KPMG, an organization of firms that provide audit, tax and advisory services, surveyed 100 U.S. building material manufacturing executives to understand what technological investments they had made—or were planning to make—and why.

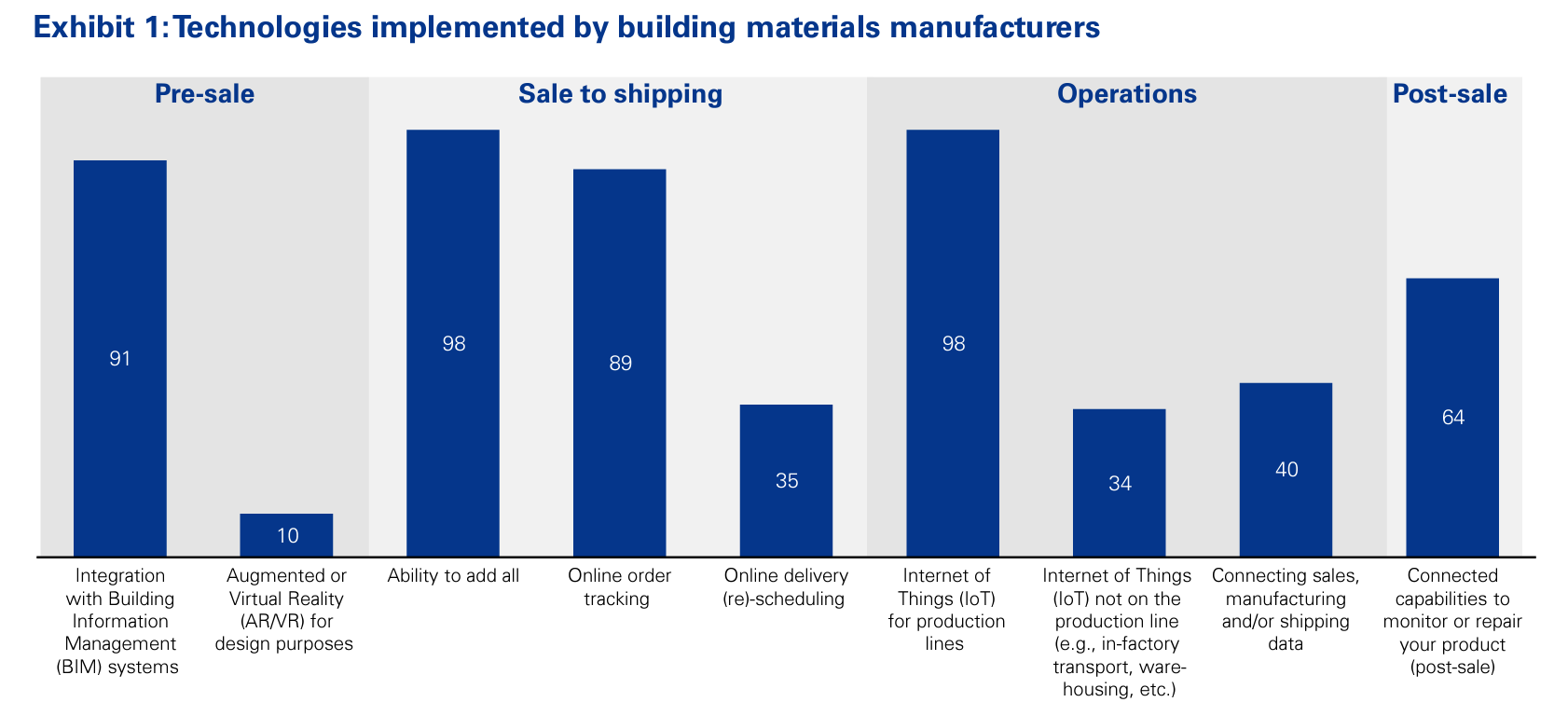

These digital developments range from Building Information Management (BIM) integration to e-commerce and online delivery. Regardless of the method, KPMG pulled out four surprising insights from the results of the survey.

Overall, half of building product manufacturers plan to invest in one or more areas of technology in the next three years. The survey breaks down technology categories by product journey, from pre-sale, sale to shipping, operations, and post-sale groups. Pre-sale technology would include BIM systems and AR/VR design, for example.

