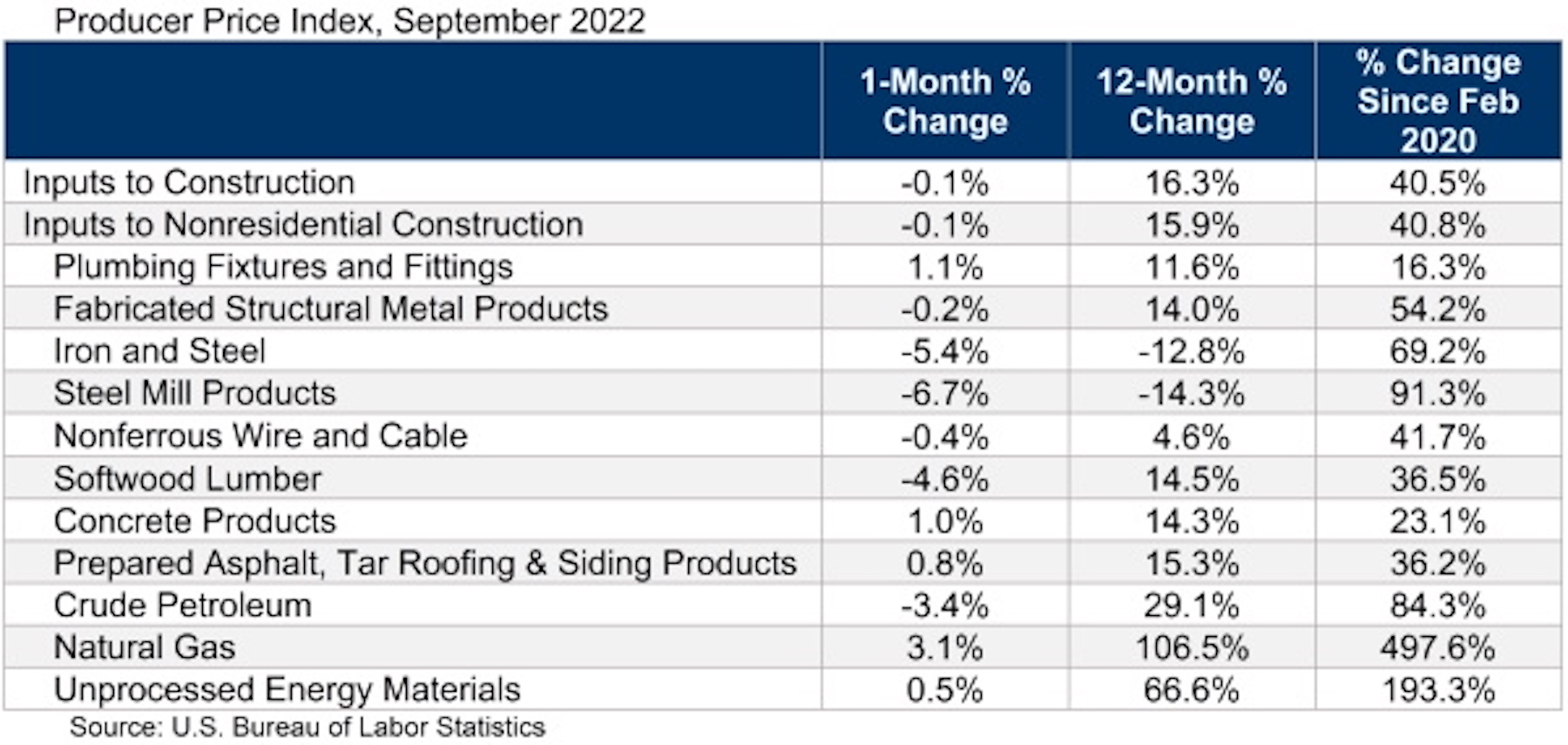

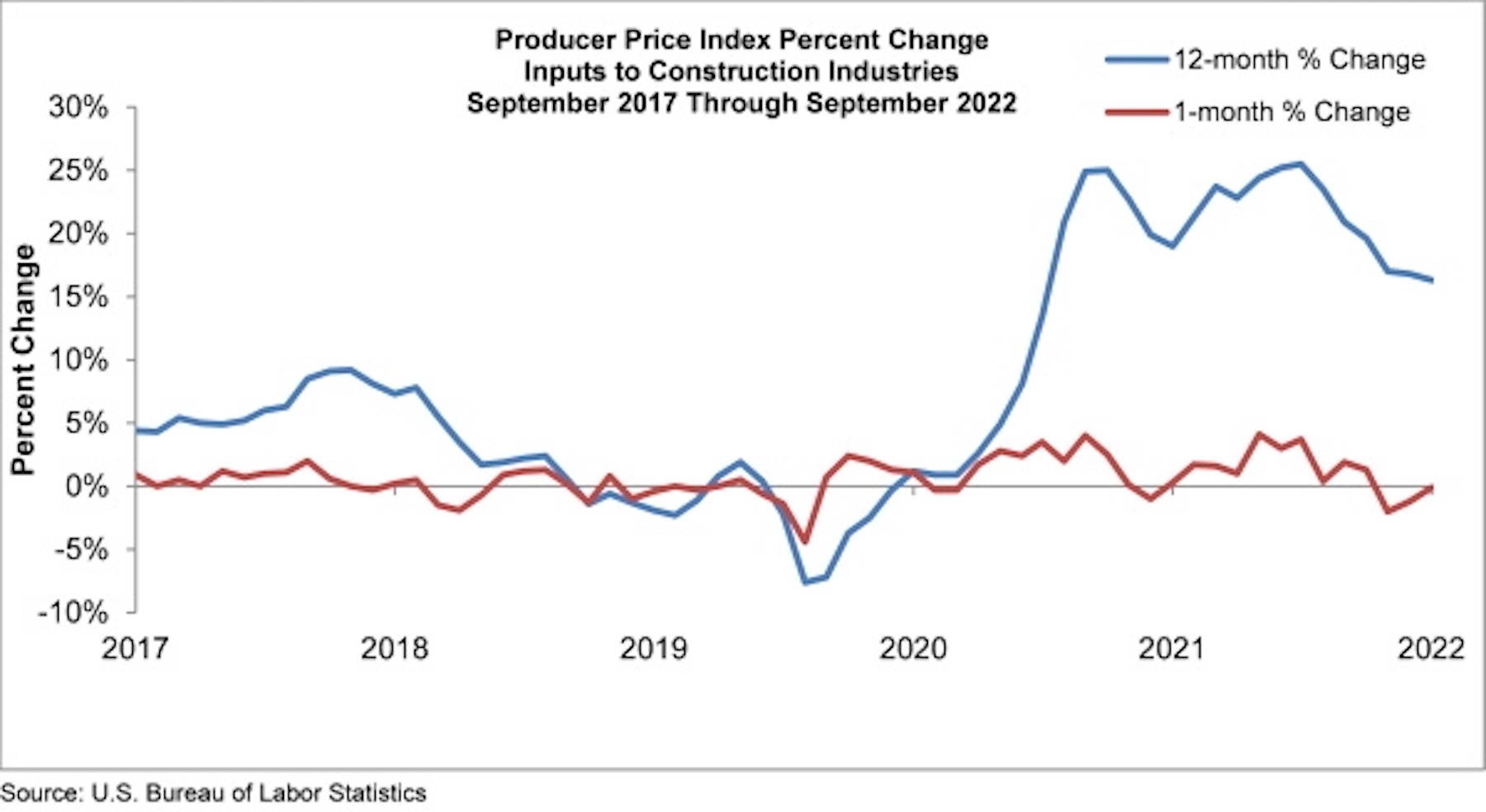

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices also fell 0.1% for the month.

Construction input prices are up 16.3% from a year ago, while nonresidential construction input prices are 15.9% higher. Input prices were down in six of 11 subcategories on a monthly basis. Steel mill prices fell 6.7% and iron and steel prices dropped 5.4%. Natural gas prices rose 3.1%, while crude petroleum prices were down 3.4% in September. Overall producer prices expanded 0.4% in September, a larger increase than the consensus estimate of 0.2%.

“Investors and other stakeholders are eagerly awaiting any indications of meaningful declines in inflationary pressures,” said ABC Chief Economist Anirban Basu. “Elevated inflation and interest rate increases have not only undone momentum in America’s homebuilding industry but also threaten the entire global economy. There are already indications of growing financial stress, including at banking giant Credit Suisse. This is bad news for the heavily financed real estate and construction segments.

“While many American nonresidential contractors remain upbeat, according to ABC’s Construction Confidence Index, there are significant threats looming over the industry,” said Basu. “Next year stands to be a weak one for the U.S. economy as it continues to absorb the impacts of rapidly rising borrowing costs.

“Today’s PPI release strongly suggests that there is no impending end to the Federal Reserve’s rate-tightening, which means that negative factors threatening the broader economy and nonresidential construction are only getting stronger,” said Basu. “While nonresidential input prices fell slightly, inflation came in hotter than anticipated in the overall report. For contractors, the upshot is that they should be actively preparing their respective balance sheets for a downturn, even as many firms presently operate at capacity.”

