With little choice but to adopt virtual care options due to pandemic restrictions and interactions, telehealth adoption soared as patients sought convenience and more efficient care options. Virtual visits peaked at 52 percent of visits in the second quarter of 2020 and since then have stabilized to around 11 percent, according to May 2021 data from Chartis Group, up from a pre-pandemic utilization of less than 1 percent in early 2020. But telehealth is not replacing the physical office by any means. JLL Healthcare’s new patient consumer survey results reveal that 62 percent of care visits were exclusively in person with no virtual care component. Of the respondents who noted having virtual care components, about 31 percent resulted in a physical office visit, suggesting telehealth’s position as an augmentation to the physical office, rather than a replacement.

“Physical facilities are still at the center of the healthcare ecosystem,” said Jay Johnson, U.S. Practice Leader, JLL Healthcare. “Virtual care via telehealth is replacing some in-person visits, but nearly three quarters of the care still involved a physical location according to our survey results. Telehealth is actually leading to subsequent in-person care interactions that might not have occurred otherwise. Steady occupancy of 91 to 92 percent in the national medical office market over the past three years, coupled with slightly increasing rental rates, seem to bear out the durability of physical sites of care.”

Overall, convenience wins, with 83 percent of patients traveling less than 30 minutes to access care and 40 percent travelling less than 15 minutes. Unsurprisingly, primary care and urgent care visits were most likely to have had shorter travel times. Visits to surgery centers required the longest amounts of travel, with 31 percent traveling 30 minutes or more. Patients continue to prioritize locational convenience over facility quality, which has remained true since 2020.

According to the 2022 survey, virtual components of care were more common in the Northeast and West (41 percent and 43 percent respectively), in comparison to the Midwest and South (32 percent and percent respectively). Specifically, 75 percent of behavioral health/psychiatry clinic respondents had a virtual component to care.