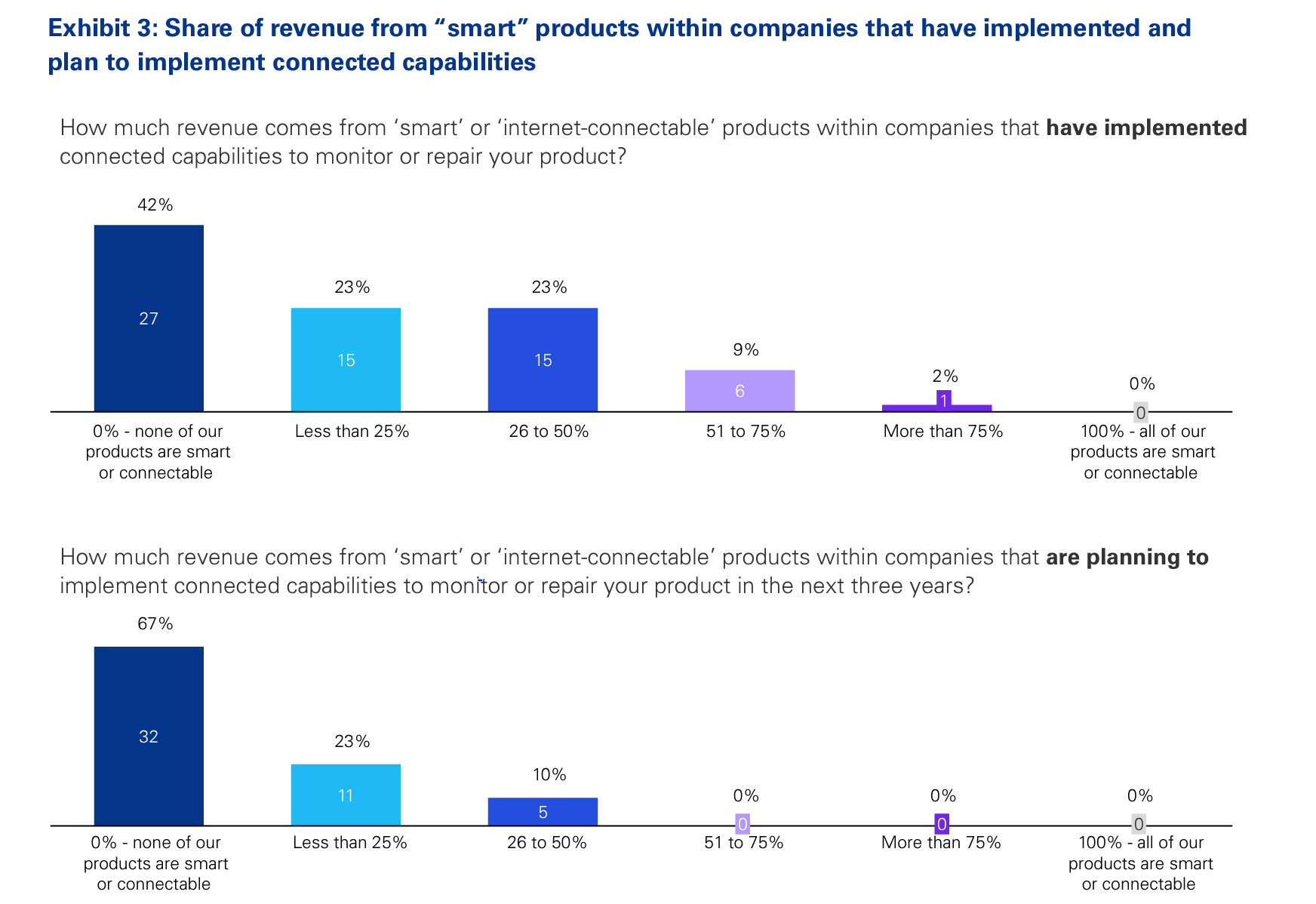

1. Connected capabilities can work without ‘smart’ products

In the study, KPMG expected to see post-sale connected capabilities to only be applicable to smart products, such as thermostats, security systems, and air conditioners. However, 42% of respondents that have already implemented such connected capabilities have no products with any smart features.

Likewise, 67% of respondents who plan to implement these technologies in the next three years said the same.

