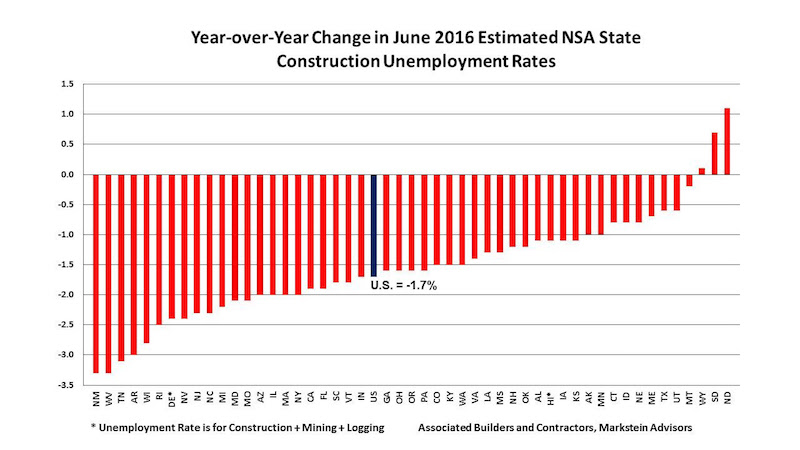

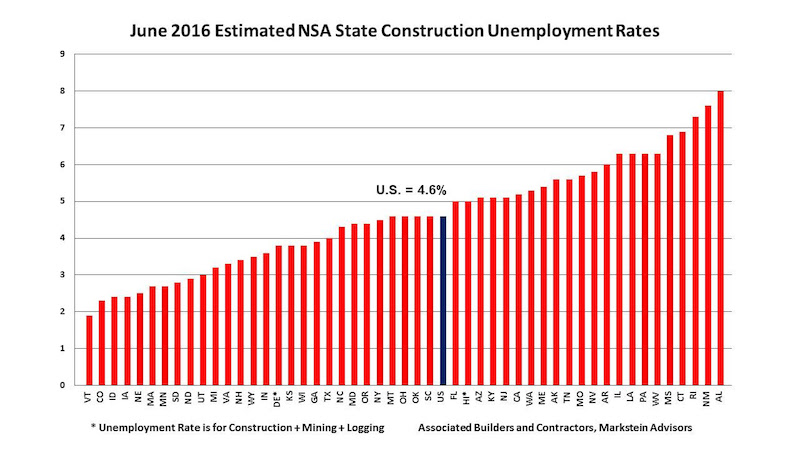

June not seasonally adjusted (NSA) construction unemployment rates improved in 47 states and the nation on a year-over-year basis according to analysis released today by Associated Builders and Contractors (ABC). The national construction unemployment rate of 4.6 percent was 1.7 percent lower than a year ago according to data from the Bureau of Labor Statistics (BLS). Further, the industry boasted its lowest June rate since 2000 when it matched this June’s 4.6 percent rate. BLS data also showed that the industry employed 229,000 more people than in June 2015.

“Starting in 2000, when the BLS data for this series begins, the June national NSA construction unemployment rate has fallen from May every year except 2010 when it was unchanged. This is not surprising given that this is not seasonally adjusted data and that construction activity normally continues to rise nationwide as the weather improves throughout the country. This year’s decrease of 0.6 percent from May continues this pattern,” says economist Bernard M. Markstein, Ph.D., President and Chief Economist of Markstein Advisors, who conducted the analysis for ABC.

The five states with the lowest estimated NSA construction unemployment rates in order from lowest rate to highest were:

1. Vermont

2. Colorado

3. Idaho and Iowa (tie)

5. Nebraska

Three states—Iowa, Nebraska and Vermont—were also among the top five in May.

The five states with the highest estimated NSA construction unemployment rates (from lowest to highest) were:

46. Mississippi

47. Connecticut

48. Rhode Island

49. New Mexico

50. Alabama

Alabama, New Mexico and Rhode Island were also in the bottom five in May.

View states ranked by their construction unemployment rate, their year-over-year improvement in construction employment and monthly improvement in construction employment.

Read more on ABC's website.

Related Stories

Market Data | May 2, 2017

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Architects | Apr 27, 2017

Number of U.S. architects holds steady, while professional mobility increases

New data from NCARB reveals that while the number of architects remains consistent, practitioners are looking to get licensed in multiple states.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.