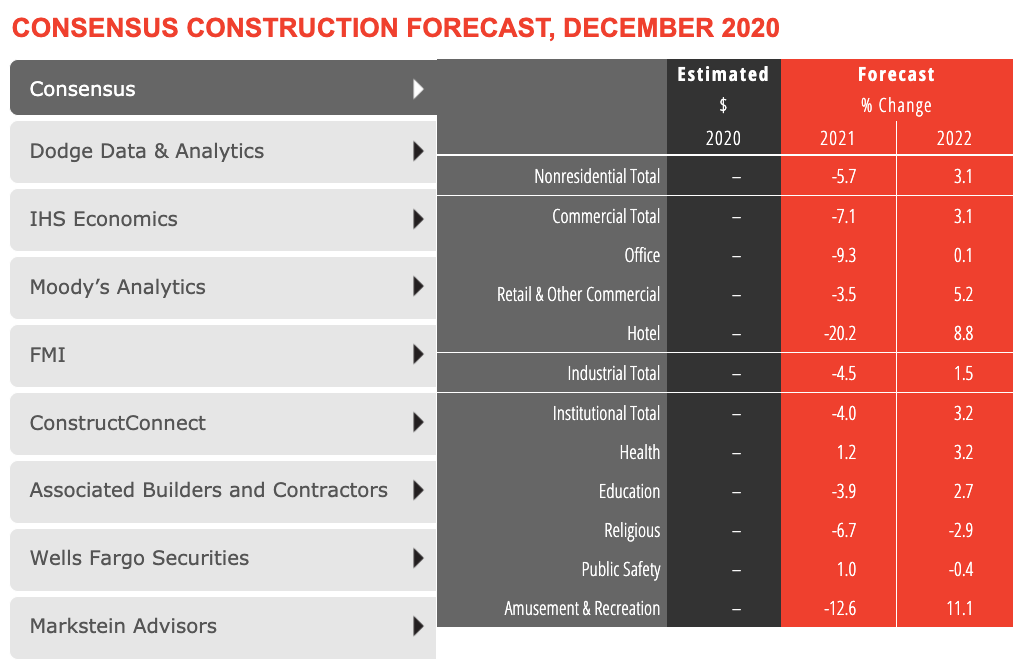

Slowing demand at architecture firms last year is expected to contribute to a projected 5.7% decline in construction spending for 2021, according to a new consensus forecast from The American Institute of Architects (AIA).

The AIA Consensus Construction Forecast Panel—comprised of leading economic forecasters—expects steep declines this year in construction spending on office buildings, hotels, and amusement and recreation centers. Health care and public safety are the only major sectors that are slated to produce gains in 2021.

Growth in nonresidential construction is expected for 2022, with 3% gains projected for the overall building market matched by both the commercial and institutional sectors.

“The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “As pandemic concerns begin to wane and economic activity begins to pick up later in 2021, there is likely to be considerable pent-up demand for nonresidential space, leading to anticipated growth in construction spending in 2022.”

