Despite a weak global economy, the industry's solid economic recovery in 2015 should continue in 2016, led by strong consumer spending, according to the 2016 construction industry forecast from the Associated Builders and Contractors (ABC).

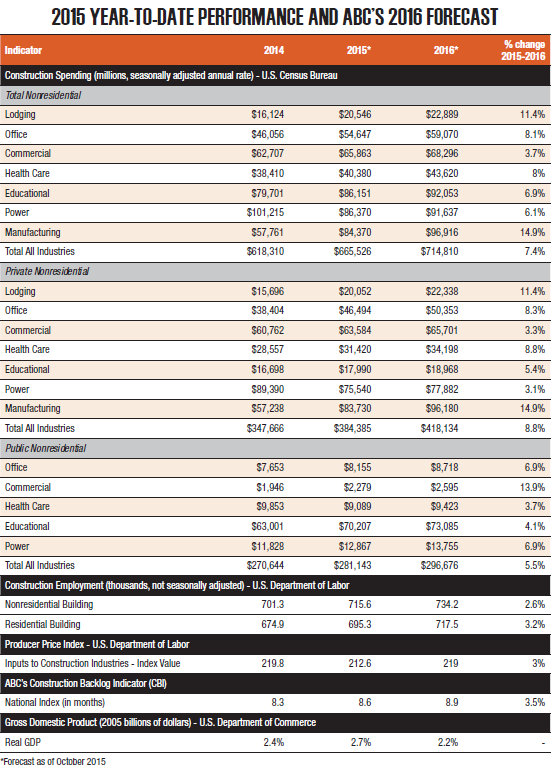

The group forecasts growth in nonresidential construction spending of 7.4% next year, along with growth in employment and backlog.

"The mid-phase of the recovery is typically the lengthiest part and ultimately gives way to the late phase, when the economy overheats,” ABC Chief Economist Anirban Basu said. "Already, signs of overheating are evident, particularly with respect to emerging skills shortages in key industry categories such as trucking and construction."

Basu said that average hourly earnings across all industries are up only 2% in the past year, below the Federal Reserve's goal of 3.5%. Purchase prices in real estate and technology segments are rocketing higher and capitalization rates remain unusually low.

According to the most recent ABC Construction Confidence Index, overall contractor confidence has increased with respect to both sales (67.3 to 69.4) and profit margins (61 to 62.9). While the pace of hiring is not expected to increase rapidly during the next six months, largely because of the lack of suitably trained skilled personnel, the rate of new hires will continue at a steady pace.

ABC's Construction Backlog Indicator also signals strong demand. According to the latest survey, average contractor backlog stood at 8.5 months by mid-year 2015, with backlog surging in the western United States and the heavy industrial category.

Basu's full forecast is available in the December edition of ABC's Construction Executive magazine, along with the regional outlook for commercial and industrial construction by economist Bernard Markstein, PhD. Free subscriptions are available to construction industry professionals.

Related Stories

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.