Despite a weak global economy, the industry's solid economic recovery in 2015 should continue in 2016, led by strong consumer spending, according to the 2016 construction industry forecast from the Associated Builders and Contractors (ABC).

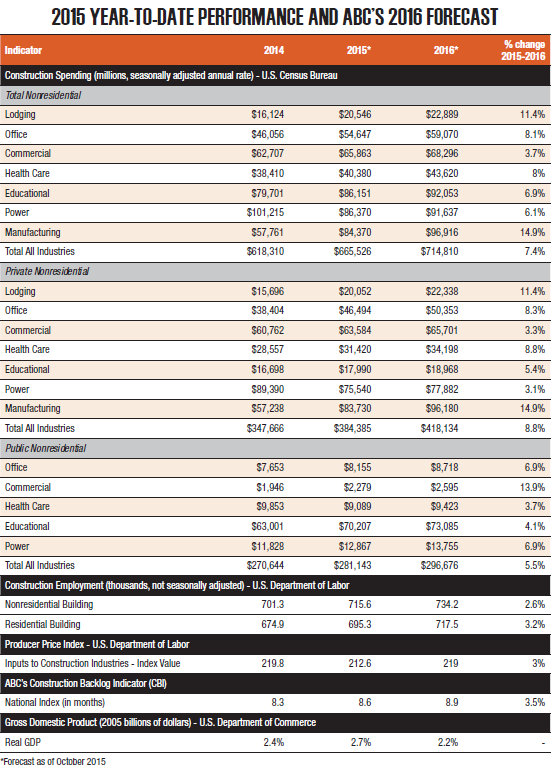

The group forecasts growth in nonresidential construction spending of 7.4% next year, along with growth in employment and backlog.

"The mid-phase of the recovery is typically the lengthiest part and ultimately gives way to the late phase, when the economy overheats,” ABC Chief Economist Anirban Basu said. "Already, signs of overheating are evident, particularly with respect to emerging skills shortages in key industry categories such as trucking and construction."

Basu said that average hourly earnings across all industries are up only 2% in the past year, below the Federal Reserve's goal of 3.5%. Purchase prices in real estate and technology segments are rocketing higher and capitalization rates remain unusually low.

According to the most recent ABC Construction Confidence Index, overall contractor confidence has increased with respect to both sales (67.3 to 69.4) and profit margins (61 to 62.9). While the pace of hiring is not expected to increase rapidly during the next six months, largely because of the lack of suitably trained skilled personnel, the rate of new hires will continue at a steady pace.

ABC's Construction Backlog Indicator also signals strong demand. According to the latest survey, average contractor backlog stood at 8.5 months by mid-year 2015, with backlog surging in the western United States and the heavy industrial category.

Basu's full forecast is available in the December edition of ABC's Construction Executive magazine, along with the regional outlook for commercial and industrial construction by economist Bernard Markstein, PhD. Free subscriptions are available to construction industry professionals.

Related Stories

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.