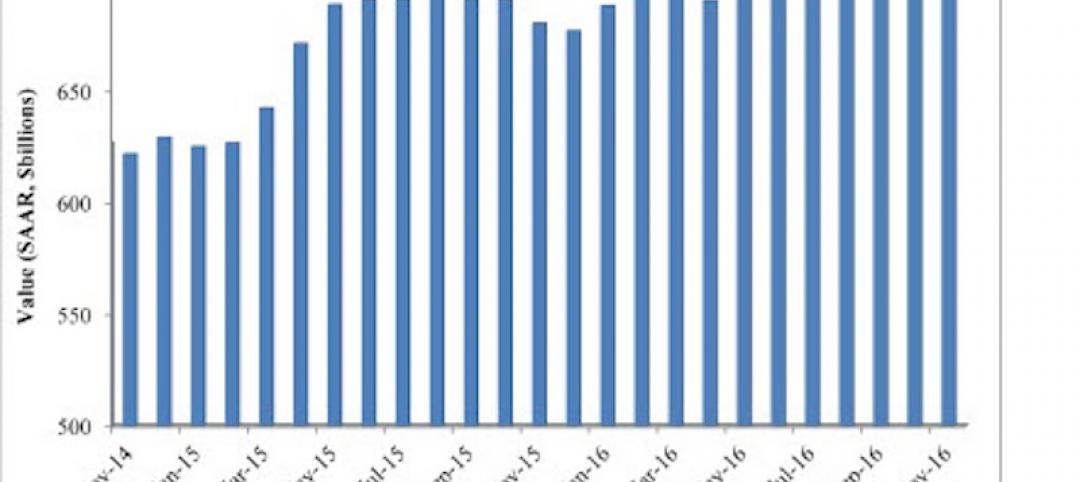

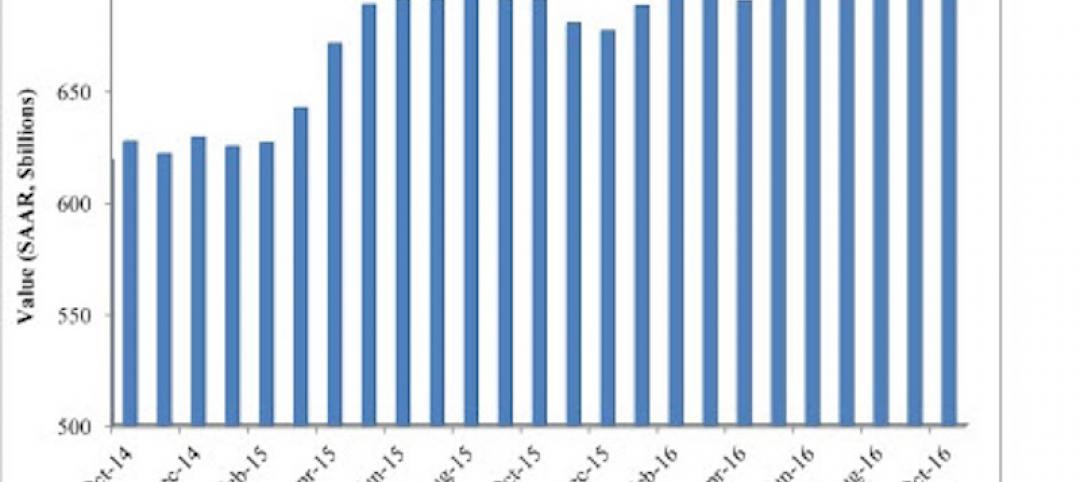

CLICK CHART TO LAUNCH INTERACTIVE CHART FROM AIA

Here are some takeaways from AIA's Chief Economist Kermit Baker, Hon. AIA:

• Hotel, airlines, and recreation industry jobs have been decimated by the pandemic. "The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion. Of particular concern were the 500,000 payroll positions lost in the leisure and hospitality sector. That means that this sector has lost almost 25% of payroll positions since February 2020, matching losses in the airline industry."

• The $900 billion stimulus package passed in December 2020 is not nearly enough to sustain economic growth. "Key elements of this package include another $600 in direct payments to qualifying individuals, $300 per week in supplemental unemployment insurance for up to 11 weeks, and $280 billion designated for the Paycheck Protection Program, which provided incentives for small businesses to keep employees on their payrolls. These initiatives were generally very effective in providing a safety net for impacted households and small businesses last spring. However, they weren’t designed to provide sufficient support for an extended period of economic weakness, and the December jobs report suggests that we may already be heading into another down cycle. Even this additional funding is unlikely to provide sufficient financial support for economic growth through the entire vaccination period, suggesting that even more stimulus will be needed in the coming months or else our economy likely will be in for an extended period of stagnant growth or modest declines."

• Biden win bodes well for infrastructure investment. "With the two Georgia senate seats now in the democratic column, there are a new set of policy options for the Biden administration. Still, given the razor thin margins in both the House and the Senate, programs likely to be enacted will need to have at least modest levels of bipartisan support. An infrastructure program is likely near the top of the list of programs that both parties could support, and the Biden Administration seems ready to make this a priority, in part because it would be viewed as a stimulus program, but also because borrowing costs are near historical lows."

• Architecture firms are seeing more positive signs for the long-term. "Project inquiries from prospective and former clients have been strong recently, suggesting that new work may be picking up. More concretely, new design work coming into architecture firms has generally been more positive than billings in recent months, suggesting that firms are bringing in more project activity than they are completing. However, firms are seeing different business conditions regionally. Firms in the northeast saw the steepest downturns as the pandemic hit, and conditions remained the weakest for the remainder of the year. Business conditions at firms in the other three regions – all modestly declining – are fairly comparable."

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

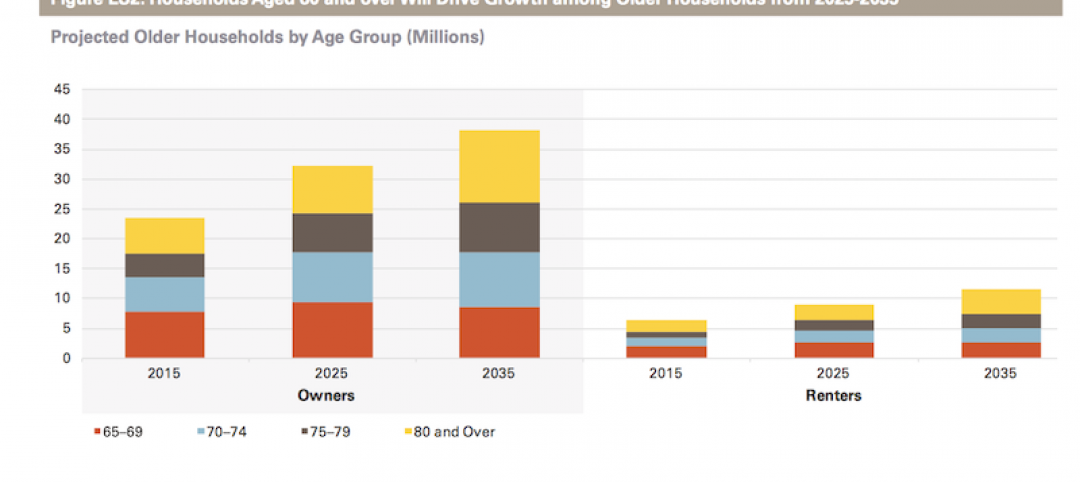

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.