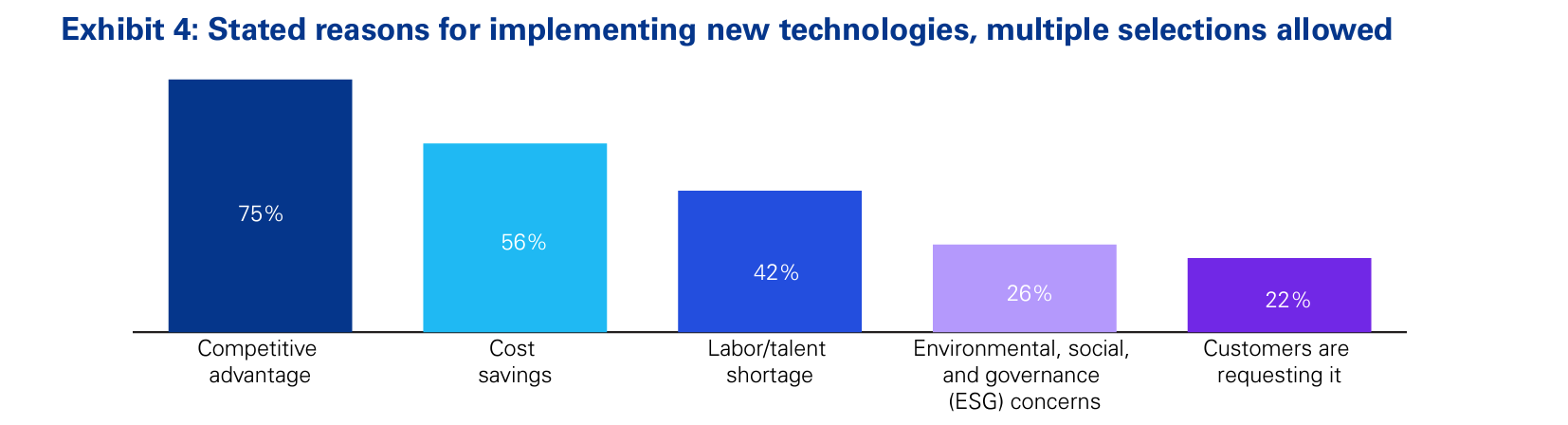

2. Technology can drive both revenue and cost benefits

What are the largest influences behind implementing new technologies? Over half (56%) of building materials manufacturers report cost savings as one of the biggest reasons. Forty-two percent attribute their influence towards the labor/talent shortage, while 75% of manufacturers planning to implement new technologies do so for a competitive advantage.

Alternatively, one-quarter (26%) of respondents listed ESG concerns as an influence, and just 22% said that customers were requesting it. KPMG finds that the reasons did not differ significantly across company types or types of technology.

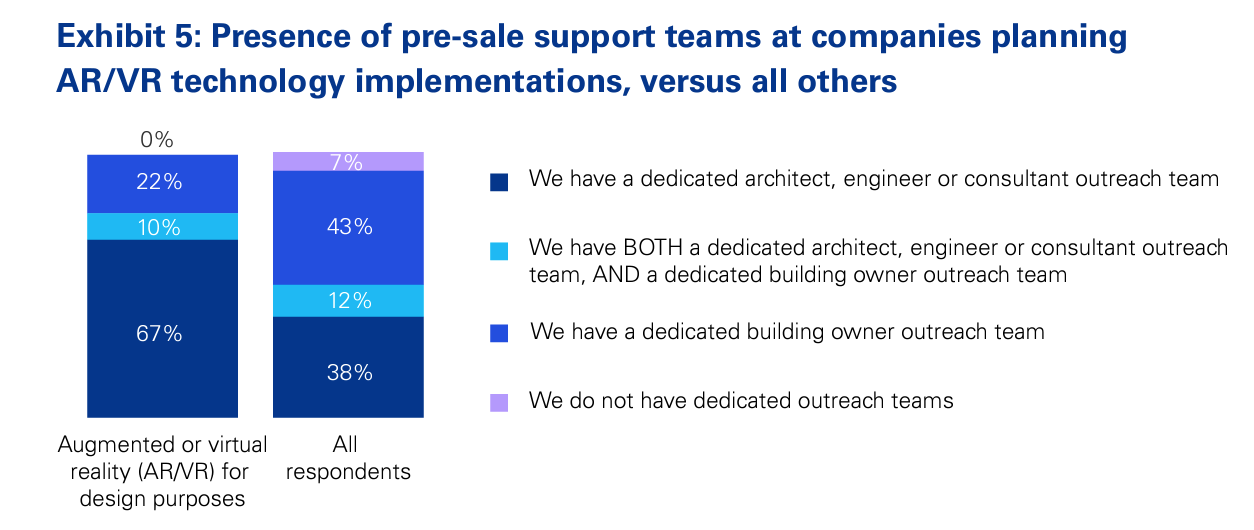

3. AR/VR technology is in addition to—not a replacement for—outreach teams

Rather than displacing the role of sales support teams, AR/VR tech was found to be an additional tool for architects, engineers, and consultant outreach teams. The survey shows that 78% of companies investing in AR/VR and remote monitoring to help the pre-sale process have a dedicated support team.

