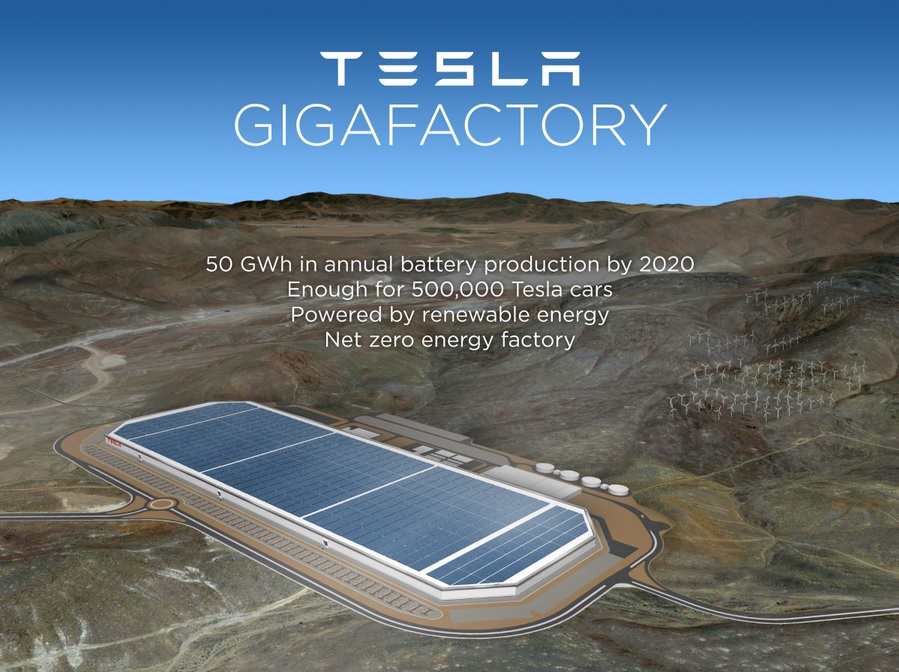

Work has begun on Tesla Motors’ “gigafactory,” a $5 billion project on 980 acres in Sparks, Nev., that, when at full capacity in 2020, could annually produce 50 gigawatt-hours of lithium-ion batteries, or enough for 500,000 of Tesla’s electric cars.

Sparks, a suburb of Reno, Nev., was the winner in the gigafactory sweepstakes whose finalists were Fort Worth, Austin, Phoenix, and Albuquerque. Last September, Nevada Gov. Brian Sandoval signed a bill granting $1.3 billion in tax breaks to Tesla—including giving it the land for free—to build this massive plant, which at an estimated 5.5 million sf would be equal to 174 football fields.

Panasonic, which owns a portion of Tesla, last October said it would invest 10 billion Yen—or the equivalent of $92 million—into this project. The Wall Street Journal quoted Panasonic’s CEO, Kazuhiro Tsuga, who promised “installments of similar amounts” into this plant in the future. Currently, Panasonic supplies batteries for Tesla’s cars from its plants in Asia.

Elon Musk, Tesla’s CEO, says he expects Panasonic to contribute between 30% and 40% of the plant’s total cost. Tesla Motors will ante up half of the cost, and will manage the plant itself.

Tesla is building this plant to provide batteries for its Model 3 car, which is scheduled to go into production in late 2017 or early 2018. The plant would also provide batteries for Tesla’s Model S, and its upcoming Model X SUV. However, when this plant is scheduled to open is uncertain, as different news reports have said the opening could be in late 2016 or sometime in 2017.

The Nevada plant’s construction is projected to create between 20,000 and 22,000 jobs, and 6,500 permanent jobs. Over a 20-year period, the plant is expected to add $100 billion to Nevada’s economy.

Tesla’s goal is to produce batteries that are cheap enough for it to be sell its Model 3s for around $35,000. These batteries would also allow the electric cars to drive up to 200 miles before needing recharging.

However, given that Tesla sold between 33,000 and 35,000 cars globally in 2014, according to the website InsideEVs, its dreams of 500,000 units sales seem quixotic, especially given buyers’ lukewarm reception to all-electric cars so far.

To put this into some perspective, the two best-selling vehicle models in the U.S.—the Ford F-series trucks and Toyota Camry—sold 763,000 and 404,000 units in the U.S., respectively, last year, when a total of 16.5 million autos were purchased by American buyers. Toyota offers a gas-electric hybrid model, one of 47 hybrids from different manufacturers available in the U.S., where hybrids account for 3.2% of all light-vehicle sales.

Plug-in electric car sales in the U.S., on the other hand, rose above the 100,000-unit level for the third consecutive year in 2014, according to the website GreenCarReports.

Tesla doesn’t break out its U.S. sales, but given that its Model S starts at $70,000, one would think its market share is small. Nevertheless, the company is banking on a sizable increase in worldwide demand for electric cars. Last week Musk told CNBC that his company “should be able to produce a few million cars a year by 2025.” Tesla recently upgraded its plant in Fremont, Calif., to be able to produce 100,000 electric cars by the end of 2015.

Related Stories

Building Team | Feb 19, 2019

Strategies and tools to help navigate a successful M&A

Based on Hinge’s industry research, smaller firms typically spend a higher percentage of revenue on marketing and business development efforts for the same return.

Building Team | Feb 13, 2019

3 exciting tech developments that show promise for AEC adoption

The BD+C editorial team is on a mission to track and evaluate the latest tech tools and trends that show promise for widespread AEC adoption.

Building Team | Jan 10, 2019

Skilled labor shortages continue to make off-site fabrication and construction attractive

But the AEC industry’s “culture” impedes greater acceptance, according to a recent National Institute of Building Sciences survey.

Building Team | Jan 7, 2019

2019 outlook: Firms not betting on another record-setting year

Despite the positive indicators for the market, AEC professionals remain largely cautious when it comes to growth prospects for 2019.

Building Team | Jan 4, 2019

Design-build delivery is setting new parameters for project management

FMI paper provides clues to what makes these contracts click (or not).

Building Team | Dec 11, 2018

And then there were two: HQ2 sites, in hindsight, seemed obvious

The two cities already had the greatest number of Amazon employees outside of Seattle.

Building Team | Oct 16, 2018

Dead lobby syndrome: An affliction only experience can cure

The competition for great tenants has rarely been as fierce as it is today.

Building Team | Aug 21, 2018

Five habits that are keeping your digital strategy from working

Strategies are always created with the best of intentions for improving business, the effort involved in executing the strategy – especially ones involving disruptive digital capabilities – is greatly underestimated.

Building Team | Aug 17, 2018

Silicon Valley is here. Get over it.

AEC firms continue to have angst about a tech-industry takeover of the market. One expert’s advice: “Embrace technology. Do not fear. You can shape it.”