Associated Builders and Contractors (ABC) Chief Economist Anirban Basu predicts stability for the construction industry’s economy and expanding nonresidential construction spending in 2018. While construction project backlog and contractor confidence remain high heading into the new year, Basu warns there are risks to the 2018 outlook as a number of potential cost increases could come into play.

“With wage pressures building, healthcare costs surging and fuel prices edging higher, inflation is becoming more apparent,” Basu said. “That could translate into some meaningful interest rate increases in 2018, which all things being equal is not good for construction spending. The stock market’s performance has been simply brilliant. But what goes up can go down.”

Basu added that asset prices might head in a different direction in 2018, including commercial real estate prices. Segments like hotels, office buildings and apartments have helped to fuel construction spending in recent years. If the value of properties begins to stagnate or worse, construction spending momentum will eventually wind down. The impact of this may not be felt in 2018, however, but in out years, Basu said.

“For now, there is plentiful momentum,” said Basu. “A recent reading of the Conference Board’s Index of Leading Economic Indicators suggests that the U.S. economy will enter 2018 with substantial momentum. Corporate earnings remain healthy. Global growth is accelerating. Consumers are upbeat. Tax cuts could fuel faster business spending. All of this suggests that the construction recovery that began in earnest in 2011 may have a few more birthdays ahead.”

Read Basu’s full 2018 construction economic forecast in Construction Executive magazine. You can also listen to Basu talk about his forecast in a recent webinar.

Visit ABC Construction Economics for the Construction Backlog Indicator, Construction Confidence Index and state unemployment reports, plus analysis of spending, employment, GDP and the Producer Price Index.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

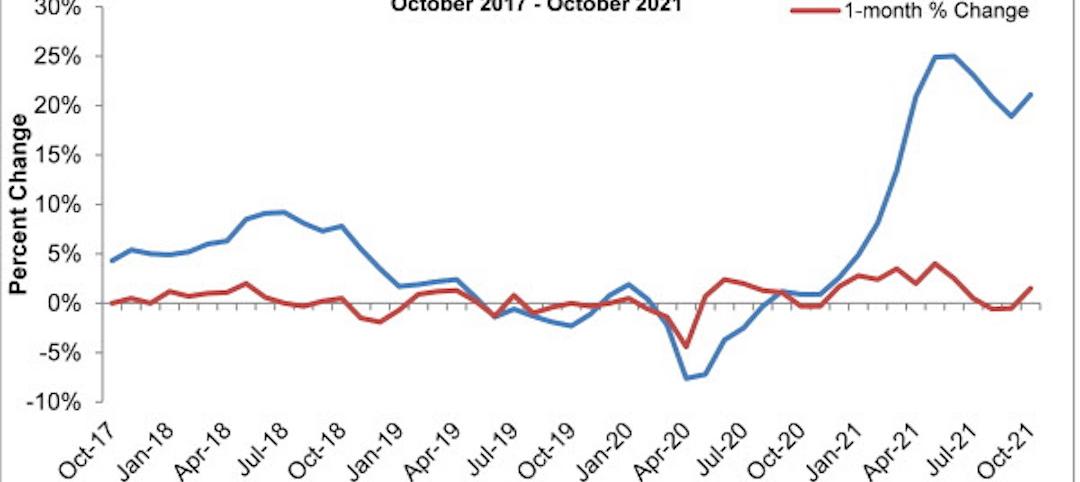

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

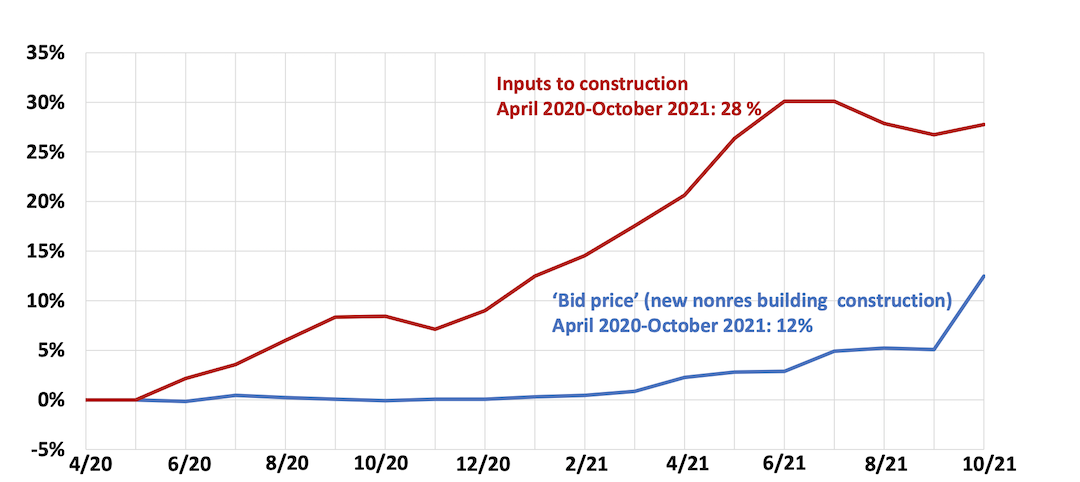

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.