MGM Resorts International shareholders and bondholders have filed an amended class-action lawsuit in hopes of recovering losses from the decline of the Las Vegas company’s stock and bond prices between 2007 and 2009.

Two and a half years ago, stockholders filed six lawsuits after the stock price fell from $99.75 on Oct. 9, 2007, to $1.89 on March 5, 2009. Bondholders sued over similar steep losses.

The securities holders complained the prices fell because of problems related to the global recession as well as undisclosed cost overruns, construction problems, and financial difficulties MGM Resorts faced with its half-owned $8.5 billion CityCenter casino resort complex on the Las Vegas Strip.

The lawsuits complained that MGM Resorts officials failed to promptly disclose many of these problems, causing the stock and bond prices to be inflated before they tumbled once the market realized how serious the issues were.

U.S. District Judge Gloria Navarro in Las Vegas on March 27 dismissed two of the suits, saying they weren’t specific enough.

The shareholders and bondholders responded Tuesday by filing an amended combined lawsuit with more specific allegations about what certain MGM Resorts officials told shareholders, bondholders and analysts in presentations and in earnings reports and conference calls in 2007, 2008, and 2009.

The amended suit says 10 confidential witnesses have provided detailed information to the shareholders’ attorneys about CityCenter construction and financing problems.

The suit says these witnesses are executives who served as a vice president of global sourcing for MGM Resorts, an MGM director of construction management and finance, an MGM design project manager, an MGM corporate finance officer, an MGM financial analyst, an MGM internal audit director, an MGM lead project manager, a cost engineer for general contractor Perini Building Co., a project control director for contractor Tishman Construction and an engineer on the podium portion of the Harmon Hotel, where construction remains halted because of construction defects.

Based on information from these witnesses, the shareholders allege that as early as August 2007 MGM Resorts officials falsely told shareholders that construction was “progressing nicely” on CityCenter and that it was “on budget.”

The shareholders allege these statements were false because much of CityCenter was being designed as it was being built, sometimes forcing contractors to remove components and then rebuild them according to updated designs.

“Constant design changes while construction was already in progress led to increasing construction costs,” the suit says, citing information from one of the confidential witnesses.

One witness “confirmed that MGM’s construction estimates were underestimated from the very beginning of the project because the design drawings were not completed and the exact quantity and grade of materials was not known to Perini when it made its initial bids (the bids on which MGM’s estimates were based),” the suit says. “After Perini submitted its bids, MGM changed the designs, increasing the quantity, grade and price of materials required, thereby increasing the construction costs.”

“The publicly announced construction costs for CityCenter were purposely underestimated. This was so because, while Perini provided accurate cost estimates to MGM, MGM and Tishman arbitrarily reduced those estimates by 20 percent when formulating CityCenter’s estimated construction costs to be reported to the public,” the suit charges.

The shareholders complained that CityCenter was “plagued by construction problems” including at the Harmon, where the suit says major issues were apparent as early as March 2008 but weren’t disclosed until January 2009.

The suit says that even when CityCenter was described as a $7.4 billion project in 2007, MGM Resorts was facing difficulties in finalizing $3 billion in financing for it.

That’s because just as the credit markets were tightening in response to the global recession, MGM Resorts was being squeezed by the declining value of CityCenter as well as a slowdown in visitation to Las Vegas that was reducing its revenue and cash flow.

“CityCenter would prove much more costly to MGM — and its shareholders — than ever disclosed by defendants. In fact, MGM’s crown jewel project would prove to be a virtual black hole, bringing the company to the brink of bankruptcy and causing its investors to suffer massive losses,” the suit complained.

The shareholders and bondholders in Tuesday’s amended complaint are pension funds, including the Arkansas Teacher Retirement System, the Philadelphia Board of Pensions and Retirement, the Luzerne County (Pa.) Retirement System and Netherlands-based pension fund manager PMT.

They claim to have lost about $6.7 million on their MGM Resorts investments and hope to recover their losses and the unspecified losses of others who bought MGM Resorts securities between Aug. 7, 2007, and March 5, 2009.

MGM Resorts – then called MGM Mirage – eventually finalized financing for CityCenter and beefed up its own balance sheet with a series of debt and equity issuances beginning in 2009.

The company has denied the shareholders’ allegations that it failed to disclose problems with the construction and financing of CityCenter; and it’s unknown when or how the shareholder lawsuits will be resolved. BD+C

Related Stories

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Legislation | Mar 28, 2022

LEED Platinum office tower faces millions in fines due to New York’s Local Law 97

One Bryant Park, also known as the Bank of America Tower, in Manhattan faces an estimated $2.4 million in annual fines when New York City’s York’s Local Law 97 goes into effect.

