It’s still faster and more cost effective to ship to most parts of the U.S. from West Coast ports than through the Panama Canal, according to a report from CBRE. The Journal of Commerce recently noted that West Coast ports have bounced back from last year’s prolonged longshoremen’s strike and have regained their customary share of containerized imports.

An expanded Panama Canal will cap cargo capacity per vessel at 13,000-14,000 TEU (a measure of container capacity), whereas western ports can already accept vessels with capacities up to 18,000 TEU, according to Dr. Noel Hacegaba, PPM, CPE, Managing Director–Commercial Operations for the Port of Long Beach, Calif.

THE PANAMAX EFFECT

Cities lining the East Coast and Gulf Coast are spending big bucks to accommodate the larger vessels that will cross a wider and deeper Panama Canal.

Last year, Long Beach handled 7.2 million containers, the third best year in its history. Hacegaba says that the Panama Canal expansion might even increase the flow of goods from east to west, especially from eastern South America. “The expansion gives suppliers alternatives,” he says.

Long Beach projects a 4% annual increase in container volume over the next several years. The port is in the midst of a $4 billion infrastructure upgrade over the next decade. Improvements include a fully automated, $1.3 billion Middle Harbor terminal capable of handling 3.3 million TEU. The port is also replacing the 50-year-old Gerald Desmond Bridge—over which 15% of the nation’s goods travel—at a cost of $1.5 billion.

Hacegaba says about 30% of containers leave Long Beach by rail. The port wants to increase rail traffic to 50% to take advantage of rail’s efficiency and environmental cleanliness compared to other transport modes. Long Beach is exploring a short-haul rail operation and an inland container yard.

Hacegaba says 18 million sf of warehouse space lies within 100 miles of the Port of Long Beach, and more is being built. “The port is an economic engine for the Inland Empire,” he says.

Related Stories

Industrial Facilities | Mar 12, 2020

Cutting cost on flooring could cost your next industrial project big

It’s underfoot, sure, but the floor coatings in your manufacturing facility should be top of mind.

Industrial Facilities | Sep 24, 2019

Katerra’s new mass timber factory will produce the largest volume of CLT in North America

The factory recently opened in Spokane Valley, Wash.

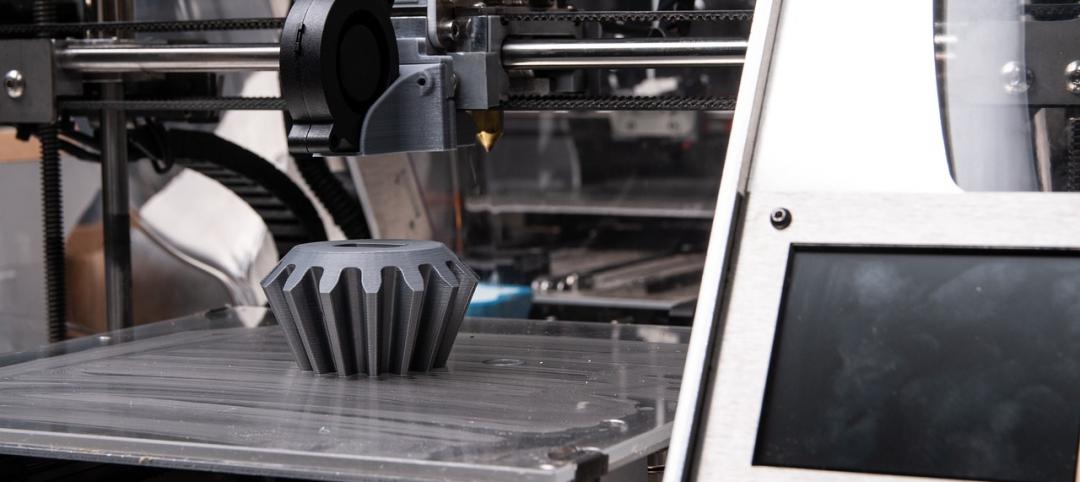

3D Printing | Sep 17, 2019

Additive manufacturing goes mainstream in the industrial sector

More manufacturers now include this production process in their factories.

Giants 400 | Sep 11, 2019

Top 95 Industrial Sector Contractors for 2019

Fluor, Clayco, Jacobs, ARCO, and Gray Construction top the rankings of the nation's largest industrial sector contractors and construction management firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Sep 11, 2019

Top 85 Industrial Sector Engineering Firms for 2019

Jacobs, Fluor, IPS, CRB, and SSOE head the rankings of the nation's largest industrial sector engineering and engineering architecture (EA) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Sep 9, 2019

Top 70 Industrial Sector Architecture Firms for 2019

AECOM, Stantec, Ware Malcomb, FSB, and Macgregor Associates top the rankings of the nation's largest industrial sector architecture and architecture engineering (AE) firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Giants 400 | Sep 9, 2019

2019 Industrial Sector Giants Report: Managing last mile delivery

This and more industrial building sector trends from Building Design+Construction's 2019 Giants 300 Report.

Industrial Facilities | Mar 14, 2019

$50 million industrial-focused business park under construction in Las Vegas

Lee & Sakahara designed the project.

Industrial Facilities | Mar 10, 2019

The burgeoning Port San Antonio lays out growth plans

Expansions would accommodate cybersecurity, aerospace, and defense tenants, and help commercialize technologies.

Industrial Facilities | Feb 28, 2019

*UPDATED WITH IMAGES* Rooftop park and ski slope on Amager Bakke waste-to-energy plant set to open in April

The park is designed to act as a ‘green bomb’ for the surrounding area.