The University of Southern California Lusk Center for Real Estate’s annual analysis of industrial and office real estate in Los Angeles County, Orange County and the Inland Empire shows signs of a slow market recovery.

The 10th Annual Casden Southern California Industrial and Office Forecast reveals that all three areas experienced job growth and increased demand for both property types in 2011. An analysis of each area’s submarkets found lower vacancy rates in 11 of 17 office submarkets and 11 of 14 industrial submarkets. On the rent side, four office submarkets and eight industrial submarkets experienced increases. Overall, declines were smaller than in the previous two years.

“Although Southern California is a long way from pre-crisis levels of economic health, the improved employment picture and profound turnaround in the industrial market are signs of a slow recovery,” said study author Tracey Seslen. “The office market is only slightly improved over last year and vacancy rates may continue to fall for many months before we see rents stabilize.”

As a result, while office demand is expected to grow over the next two years, office rents were down for the third straight year and will continue to decline. On the industrial side, all three markets are expected to see ongoing declines in vacancies and increases in rents over the next two years.

In particular, the Inland Empire’s industrial market – the top performer in 2011 with a 6.4% increase in rents and nearly 17 million square feet of net absorption – is expected to see more growth in the next two years, but the magnitude will depend on rail and port activity.

“Sovereign risk in Europe, geopolitical turmoil and the growing U.S. debt crisis are undermining consumer confidence. Port and rail traffic, particularly activity at the Port of Long Beach, is down and could hinder the positive outlook for industrial rents,” Seslen said. BD+C

Related Stories

| Jul 18, 2014

Top Contractors [2014 Giants 300 Report]

Turner, Whiting-Turner, Skanska top Building Design+Construction's 2014 ranking of the largest contractors in the United States.

| Jul 18, 2014

Engineering firms look to bolster growth through new services, technology [2014 Giants 300 Report]

Following solid revenue growth in 2013, the majority of U.S.-based engineering and engineering/architecture firms expect more of the same this year, according to BD+C’s 2014 Giants 300 report.

| Jul 18, 2014

Top Engineering/Architecture Firms [2014 Giants 300 Report]

Jacobs, AECOM, Parsons Brinckerhoff top Building Design+Construction's 2014 ranking of the largest engineering/architecture firms in the United States.

| Jul 18, 2014

Top Engineering Firms [2014 Giants 300 Report]

Fluor, Arup, Day & Zimmermann top Building Design+Construction's 2014 ranking of the largest engineering firms in the United States.

| Jul 18, 2014

Top Architecture Firms [2014 Giants 300 Report]

Gensler, Perkins+Will, NBBJ top Building Design+Construction's 2014 ranking of the largest architecture firms in the United States.

| Jul 18, 2014

Top Architecture/Engineering Firms [2014 Giants 300 Report]

Stantec, HOK, and Skidmore, Owings & Merrill top Building Design+Construction's 2014 ranking of the largest architecture/engineering firms in the United States.

| Jul 18, 2014

2014 Giants 300 Report

Building Design+Construction magazine's annual ranking the nation's largest architecture, engineering, and construction firms in the U.S.

| Jul 17, 2014

A new, vibrant waterfront for the capital

Plans to improve Washington D.C.'s Potomac River waterfront by Maine Ave. have been discussed for years. Finally, The Wharf has started its first phase of construction.

| Jul 17, 2014

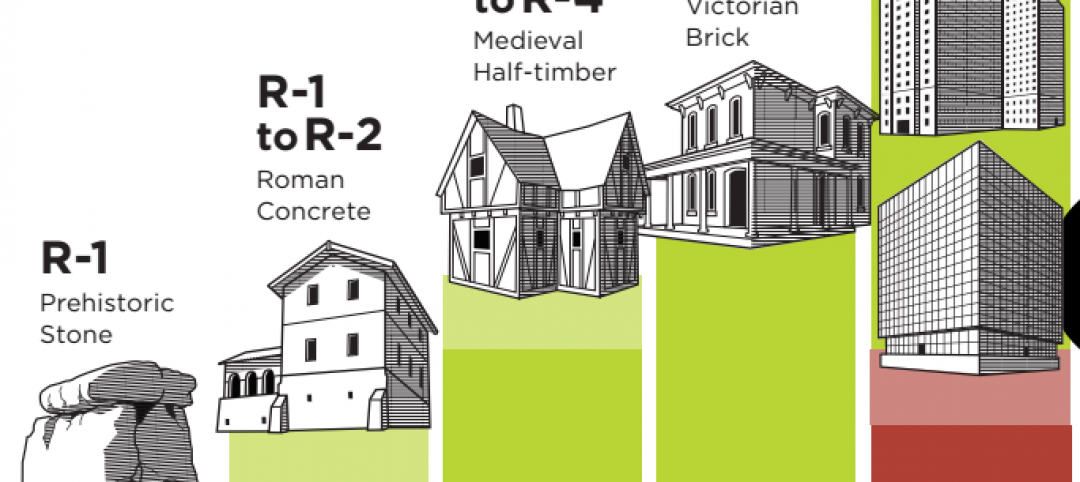

A harmful trade-off many U.S. green buildings make

The Urban Green Council addresses a concern that many "green" buildings in the U.S. have: poor insulation.

| Jul 17, 2014

A high-rise with outdoor, vertical community space? It's possible! [slideshow]

Danish design firm C.F. Møller has developed a novel way to increase community space without compromising privacy or indoor space.