Related Stories

Market Data | Sep 15, 2020

7 must reads for the AEC industry today: September 15, 2020

Energy efficiency considerations for operating buildings during a pandemic and is there really a glass box paradox?

Market Data | Sep 14, 2020

6 must reads for the AEC industry today: September 14, 2020

63% of New York's restaurants could be gone by 2021 and new weapons in the apartment amenities arms race.

Market Data | Sep 11, 2020

5 must reads for the AEC industry today: September 11, 2020

Des Moines University begins construction on new campus and the role of urgent care in easing the oncology journey.

Market Data | Sep 10, 2020

6 must reads for the AEC industry today: September 10, 2020

Taipei's new Performance Hall and Burger King's touchless restaurant designs.

Market Data | Sep 9, 2020

6 must reads for the AEC industry today: September 9, 2020

What will the 'new normal' look like and the AIA hands out its Twenty-five Year Award.

Market Data | Sep 8, 2020

‘New normal’: IAQ, touchless, and higher energy bills?

Not since 9/11 has a single event so severely rocked the foundation of the commercial building industry.

Market Data | Sep 8, 2020

7 must reads for the AEC industry today: September 8, 2020

Google proposes 40-acre redevelopment plan and office buildings should be an essential part of their communities.

Market Data | Sep 4, 2020

6 must reads for the AEC industry today: September 4, 2020

10 Design to redevelop Nanjing AIrport and TUrner Construction takes a stand against racism.

Market Data | Sep 4, 2020

Construction sector adds 16,000 workers in August but nonresidential jobs shrink

Association survey finds contractor pessimism is increasing.

Market Data | Sep 3, 2020

6 must reads for the AEC industry today: September 3, 2020

New affordable housing comes to the Bronx and California releases guide for state water policy.