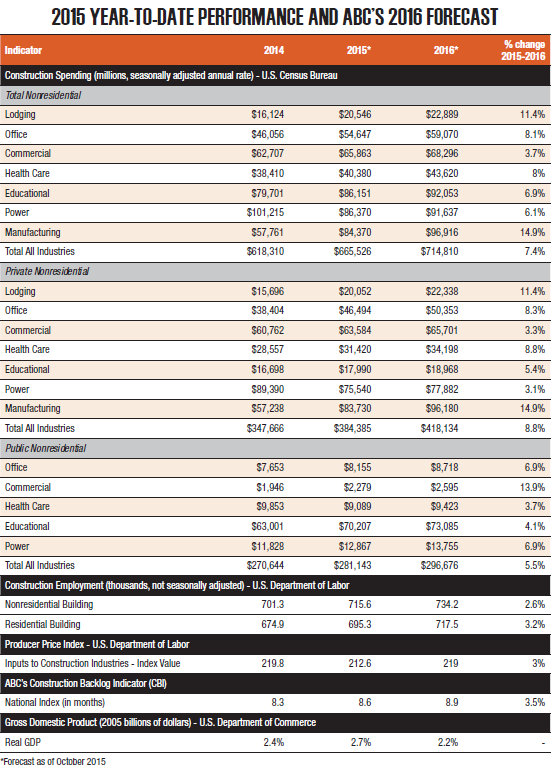

Despite a weak global economy, the industry's solid economic recovery in 2015 should continue in 2016, led by strong consumer spending, according to the 2016 construction industry forecast from the Associated Builders and Contractors (ABC).

The group forecasts growth in nonresidential construction spending of 7.4% next year, along with growth in employment and backlog.

"The mid-phase of the recovery is typically the lengthiest part and ultimately gives way to the late phase, when the economy overheats,” ABC Chief Economist Anirban Basu said. "Already, signs of overheating are evident, particularly with respect to emerging skills shortages in key industry categories such as trucking and construction."

Basu said that average hourly earnings across all industries are up only 2% in the past year, below the Federal Reserve's goal of 3.5%. Purchase prices in real estate and technology segments are rocketing higher and capitalization rates remain unusually low.

According to the most recent ABC Construction Confidence Index, overall contractor confidence has increased with respect to both sales (67.3 to 69.4) and profit margins (61 to 62.9). While the pace of hiring is not expected to increase rapidly during the next six months, largely because of the lack of suitably trained skilled personnel, the rate of new hires will continue at a steady pace.

ABC's Construction Backlog Indicator also signals strong demand. According to the latest survey, average contractor backlog stood at 8.5 months by mid-year 2015, with backlog surging in the western United States and the heavy industrial category.

Basu's full forecast is available in the December edition of ABC's Construction Executive magazine, along with the regional outlook for commercial and industrial construction by economist Bernard Markstein, PhD. Free subscriptions are available to construction industry professionals.

Related Stories

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

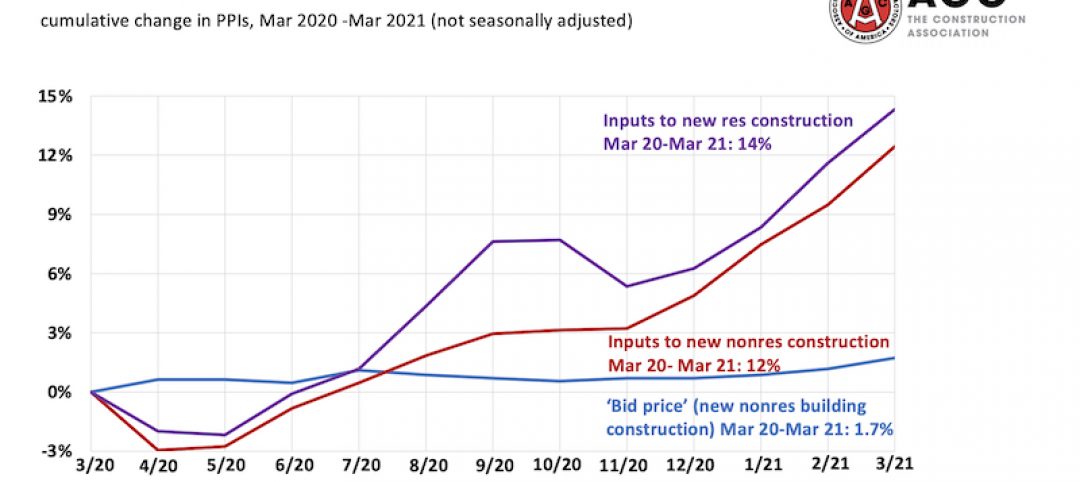

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

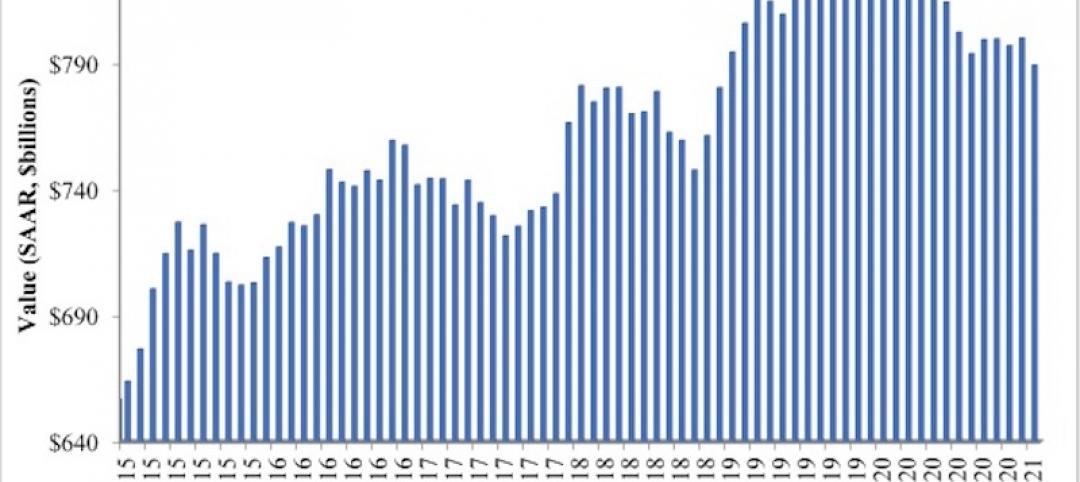

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.