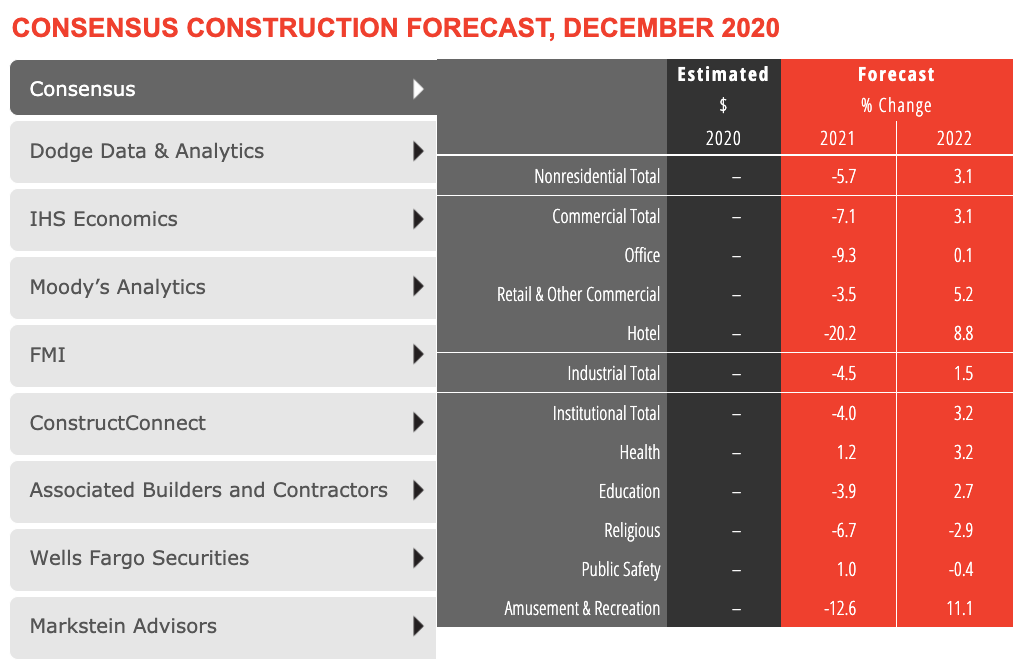

Slowing demand at architecture firms last year is expected to contribute to a projected 5.7% decline in construction spending for 2021, according to a new consensus forecast from The American Institute of Architects (AIA).

The AIA Consensus Construction Forecast Panel—comprised of leading economic forecasters—expects steep declines this year in construction spending on office buildings, hotels, and amusement and recreation centers. Health care and public safety are the only major sectors that are slated to produce gains in 2021.

Growth in nonresidential construction is expected for 2022, with 3% gains projected for the overall building market matched by both the commercial and institutional sectors.

“The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “As pandemic concerns begin to wane and economic activity begins to pick up later in 2021, there is likely to be considerable pent-up demand for nonresidential space, leading to anticipated growth in construction spending in 2022.”

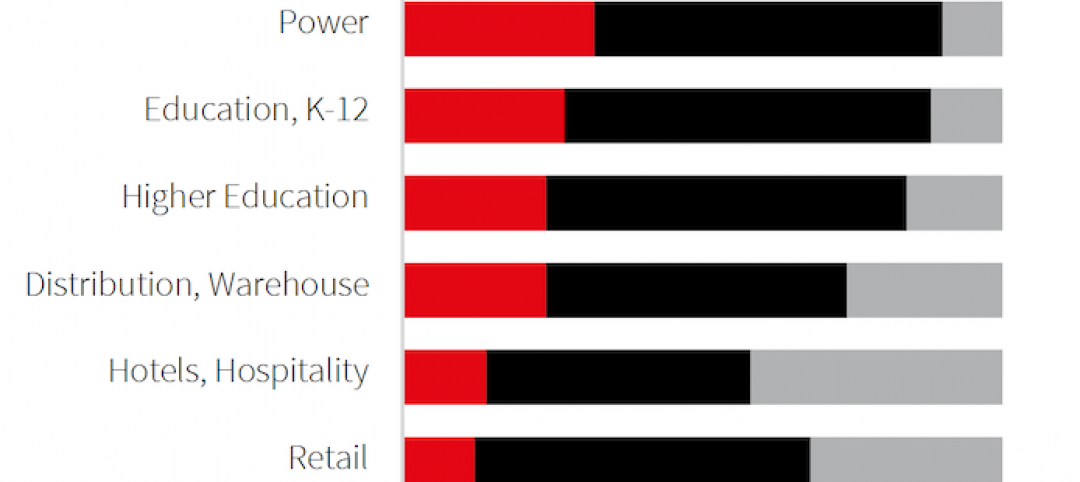

CLICK CHART TO LAUNCH INTERACTIVE CHART FROM AIA

Here are some takeaways from AIA's Chief Economist Kermit Baker, Hon. AIA:

