Blame it on the weather. That's what many economists have been doing over the past two months as economic data continue to disappoint. Retail sales, durable goods orders, and other categories have not been as strong as anticipated.

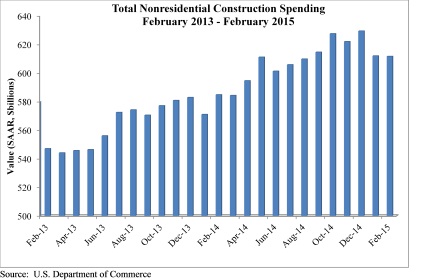

Nonresidential construction has often proved an exception, with the industry's momentum gaining steam recently. However, in February, nonresidential construction spending remained virtually unchanged, inching down 0.1% on a monthly basis, according to the April 1 release from the U.S. Census Bureau.

The February 2015 spending figure is 4.6% higher than February 2014, as spending for the month totaled $611.5 billion on a seasonally adjusted annualized basis. The estimate for January spending was revised downward, from $614.1 billion to $611.9 billion, while the government revised December's spending estimate upward from $627 billion to $629.3 billion.

"Construction is impacted more by weather than just about any economic segment, and the impact of February's brutal weather is evident in the government's spending figure," said Associated Builders and Contractors Chief Economist Anirban Basu. "ABC continues to forecast a robust nonresidential construction spending recovery in 2015, despite the most recent monthly data, with the obvious exceptions of industry segments most directly and negatively impacted by declines in energy prices.

"The broader U.S. economy has not gotten off to as good a start in 2015 as many had expected with consumer spending growth frustrated by thriftier than anticipated shoppers," said Basu. "With winter behind us and temperatures warming, the expectation is that economic growth will roar back during the second quarter, which is precisely what happened last year. To the extent that this proves to be true, nonresidential construction's recovery can be expected to persist."

Seven of 16 nonresidential construction subsectors posted increases in spending in February on a monthly basis.

- Manufacturing-related spending expanded 6.8 percent in February and is up 37.9% on a year-over-year basis.

- Conservation and development-related construction spending expanded 11% for the month and is up 19.8% on a yearly basis.

- Office-related construction spending expanded 2.4% in February and is up 19% from the same time one year ago.

- Amusement and recreation-related construction spending gained 2% on a monthly basis and is up 22.5% from the same time last year.

- Education-related construction spending grew 0.3% for the month, but is down 0.6% on a year-over-year basis.

- Construction spending in the transportation category grew 0.6% on a monthly basis and has expanded 9.3% on an annual basis.

- Lodging-related construction spending was up 5% on a monthly basis and 10.4% on a year-over-year basis.

Spending in nine nonresidential construction subsectors failed to rise in February.

- Healthcare-related construction spending fell 0.9% for the month and is down 4.5% for the year.

- Spending in the water supply category dropped 7.8% from January, but is still 7.4% higher than at the same time last year.

- Public safety-related construction spending lost 2.2% on a monthly basis and is down 9.6% on a year-over-year basis.

- Commercial construction spending lost 1.9% in February, but is up 13.5% on a year-over-year basis.

- Religious spending fell 4.8% for the month and is down 10.3% from the same time last year.

- Sewage and waste disposal-related construction spending shed 1.4% for the month, but has grown 19.9% on a 12-month basis.

- Power-related construction spending fell 4.5% for the month and is 17.2% lower than at the same time one year ago.

- Lodging construction spending is down 4.4% on a monthly basis, but is up 18.2% on a year-over-year basis.

- Sewage and waste disposal-related construction spending shed 7.5% for the month, but has grown 16% on a 12-month basis.

- Power-related construction spending fell 1.1% for the month and is 13.2% lower than at the same time one year ago.

- Communication-related construction spending fell 6.1% for the month and is down 15.5% for the year.

- Highway and street-related construction spending was unchanged in February and is up 3.3% compared to the same time last year.

To view the previous spending report, click here.

Related Stories

Contractors | Jan 4, 2021

Optimizing construction projects with value engineering

When value engineering is referenced in our industry, our minds may immediately go to a process that reduces project cost by slashing scope or decreasing the quality of materials used. However, that is not necessarily what the definition should be.

AEC Tech | Dec 17, 2020

The Weekly show: The future of eSports facilities, meet the National Institute for AI in Construction

The December 17 episode of BD+C's The Weekly is available for viewing on demand.

Multifamily Housing | Dec 16, 2020

What the Biden Administration means for multifamily construction

What can the multifamily real estate sector expect from Biden and Company? At the risk of having egg, if not a whole omelet, on my face, let me take a shot.

Giants 400 | Dec 16, 2020

Download a PDF of all 2020 Giants 400 Rankings

This 70-page PDF features AEC firm rankings across 51 building sectors, disciplines, and specialty services.

Healthcare Facilities | Dec 10, 2020

The Weekly show: The future of medical office buildings, and virtual internship programs

This week on The Weekly show, BD+C editors spoke with leaders from SMRT Architects and Engineers and Stantec about the future of medical office buildings, and virtual internship programs

Contractors | Dec 4, 2020

‘Speed to market’ defines general contractor activities in 2020

Contractors are more receptive than ever to ways that help get projects done faster.

Multifamily Housing | Dec 4, 2020

The Weekly show: Designing multifamily housing for COVID-19, and trends in historic preservation and adaptive reuse

This week on The Weekly show, BD+C editors spoke with leaders from Page & Turnbull and Grimm + Parker Architects about designing multifamily housing for COVID-19, and trends in historic preservation and adaptive reuse

Giants 400 | Dec 3, 2020

2020 Science & Technology Facilities Giants: Top architecture, engineering, and construction firms in the S+T sector

HDR, Jacobs, and Turner head BD+C's rankings of the nation's largest science and technology (S+T) facilities sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Giants 400 | Dec 3, 2020

2020 Laboratory Facilities Sector Giants: Top architecture, engineering, and construction firms in the U.S. laboratory facilities sector

Affiliated Engineers, HDR, and Skanska top BD+C's rankings of the nation's largest laboratory facilities sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Giants 400 | Dec 3, 2020

2020 Industrial Sector Giants: Top architecture, engineering, and construction firms in the U.S. industrial buildings sector

Clayco, Jacobs, and Ware Malcomb top BD+C's rankings of the nation's largest industrial buildings sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.