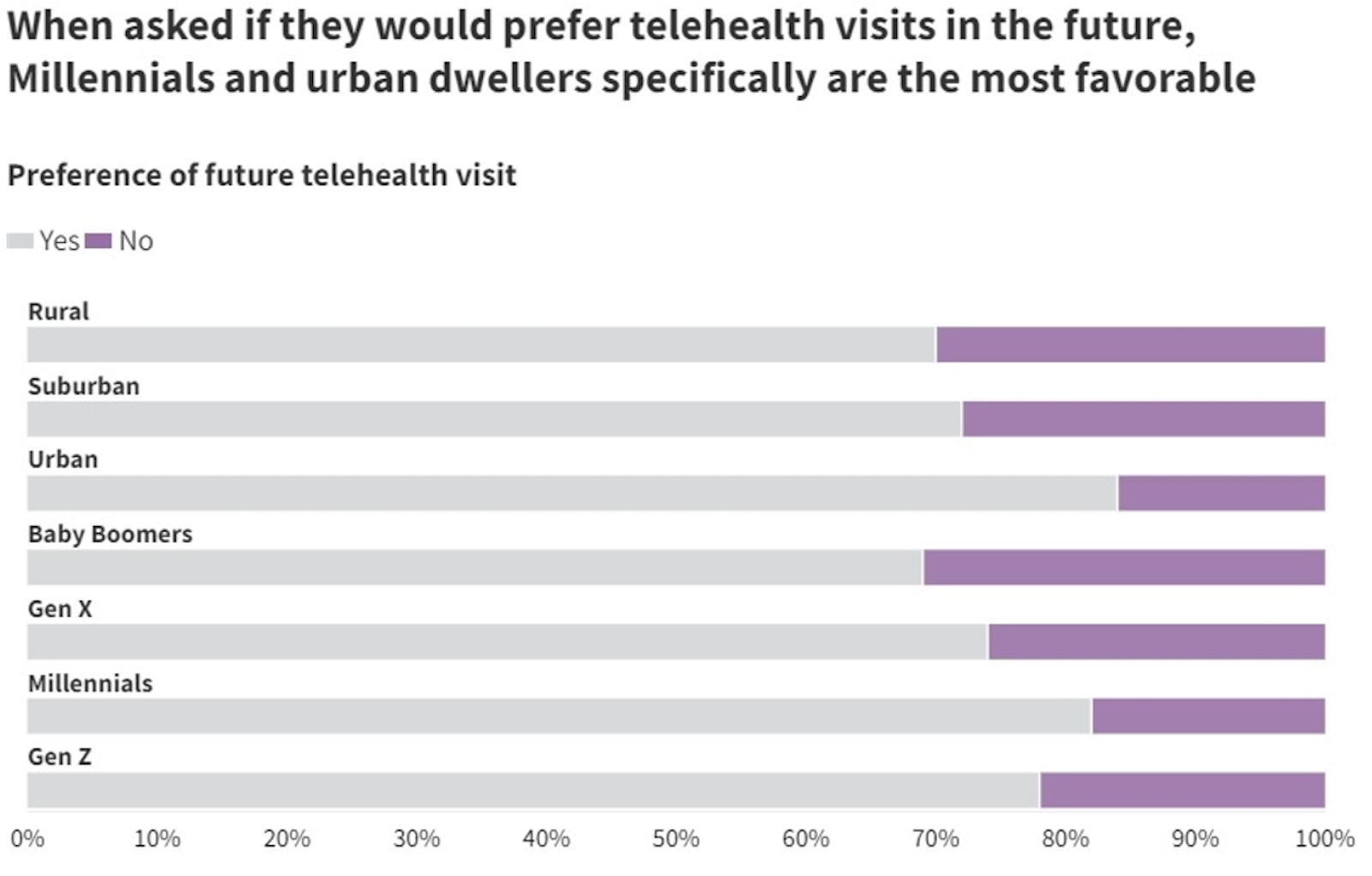

Seventy-six percent of all respondents who have had a telehealth visit since July 1, 2021 would prefer telehealth visits in the future. However, preferences in care differ based on patient community, with urbanites more likely than others to request a telehealth appointment for an initial consultation, suggesting that even in a dense urban community with more options for care available, convenience still prevails. Only 36 percent of urbanites traveled less than 15 minutes to a healthcare facility, compared to 45 percent of suburbanites, which also alludes to why telehealth is more likely to be embraced in urban settings.

“Telehealth’s convenience will make it here to stay as a facet of the healthcare industry, and in turn, its accessibility will result in more in-person care,” said Richard Taylor, President, JLL Healthcare. “Because of this, systems need to embrace telehealth and invest in strengthening the performance and capabilities of their technology platforms.”

The JLL Healthcare Patient Survey was conducted via Engine Insights with a nationally representative group of U.S. residents from January 3, 2022 to January 12, 2022. The number of respondents totaled 4,060, in which 52 percent were female and 48 percent were male.

JLL Healthcare provides a full range of real estate and facilities solutions for hospitals, physicians and other care providers as well as real estate investors that own and operate medical and seniors housing properties. JLL Healthcare helps clients plan, find, finance, buy, lease, sell, construct, optimize, manage and maintain the most-advantageous facilities anywhere in the US for all property types along the continuum of care, serving over 350 million square feet of healthcare property annually. Visit us.jll.com/healthcare to learn more.

Related Stories

Industry Research | Jun 15, 2017

Commercial Construction Index indicates high revenue and employment expectations for 2017

USG Corporation (USG) and U.S. Chamber of Commerce release survey results gauging confidence among industry leaders.

Industry Research | Jun 13, 2017

Gender, racial, and ethnic diversity increases among emerging professionals

For the first time since NCARB began collecting demographics data, gender equity improved along every career stage.

Industry Research | May 25, 2017

Project labor agreement mandates inflate cost of construction 13%

Ohio schools built under government-mandated project labor agreements (PLAs) cost 13.12 percent more than schools that were bid and constructed through fair and open competition.

Market Data | May 24, 2017

Design billings increasing entering height of construction season

All regions report positive business conditions.

Market Data | May 24, 2017

The top franchise companies in the construction pipeline

3 franchise companies comprise 65% of all rooms in the Total Pipeline.

Industry Research | May 24, 2017

These buildings paid the highest property taxes in 2016

Office buildings dominate the list, but a residential community climbed as high as number two on the list.

Market Data | May 16, 2017

Construction firms add 5,000 jobs in April

Unemployment down to 4.4%; Specialty trade jobs dip slightly.

Industry Research | May 4, 2017

How your AEC firm can go from the shortlist to winning new business

Here are four key lessons to help you close more business.

Engineers | May 3, 2017

At first buoyed by Trump election, U.S. engineers now less optimistic about markets, new survey shows

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0.

Market Data | May 2, 2017

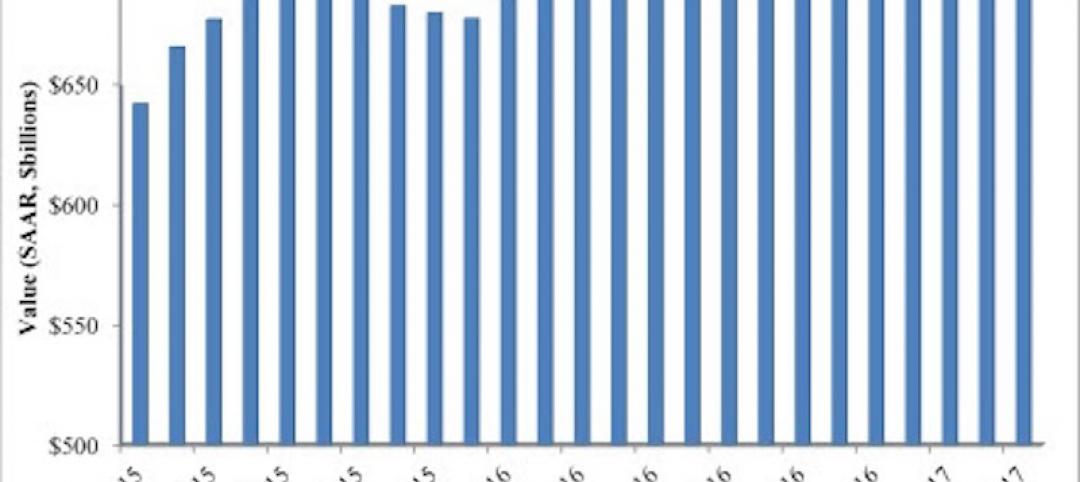

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.