Associated Builders and Contractors (ABC) Chief Economist Anirban Basu predicts stability for the construction industry’s economy and expanding nonresidential construction spending in 2018. While construction project backlog and contractor confidence remain high heading into the new year, Basu warns there are risks to the 2018 outlook as a number of potential cost increases could come into play.

“With wage pressures building, healthcare costs surging and fuel prices edging higher, inflation is becoming more apparent,” Basu said. “That could translate into some meaningful interest rate increases in 2018, which all things being equal is not good for construction spending. The stock market’s performance has been simply brilliant. But what goes up can go down.”

Basu added that asset prices might head in a different direction in 2018, including commercial real estate prices. Segments like hotels, office buildings and apartments have helped to fuel construction spending in recent years. If the value of properties begins to stagnate or worse, construction spending momentum will eventually wind down. The impact of this may not be felt in 2018, however, but in out years, Basu said.

“For now, there is plentiful momentum,” said Basu. “A recent reading of the Conference Board’s Index of Leading Economic Indicators suggests that the U.S. economy will enter 2018 with substantial momentum. Corporate earnings remain healthy. Global growth is accelerating. Consumers are upbeat. Tax cuts could fuel faster business spending. All of this suggests that the construction recovery that began in earnest in 2011 may have a few more birthdays ahead.”

Read Basu’s full 2018 construction economic forecast in Construction Executive magazine. You can also listen to Basu talk about his forecast in a recent webinar.

Visit ABC Construction Economics for the Construction Backlog Indicator, Construction Confidence Index and state unemployment reports, plus analysis of spending, employment, GDP and the Producer Price Index.

Related Stories

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

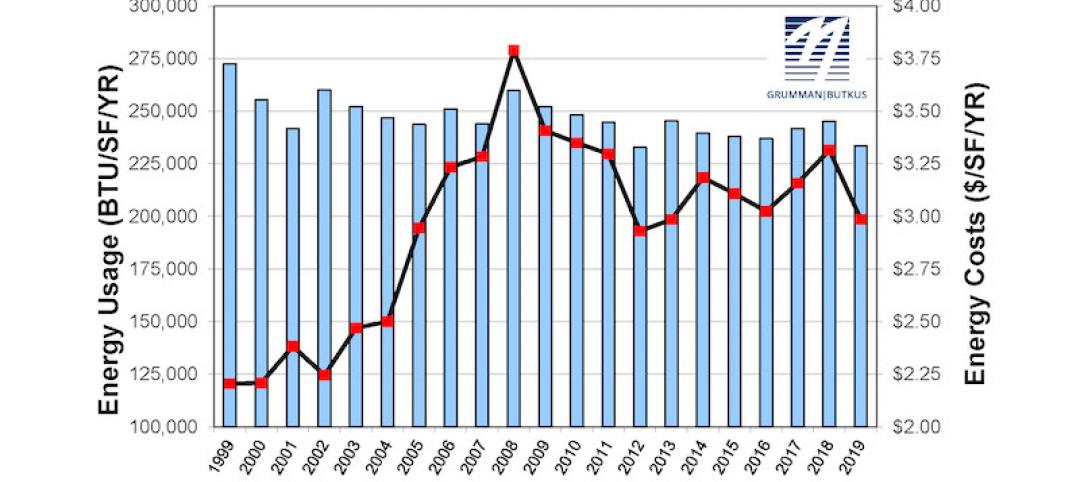

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

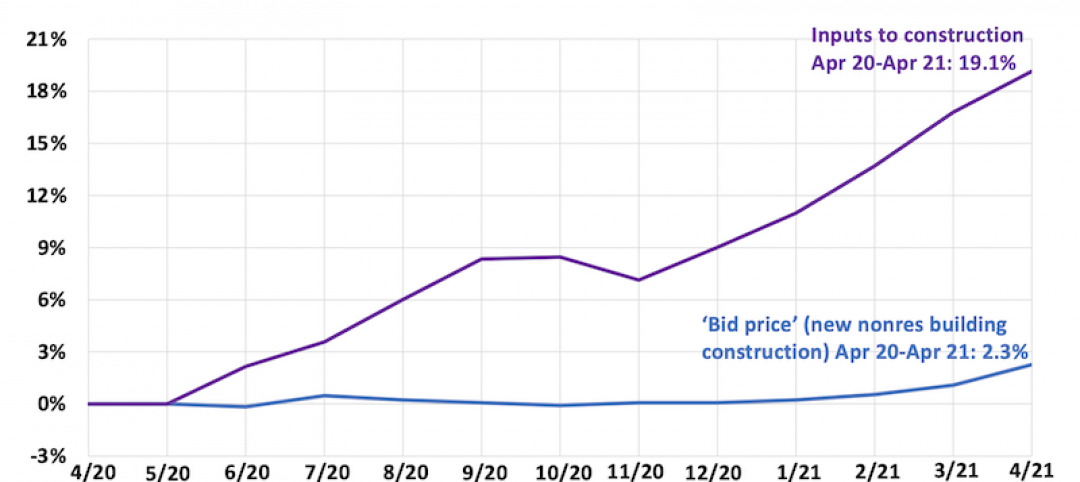

Market Data | May 13, 2021

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

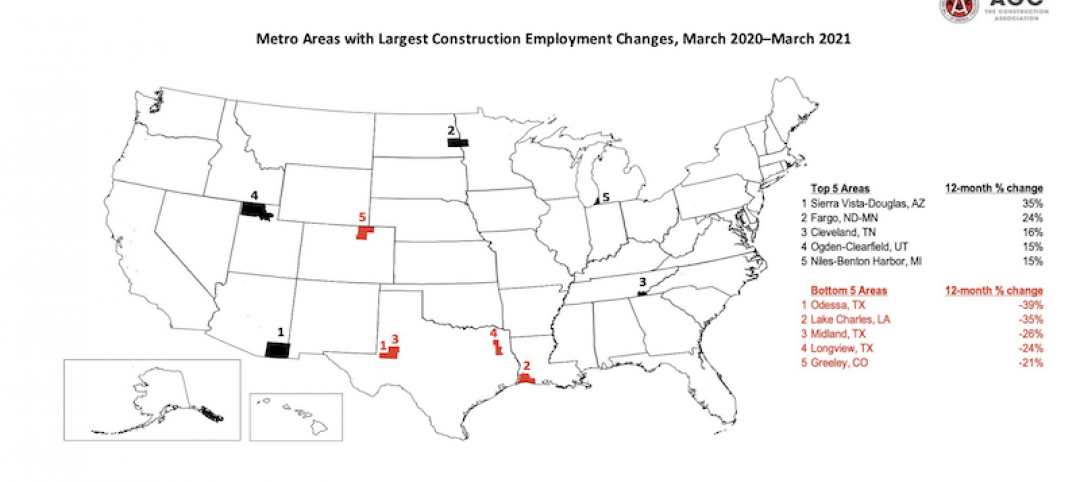

Market Data | Apr 28, 2021

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.