Healthcare Facilities | Mar 25, 2022

Health group converts bank building to drive-thru clinic

Edward-Elmhurst Health and JTS Architects had to get creative when turning an American Chartered Bank into a drive-thru clinic for outpatient testing and vaccinations.

Higher Education | Mar 24, 2022

Higher education sector sees 19 percent reduction in facilities investments

Colleges and universities face a growing backlog of capital needs and funding shortfalls, according to Gordian’s 2022 State of Facilities in Higher Education report.

Architects | Mar 16, 2022

James Hoban: Designer and builder of the White House

Stewart D. McLaurin, President of the White House Historical Association, chats with BD+C Executive Editor Robert Cassidy about James Hoban, the Irish draftsman and builder who convinced George Washington to let him design and build the White House.

Architects | Mar 16, 2022

Diébédo Francis Kéré named 2022 Pritzker Architecture Prize recipient

Diébédo Francis Kéré, architect, educator and social activist, has been selected as the 2022 Laureate of the Pritzker Architecture Prize, announced Tom Pritzker, Chairman of The Hyatt Foundation, which sponsors the award that is regarded internationally as architecture’s highest honor.

Architects | Mar 10, 2022

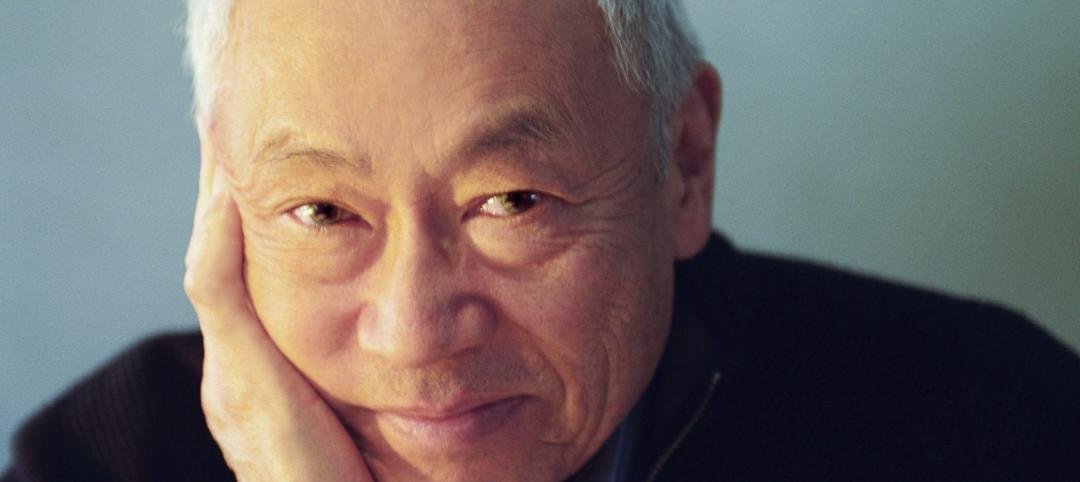

Gyo Obata, FAIA, HOK Founding Partner, passes away at 99

Obata's career spanned six decades and included iconic projects like the National Air and Space Museum in Washington, D.C., and Community of Christ Temple in Independence, Mo.

AEC Tech Innovation | Mar 9, 2022

Meet Emerge: WSP USA's new AEC tech incubator

Pooja Jain, WSP’s VP-Strategic Innovation, discusses the pilot programs her firm’s new incubator, Emerge, has initiated with four tech startup companies. Jain speaks with BD+C's John Caulfield about the four AEC tech firms to join Cohort 1 of the firm’s incubator.

Architects | Mar 2, 2022

FGM Architects and LeMay Erickson Willcox Architects join forces

FGM Architects announced that LeMay Erickson Wilcox Architects, a 19-person architectural studio based in Reston, VA is joining their firm.

Architects | Mar 1, 2022

Alyson Steele Elected President and CEO of Quinn Evans

(2.25.22) Alyson Steele, FAIA, LEED AP, has been elected president and chief executive officer of Quinn Evans, a nationally recognized firm providing architecture, planning, interior design, landscape architecture, and historic preservation services. Steele has been with the firm since 1997 and previously served as executive vice president and chief design officer. She succeeds Larry Barr, FAIA, who will continue to serve on the board of directors.