This is above the general average of 50% of respondents with the same teams, but without AR/VR technology in place, according to the report.

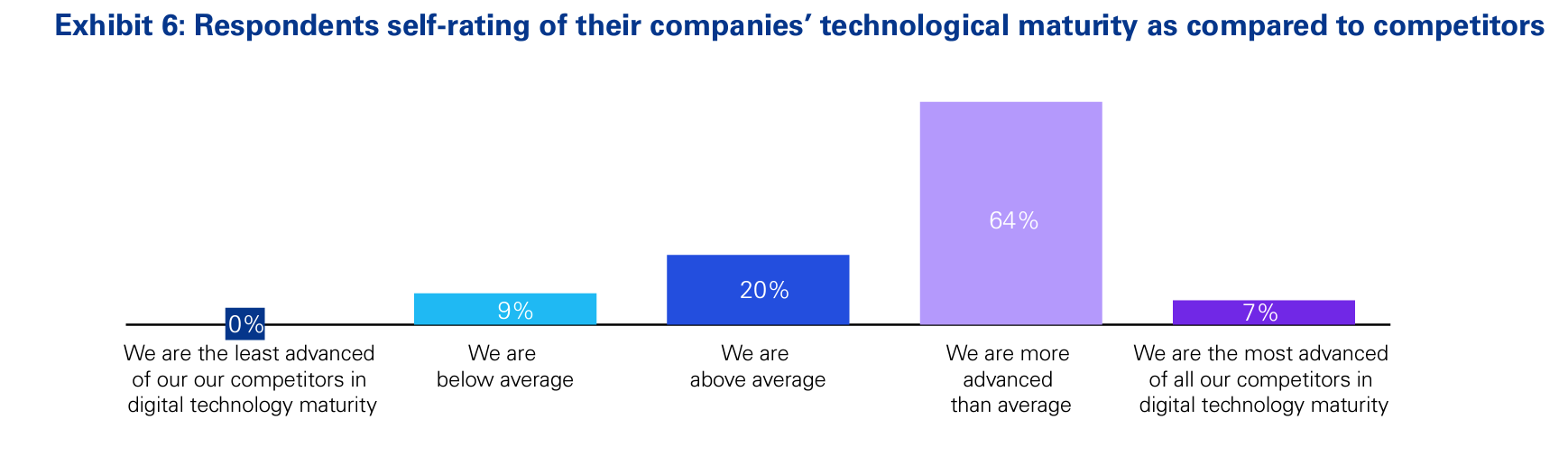

4. Companies overestimate their technological sophistication levels

When asked about their companies’ technological maturity compared to competitors, a majority of respondents (70%) believe they are more advanced than average. Only 9% believe their company is below average, but no respondents claimed to be “the least advanced of all our competitors in digital maturity.”

Furthermore, KPMG saw that the more technologies a company selected as “implemented,” the more likely they were to self-rate as being above average or best-in-class.

“While quantity certainly helps, quality of execution is a determining factor in how effective these technologies are,” says Serena Crivellaro and Len Prokopets, Managing Directors, Advisory, KPMG. “Unfortunately, with technological deployments being so broad-based across the industry, competitors may be more advanced than companies expect.”

Click here to view the entire report.

Related Stories

AEC Tech | Mar 10, 2016

Is the Internet of Things the key to smarter buildings and cities?

Experts say yes. But what’s needed is a point person who makes sure that sensing devices can “talk” to each other.

Multifamily Housing | Mar 10, 2016

Access and energy control app clicks with student housing developers and managers

Ease of installation is one of StratIS’s selling features.

AEC Tech | Mar 8, 2016

WiredScore offers developers competitive advantage in marketing

Designates best-in-class Internet connectivity.

Game Changers | Feb 5, 2016

London’s ’shadowless’ towers

Using advanced design computation, a design team demonstrates how to ‘erase’ a building’s shadows.

Game Changers | Feb 5, 2016

Asia’s modular miracle

A prefab construction company in China built a 57-story tower in 19 days. Here’s how they did it.

Game Changers | Feb 5, 2016

Tesla: Battery storage is not just about electric vehicles

With his $5 billion, 13.6 million-sf Gigafactory, Tesla’s Elon Musk seeks to change the economics of battery energy storage, forever.

BIM and Information Technology | Jan 27, 2016

Seeing double: Dassault Systèmes creating Virtual Singapore that mirrors the real world

The virtual city will be used to help predict the outcomes of and possible issues with various scenarios.

3D Printing | Jan 25, 2016

Architecture students create new method for 3D printing concrete

The team's Fossilized project allows for structures that are more varied and volumetric than other forms so far achieved.