranza and Treasury Secretary Steven T. Mnuchin announced that the SBA and Treasury Department have initiated a robust mobilization effort of banks and other lending institutions to provide small businesses with the capital they need.

The CARES Act establishes a new $349 billion Paycheck Protection Program. The Program will provide much-needed relief to millions of small businesses so they can sustain their businesses and keep their workers employed.

The new loan program will help small businesses with their payroll and other business operating expenses. It will provide critical capital to businesses without collateral requirements, personal guarantees, or SBA fees – all with a 100% guarantee from SBA. All loan payments will be deferred for six months. Most importantly, the SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll costs, rent, utilities, and mortgage interest.

The Paycheck Protection Program is specifically designed to help small businesses keep their workforce employed. Visit http://www.

- The new loan program will be available retroactive from Feb. 15, 2020, so employers can rehire their recently laid-off employees through June 30, 2020.

- Attached are the Payroll Protection Program loan related documents, along with a fact sheet on the program.

Loan Terms & Conditions

- Eligible businesses: All small businesses, including non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries

- Maximum loan amount up to $10 million

- Loan forgiveness if proceeds used for payroll costs and other designated business operating expenses in the 8 weeks following the date of loan origination (due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs)

-

All loans under this program will have the following identical features:

- Interest rate of 0.5%

- Maturity of 2 years

- First payment deferred for six months

- 100% guarantee by SBA

- No collateral

- No personal guarantees

- No borrower or lender fees payable to SBA

SBA’s announcement comes on the heels of a series of steps taken by the Agency since the President’s Emergency Declaration to expeditiously provide capital to financially distressed businesses affected by the Coronavirus (COVID-19) pandemic.

Related Stories

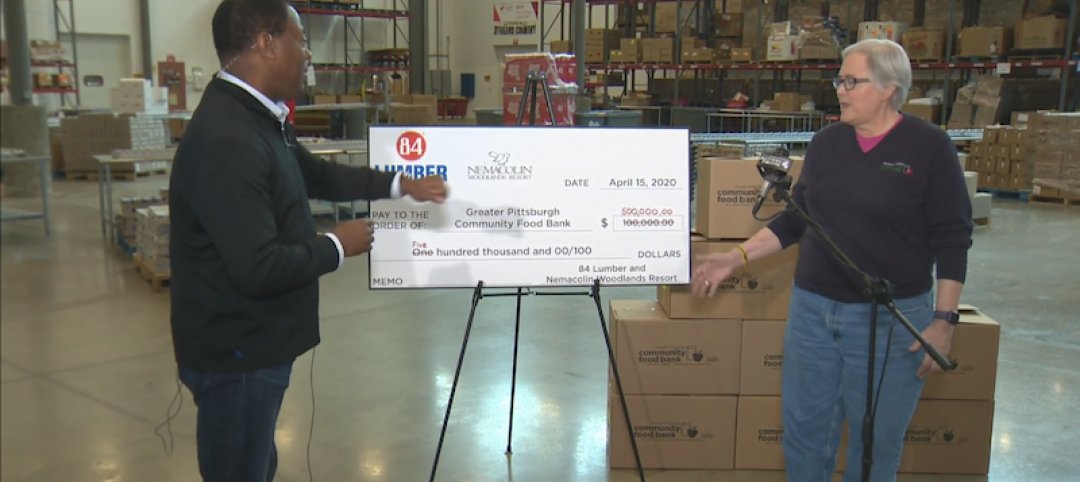

Coronavirus | Apr 16, 2020

COVID-19: Pennsylvania building products supplier raises $1.2 million for Pittsburgh-area food bank

Pennsylvania building products supplier raises $1.2 million for Pittsburgh-area food bank.

Coronavirus | Apr 15, 2020

How has your work been impacted by COVID-19?

The SMPS Foundation and Building Design+Construction are studying the impact of the coronavirus pandemic on the ability to attain and retain clients and conduct projects, along with other consequences.

Coronavirus | Apr 15, 2020

COVID-19 alert: 93% of renters in professionally managed multifamily housing paid some or all of their rent, says NMHC

In its second survey of 11.5 million units of professionally managed apartment units across the country, the National Multifamily Housing Council (NMHC) found that 84% of apartment households made a full or partial rent payment by April 12, up 15 percentage points from April 5.

Coronavirus | Apr 15, 2020

DCAMM teams with SLAM and Gilbane Building Company to re-occupy Newton Pavilion for temporary quarantine of homeless during COVID-19 pandemic

First and only quarantine shelter in Boston-area to convert a shuttered hospital for homeless patient occupancy.

Coronavirus | Apr 15, 2020

3D printing finds its groove fabricating face shields during COVID-19 crisis

The architecture firm Krueck + Sexton is producing 100 shields for a Chicago-area hospital.

Coronavirus | Apr 14, 2020

COVID-19 alert: Missouri’s first Alternate Care Facility ready for coronavirus patients

Missouri’s first Alternate Care Facility ready for coronavirus patients

Coronavirus | Apr 13, 2020

COVID-19 alert: City conducts a 'virtual building inspection' to allow Starbucks and bank to open

Bothell, Wash., issues a certificate of occupancy to developer after inspecting the property online.

Coronavirus | Apr 13, 2020

Construction layoffs spread rapidly as coronavirus shuts down projects, in contrast to job gains through February in most metros

Association officials urge quick enactment of infrastructure investment, relief for hard-hit firms and pensions in order to save jobs in construction and supplier industries.

Coronavirus | Apr 12, 2020

How prefab can enable the design and construction industry to bring much needed beds to hospitals, faster

The outbreak of COVID-19 represents an unprecedented test for the global healthcare system. Managing the pandemic—and saving lives—depends largely on the availability of medical supplies, including the capacity of hospitals. But the United States lags behind other nations, with only 2.8 beds per thousand people compared to 4.3 in China and 12.8 in South Korea.

Coronavirus | Apr 10, 2020

HGA and The Boldt Company devise a prefabricated temporary hospital to manage surge capacity during a viral crisis

A STAAT Mod system can be ready to receive patients in less than a month.