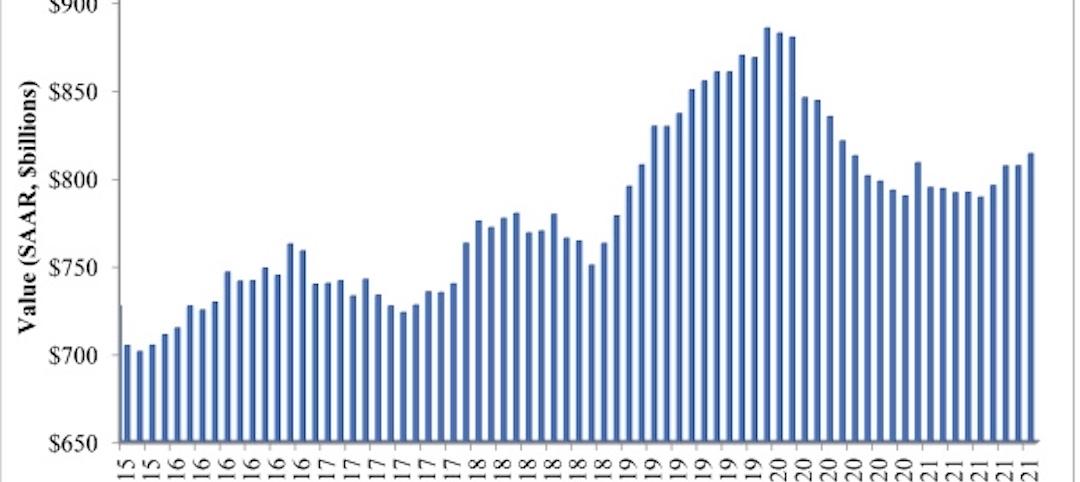

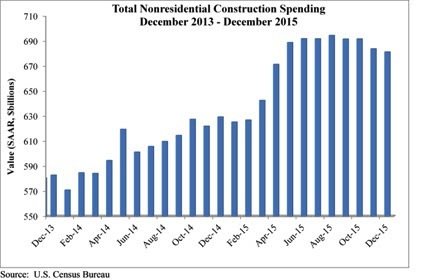

Nonresidential construction spending crested the $700 billion mark on a seasonally adjusted annualized basis in January for the first time since March 2009, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC).

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. The Census Bureau upwardly revised December's estimate from $681.2 billion to $684.5 billion, though they downgraded November's figure from $683.7 to $680.5 million. Private nonresidential construction spending increased by 1% for the month, while its public counterpart expanded by 4.6%.

"After several months of relatively weak nonresidential construction spending data, today's data release was most welcome," ABC Chief Economist Anirban Basu said. "While January is a difficult month to interpret and one that should not be overly emphasized, the fact of the matter is that the year-over-year performance in spending is consistent with a host of industry indicators. For many months, the average contractor has been reporting decent backlog. Measures of industry confidence have remained stable even in the face of adverse news coming from various parts of the world.

"While the nonresidential construction spending recovery appears to remain in place, the industry's overall outlook remains murky," Basu said. "The global economy remains weak, and domestic corporate profitability has been slipping. The U.S. economic recovery continues to be under-diversified, with consumers continuing to lead the way. If corporate profitability continues to struggle, given falling exports and a general lack of confidence among CEOs, the pace of employment growth will slow over the course of 2016. That will presumably affect consumer spending, which is already being hampered by rising health care costs. That, in turn, could jeopardize the ongoing economic recovery, now on its way to completing its seventh year."

Spending increased in January on a monthly basis in 10 of 16 nonresidential construction sectors:

- Spending in the highway and street category expanded 14.6% from December 2015 and is 33.9 higher than in January 2015.

- Sewage and waste disposal-related spending expanded 4% for the month and 1.4% from the same time last year.

- Spending in the amusement and recreation category climbed 0.7% on a monthly basis and 16.9% on a year-over-year basis.

- Conservation and development-related spending is 10% higher on a monthly basis and 1.6% higher on a yearly basis.

- Lodging-related spending is up 6.3% for the month and is up 34.8% on a year-ago basis.

- Spending in the religious category grew 4.2% for the month and 0.2% from January 2015.

- Manufacturing-related spending expanded 4.2% on a monthly basis and is up 11.3% on a yearly basis.

- Spending in the power category expanded 2.9% from December 2015 and is 8.1% higher than in January 2015.

- Water supply-related spending expanded 2% on a monthly basis but fell 7.9% on a yearly basis.

- Spending in the office category grew 0.2% from December 2015 and is up 19.6% from January 2015.

Spending in six of the nonresidential construction subsectors fell in January on a monthly basis:

- Commercial-related construction spending fell 4.3% for the month but grew 0.8% on a year-over-year basis.

- Educational-related construction spending fell 1.1% on a monthly basis, but expanded 12.1% on a yearly basis.

- Transportation-related spending fell 2.5% month-over-month, but expanded 0.6% year-over-year.

- Health care-related spending fell 0.1% month-over-month but is up 1.8% year-over-year.

- Public safety-related spending is down 1.5% for the month and 3.2% from the same time one year ago.

- Communication-related spending fell by 4.2% month-over-month but expanded 27.2% year-over-year.

Related Stories

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.