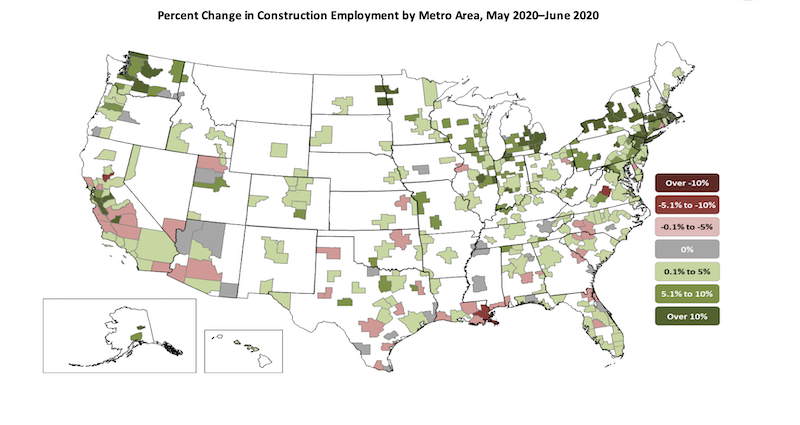

Construction employment decreased in 225, or 62%, out of 358 metro areas between June 2019 and last month despite widespread increases from May to June, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials urged government officials to enact liability reform, boost infrastructure investments and extend tax credits to help the industry recover and rebuild.

“It’s troubling to see construction employment lagging year-ago levels in most locations, in spite of a strong rebound in May and June,” said Ken Simonson, the association’s chief economist. “Those gains were not enough to erase the huge losses in March and April. Many indicators since the employment data were collected in mid-June suggest construction employment will soon decline, or stagnate at best, in much of the country.”

Simonson noted that construction employment was stagnant in 39 metro areas and increased in only 94 areas (26%) over the past 12 months. Eighteen metros had all-time lows for June construction employment, while 28 areas had record highs for June, in data going back to 1990 for most areas.

New York City lost the most construction jobs over 12 months (-38,200 jobs, -24%) despite having the largest gain from May to June. Brockton-Bridgewater-Easton, Mass. had the largest percentage decline: -37% (-2,200 jobs). Austin-Round Rock, Texas added the most construction jobs from June 2019 to June 2020: 4,100 jobs (6%). Walla Walla, Wash. had the highest percentage increase: 27% (300 jobs).

From May to June—a month when construction employment typically increases in most metro areas, 291 metros added construction employees; 42 areas had a decrease; and employment was unchanged in 25 areas. New York City added the most construction jobs between May and June: 22,100 or 22%. The largest percentage increase occurred in Monroe, Mich.: 31% (500 jobs). New Orleans-Metairie La. lost the most jobs during the month: -1,500 jobs (-6%). The largest percentage loss was in Yuba City, Calif.: -10% (-300 jobs).

Association officials noted that Senate Republican leaders released a new coronavirus recovery measure earlier this week that includes provisions that can help construction firms rebuild their payrolls. These include liability reforms so construction firms that are protecting workers from the coronavirus will not be subject to needless litigation. The proposal also includes improvement to the Paycheck Protection Program and an expansion of the Employee Retention Tax Credit the association supports.

“While the measure also addresses unemployment insurance and workforce development, it fails to include the kind of infrastructure funding needed to rebuild our economy” said Stephen E. Sandherr, the association’s chief executive officer. “That new funding is needed to address state transportation funding shortfalls, fix aging public facilities and help retrofit structures to protect students and others from the coronavirus.”

View the metro employment 1-month data, rankings, top 10, map and 12-month data, rankings, top 10, and map.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

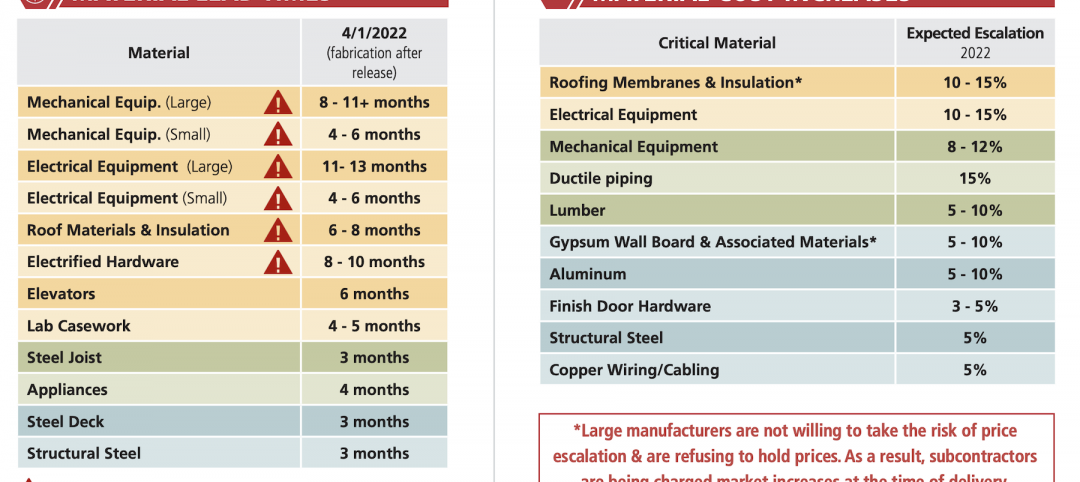

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment