Coming off a record-setting year for the nonresidential construction industry (more than $760 billion was spent on new construction and renovation work nationwide last year), AEC firm leaders should be brimming with confidence over the growth potential for their firms heading into 2019. The arrow is pointing up for nearly all building sectors, construction backlogs remain healthy, and architecture firms continue to see strong demand for their design services, according to AIA and ABC data.

Yet despite the positive indicators for the market, AEC professionals remain largely cautious when it comes to growth prospects for 2019. In October, BD+C surveyed 314 readers about their thoughts on a variety of issues: materials prices, bid prices, obstacles to growth, emerging opportunities, etc. Only slightly more than half (56.0%) of industry professionals expect higher revenue for their firm in 2018 compared to last year. More surprisingly, 13.4% are forecasting a decrease in revenue.

And their forecast for 2019 isn’t much rosier: 54.7% expect revenue to increase, 8.7% call for a drop, and 36.7% predict flat revenue this year. This is a markedly different sentiment than last year’s respondents, who were much more upbeat with their forecasts for the upcoming year: 62.0% predicted revenue to rise and only 6.1% called for it to drop.

When asked about their top concerns for 2019, the largest number of respondents cited “general economic conditions” (52.7%) as a key issue, followed by “competition from other firms” (41.0%) and “price increases in materials and services” (39.0%). In fact, nearly 90% of respondents anticipate construction materials prices to rise in 2019. That’s up from 86% in last year’s survey of BD+C readers.

See Also: And then there were two: HQ2 sites, in hindsight, seemed obvious

To help keep their project pipelines full through 2019, AEC firms are focusing on a number of business development strategies heading into this year. Selective hires (44.1%) and marketing/public relations efforts (42.2%) top the list, followed by investments in technology (39.0%), staff training/education (35.9%), and new services/business opportunities (29.2%).

Healthcare facilities and multifamily housing head the list of the hottest sectors heading into 2019, according to survey respondents. More than half (52.5%) indicated that the prospects for healthcare/hospital work were either “excellent” or “good” for 2019; 52.4% said the same for multifamily housing work. Other strong building sectors: senior/assisted living facilities (51.9%), office interiors/fitouts (46.9%), industrial/warehouse buildings (42.7%), hotel/hospitality developments (39.7%), university facilities (38.2%), government/military buildings (37.5%), and office buildings (37.4).

Related Stories

| Oct 12, 2010

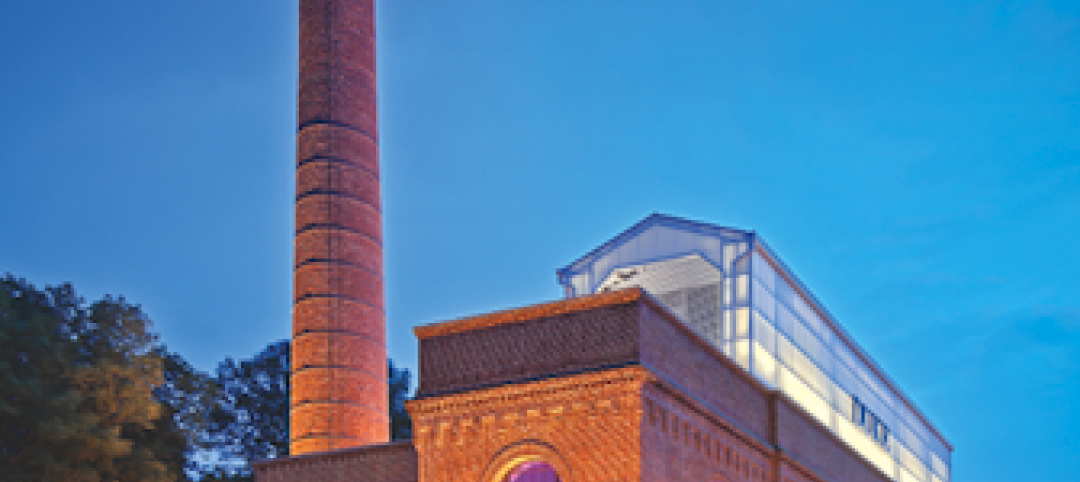

Full Steam Ahead for Sustainable Power Plant

An innovative restoration turns a historic but inoperable coal-burning steam plant into a modern, energy-efficient marvel at Duke University.

| Oct 6, 2010

From grocery store to culinary school

A former West Philadelphia supermarket is moving up the food chain, transitioning from grocery store to the Center for Culinary Enterprise, a business culinary training school.

| Sep 30, 2010

Luxury hotels lead industry in green accommodations

Results from the American Hotel & Lodging Association’s 2010 Lodging Survey showed that luxury and upper-upscale hotels are most likely to feature green amenities and earn green certifications. Results were tallied from 8,800 respondents, for a very respectable 18% response rate. Questions focused on 14 green-related categories, including allergy-free rooms, water-saving programs, energy management systems, recycling programs, green certification, and green renovation.

| Sep 22, 2010

Michael Van Valkenburg Assoc. wins St. Louis Gateway Arch design competition

Landscape architect Michael Van Valkenburgh and a multidisciplinary team of experts in “urban renewal, preservation, commemoration, social connections and ecological restoration” have been picked for the planning phase of The City+The Arch+The River 2015 International Design Competition.

| Sep 21, 2010

Forecast: Existing buildings to earn 50% of green building certifications

A new report from Pike Research forecasts that by 2020, nearly half the green building certifications will be for existing buildings—accounting for 25 billion sf. The study, “Green Building Certification Programs,” analyzed current market and regulatory conditions related to green building certification programs, and found that green building remain robust during the recession and that certifications for existing buildings are an increasing area of focus.

| Sep 16, 2010

Gehry’s Santa Monica Place gets a wave of changes

Omniplan, in association with Jerde Partnership, created an updated design for Santa Monica Place, a shopping mall designed by Frank Gehry in 1980.

| Sep 13, 2010

Campus housing fosters community connection

A 600,000-sf complex on the University of Washington's Seattle campus will include four residence halls for 1,650 students and a 100-seat cafe, 8,000-sf grocery store, and conference center with 200-seat auditorium for both student and community use.

| Sep 13, 2010

Second Time Around

A Building Team preserves the historic facade of a Broadway theater en route to creating the first green playhouse on the Great White Way.

| Sep 13, 2010

Palos Community Hospital plans upgrades, expansion

A laboratory, pharmacy, critical care unit, perioperative services, and 192 new patient beds are part of Palos (Ill.) Community Hospital's 617,500-sf expansion and renovation.