• Hotel, airlines, and recreation industry jobs have been decimated by the pandemic. "The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion. Of particular concern were the 500,000 payroll positions lost in the leisure and hospitality sector. That means that this sector has lost almost 25% of payroll positions since February 2020, matching losses in the airline industry."

• The $900 billion stimulus package passed in December 2020 is not nearly enough to sustain economic growth. "Key elements of this package include another $600 in direct payments to qualifying individuals, $300 per week in supplemental unemployment insurance for up to 11 weeks, and $280 billion designated for the Paycheck Protection Program, which provided incentives for small businesses to keep employees on their payrolls. These initiatives were generally very effective in providing a safety net for impacted households and small businesses last spring. However, they weren’t designed to provide sufficient support for an extended period of economic weakness, and the December jobs report suggests that we may already be heading into another down cycle. Even this additional funding is unlikely to provide sufficient financial support for economic growth through the entire vaccination period, suggesting that even more stimulus will be needed in the coming months or else our economy likely will be in for an extended period of stagnant growth or modest declines."

• Biden win bodes well for infrastructure investment. "With the two Georgia senate seats now in the democratic column, there are a new set of policy options for the Biden administration. Still, given the razor thin margins in both the House and the Senate, programs likely to be enacted will need to have at least modest levels of bipartisan support. An infrastructure program is likely near the top of the list of programs that both parties could support, and the Biden Administration seems ready to make this a priority, in part because it would be viewed as a stimulus program, but also because borrowing costs are near historical lows."

• Architecture firms are seeing more positive signs for the long-term. "Project inquiries from prospective and former clients have been strong recently, suggesting that new work may be picking up. More concretely, new design work coming into architecture firms has generally been more positive than billings in recent months, suggesting that firms are bringing in more project activity than they are completing. However, firms are seeing different business conditions regionally. Firms in the northeast saw the steepest downturns as the pandemic hit, and conditions remained the weakest for the remainder of the year. Business conditions at firms in the other three regions – all modestly declining – are fairly comparable."

Related Stories

Coronavirus | Mar 20, 2020

Pandemic has halted or delayed projects for 28% of contractors

Coronavirus-caused slowdown contrasts with January figures showing a majority of metro areas added construction jobs; Officials note New infrastructure funding and paid family leave fixes are needed.

Market Data | Mar 17, 2020

Construction spending to grow modestly in 2020, predicts JLL’s annual outlook

But the coronavirus has made economic forecasting perilous.

Market Data | Mar 16, 2020

Grumman/Butkus Associates publishes 2019 edition of Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Mar 12, 2020

New study from FMI and Autodesk finds construction organizations with the highest levels of trust perform twice as well on crucial business metrics

Higher levels of trust within organizations and across project teams correlate with increased profit margins, employee retention and repeat business that can all add up to millions of dollars of profitability annually.

Market Data | Mar 11, 2020

The global hotel construction pipeline hits record high at 2019 year-end

Projects currently under construction stand at a record 991 projects with 224,354 rooms.

Market Data | Mar 6, 2020

Construction employment increases by 43,000 in February and 223,000 over 12 months

Average hourly earnings in construction top private sector average by 9.9% as construction firms continue to boost pay and benefits in effort to attract and retain qualified hourly craft workers.

Market Data | Mar 4, 2020

Nonresidential construction spending attains all-time high in January

Private nonresidential spending rose 0.8% on a monthly basis and is up 0.5% compared to the same time last year.

Market Data | Feb 21, 2020

Construction contractor confidence remains steady

70% of contractors expect their sales to increase over the first half of 2020.

Market Data | Feb 20, 2020

U.S. multifamily market gains despite seasonal lull

The economy’s steady growth buoys prospects for continued strong performance.

Market Data | Feb 19, 2020

Architecture billings continue growth into 2020

Demand for design services increases across all building sectors.