Blame it on the weather. That's what many economists have been doing over the past two months as economic data continue to disappoint. Retail sales, durable goods orders, and other categories have not been as strong as anticipated.

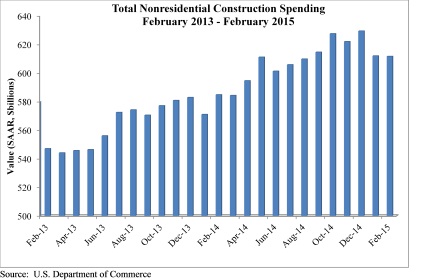

Nonresidential construction has often proved an exception, with the industry's momentum gaining steam recently. However, in February, nonresidential construction spending remained virtually unchanged, inching down 0.1% on a monthly basis, according to the April 1 release from the U.S. Census Bureau.

The February 2015 spending figure is 4.6% higher than February 2014, as spending for the month totaled $611.5 billion on a seasonally adjusted annualized basis. The estimate for January spending was revised downward, from $614.1 billion to $611.9 billion, while the government revised December's spending estimate upward from $627 billion to $629.3 billion.

"Construction is impacted more by weather than just about any economic segment, and the impact of February's brutal weather is evident in the government's spending figure," said Associated Builders and Contractors Chief Economist Anirban Basu. "ABC continues to forecast a robust nonresidential construction spending recovery in 2015, despite the most recent monthly data, with the obvious exceptions of industry segments most directly and negatively impacted by declines in energy prices.

"The broader U.S. economy has not gotten off to as good a start in 2015 as many had expected with consumer spending growth frustrated by thriftier than anticipated shoppers," said Basu. "With winter behind us and temperatures warming, the expectation is that economic growth will roar back during the second quarter, which is precisely what happened last year. To the extent that this proves to be true, nonresidential construction's recovery can be expected to persist."

Seven of 16 nonresidential construction subsectors posted increases in spending in February on a monthly basis.

- Manufacturing-related spending expanded 6.8 percent in February and is up 37.9% on a year-over-year basis.

- Conservation and development-related construction spending expanded 11% for the month and is up 19.8% on a yearly basis.

- Office-related construction spending expanded 2.4% in February and is up 19% from the same time one year ago.

- Amusement and recreation-related construction spending gained 2% on a monthly basis and is up 22.5% from the same time last year.

- Education-related construction spending grew 0.3% for the month, but is down 0.6% on a year-over-year basis.

- Construction spending in the transportation category grew 0.6% on a monthly basis and has expanded 9.3% on an annual basis.

- Lodging-related construction spending was up 5% on a monthly basis and 10.4% on a year-over-year basis.

Spending in nine nonresidential construction subsectors failed to rise in February.

- Healthcare-related construction spending fell 0.9% for the month and is down 4.5% for the year.

- Spending in the water supply category dropped 7.8% from January, but is still 7.4% higher than at the same time last year.

- Public safety-related construction spending lost 2.2% on a monthly basis and is down 9.6% on a year-over-year basis.

- Commercial construction spending lost 1.9% in February, but is up 13.5% on a year-over-year basis.

- Religious spending fell 4.8% for the month and is down 10.3% from the same time last year.

- Sewage and waste disposal-related construction spending shed 1.4% for the month, but has grown 19.9% on a 12-month basis.

- Power-related construction spending fell 4.5% for the month and is 17.2% lower than at the same time one year ago.

- Lodging construction spending is down 4.4% on a monthly basis, but is up 18.2% on a year-over-year basis.

- Sewage and waste disposal-related construction spending shed 7.5% for the month, but has grown 16% on a 12-month basis.

- Power-related construction spending fell 1.1% for the month and is 13.2% lower than at the same time one year ago.

- Communication-related construction spending fell 6.1% for the month and is down 15.5% for the year.

- Highway and street-related construction spending was unchanged in February and is up 3.3% compared to the same time last year.

To view the previous spending report, click here.

Related Stories

Giants 400 | Dec 2, 2020

2020 University Giants: Top architecture, engineering, and construction firms in the higher education sector

Gensler, AECOM, and Turner Construction top BD+C's rankings of the nation's largest university sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Giants 400 | Dec 2, 2020

2020 Multifamily Sector Giants: Top architecture, engineering, and construction firms in the U.S. multifamily building sector

Clark Group, Humphreys & Partners Architects, and Kimley-Horn head BD+C's rankings of the nation's largest multifamily building sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Giants 400 | Dec 2, 2020

2020 Airport Sector Giants: Top architecture, engineering, and construction firms in the U.S. airport facilities sector

AECOM, Hensel Phelps, and PGAL top BD+C's rankings of the nation's largest airport sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Contractors | Dec 1, 2020

Abbott Construction to join the STO Building Group

Merger will expand both firms’ geographic reach and services.

Giants 400 | Nov 29, 2020

Top 85 Construction Management + Project Management Firms for 2020

Jacobs, CBRE, VCC, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential and multifamily buildings work, as reported in Building Design+Construction's 2020 Giants 400 Report.

Giants 400 | Nov 29, 2020

Top 135 Contractors for 2020

Turner, Whiting-Turner, and STO Building Group head the rankings of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2020 Giants 400 Report.

Architects | Nov 24, 2020

AEC Leaders share lessons from past downturns

Positions of passivity and cost-cutting run counter to the key lessons from AEC leaders who successfully navigated their firms through past market downturns.

Smart Buildings | Nov 20, 2020

The Weekly show: SPIRE smart building rating system, and pickleball court design tips

The November 19 episode of BD+C's The Weekly is available for viewing on demand.

Government Buildings | Nov 13, 2020

Tax shortfalls nip government projects in the bud

Federal contracts are proceeding, but states and cities are delaying, deferring, and looking for private investment.

AEC Tech | Nov 12, 2020

The Weekly show: Nvidia's Omniverse, AI for construction scheduling, COVID-19 signage

BD+C editors speak with experts from ALICE Technologies, Build Group, Hastings Architecture, Nvidia, and Woods Bagot on the November 12 episode of "The Weekly." The episode is available for viewing on demand.