According to Associated Builders and Contractors (ABC), the Construction Backlog Indicator (CBI) for the fourth quarter of 2014 declined 0.1 months, or 1%. Despite the quarter-over-quarter decline, backlog ended the year at 8.7 months, which is still 4.4% higher than one year ago.

"Inconsistent growth in the volume of public work continues to suppress the pace of nonresidential construction; however, private construction momentum continues to build," said ABC Chief Economist Anirban Basu. "With hotel occupancy rising, office vacancy falling and demand for data climbing exponentially, a number of key private segments are positioned for rapid growth in construction spending this year.

"There are a number of factors that are likely to be beneficial to nonresidential contractors in 2015," said Basu. "First, although interest rates were expected to rise after the Federal Reserve ended its third round of quantitative easing, they have actually been trending lower—due to factors such as falling interest rates abroad and a strengthening U.S. dollar—which helps contractors with construction volume and borrowing costs. Second, materials prices have continued to fall—particularly inputs related to the price of oil, iron ore and copper. This also makes it more likely that construction projects will move forward and helps boost profit margins."

Regional Highlights

• Average backlog in the South is back above 9 months for the first time since the first quarter of 2014.

• Though backlog in the West fell sharply during 2014's final quarter, average backlog remains comparable to where it was a year ago.

• Both the Northeast and the Middle States registered levels of average backlog unseen during the history of the CBI survey.

Industry Highlights

• Average backlog in the commercial and institutional category is virtually unchanged over the past year, suggesting the pace of recovery will remain moderate overall.

• Infrastructure-related spending is likely to be brisk going forward primarily due to improved state and local government fiscal conditions.

• Heavy industrial average backlog remains in the vicinity of multi-year highs, but these readings do not fully reflect the impact of a stronger U.S. dollar, which may result in a slowdown in export growth and an associated softening in industrial investment.

Highlights by Company Size

• During the fourth quarter, backlog expanded for mid-sized companies with annual revenue ranging between $30 million-$100 million. These firms enjoyed approximately half a month expansion in their respective average backlogs during the fourth quarter.

• On the other hand, backlog for small firms (annual revenue less than $30 million) and very large firms (annual revenue greater than $100 million) declined 0.2 months and 0.5 months, respectively.

• Large firms appear to have been impacted by a slowdown in large project infrastructure spending in certain parts of the country, while smaller firms have been impacted by greater observed difficulty in obtaining bonding for projects in the context of accelerating small firm failure.

• Average backlog has increased by nearly three months or by more than three months for all firm size categories since the fourth quarter of 2009.

Related Stories

| Jul 26, 2013

Boldt opens Southern California office

Location is Boldt’s third in the state, will expand firm’s established presence on the west coast.

| Jul 26, 2013

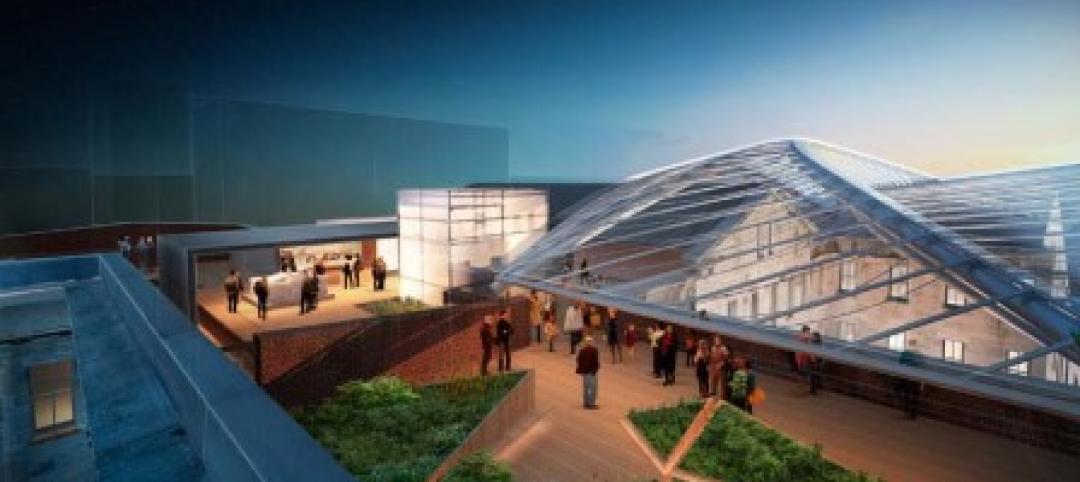

How biomimicry inspired the design of the San Francisco Museum at the Mint

When the city was founded in the 19th century, the San Francisco Bay’s edge and marshland area were just a few hundred feet from where the historic Old Mint building sits today. HOK's design team suggested a design idea that incorporates lessons from the local biome while creating new ways to collect and store water.

| Jul 25, 2013

3 office design strategies for creating happy, productive workers

Office spaces that promote focus, balance, and choice are the ones that will improve employee experience, enhance performance, and drive innovation, according to Gensler's 2013 U.S. Workplace Survey.

| Jul 25, 2013

Rep. Burke, contractors welcome new Builders Association Executive Director

Illinois State Representative Kelly Burke and many of Chicagoland's leading contractors were on hand this week to welcome new Executive Director Dan McLaughlin to the Builders Association.

| Jul 25, 2013

How can I help you?: The evolution of call center design

Call centers typically bring to mind an image of crowded rows of stressed-out employees who are usually receiving calls from people with a problem or placing calls to people that aren’t thrilled to hear from them. But the nature of the business is changing; telemarketing isn’t what it used to be.

| Jul 25, 2013

First look: Studio Gang's residential/dining commons for University of Chicago

The University of Chicago will build a $148 million residence hall and dining commons designed by Studio Gang Architects, tentatively slated for completion in 2016.

| Jul 25, 2013

ACEEE presents the 2013 Champions of Energy Efficiency in Industry Awards

The American Council for an Energy-Efficient Economy (ACEEE) presented four Champion of Energy Efficiency Awards last night at its Summer Study on Energy Efficiency in Industry.

| Jul 23, 2013

Paul Bertram to speak at ACEEE Summer Study on Energy Efficiency

Paul Bertram, FCSI, CDT, LEED AP and director of environment and sustainability for Kingspan Insulated Panels N.A., will present a white paper during the American Council for an Energy Efficient Economy (ACEEE) 2013 Summer Study on Energy Efficiency in Industry.

| Jul 22, 2013

School officials and parents are asking one question: Can design prevent another Sandy Hook? [2013 Giants 300 Report]

The second deadliest mass shooting by a single person in U.S. history galvanizes school officials, parents, public officials, and police departments, as they scrambled to figure out how to prevent a similar incident in their communities.

| Jul 22, 2013

Competitive pressures push academia to improve residences, classrooms, rec centers [2013 Giants 300 Report]

College and university construction continues to suffer from strained government spending and stingy commercial credit.