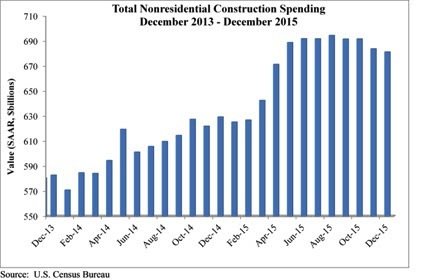

Nonresidential construction spending crested the $700 billion mark on a seasonally adjusted annualized basis in January for the first time since March 2009, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC).

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. The Census Bureau upwardly revised December's estimate from $681.2 billion to $684.5 billion, though they downgraded November's figure from $683.7 to $680.5 million. Private nonresidential construction spending increased by 1% for the month, while its public counterpart expanded by 4.6%.

"After several months of relatively weak nonresidential construction spending data, today's data release was most welcome," ABC Chief Economist Anirban Basu said. "While January is a difficult month to interpret and one that should not be overly emphasized, the fact of the matter is that the year-over-year performance in spending is consistent with a host of industry indicators. For many months, the average contractor has been reporting decent backlog. Measures of industry confidence have remained stable even in the face of adverse news coming from various parts of the world.

"While the nonresidential construction spending recovery appears to remain in place, the industry's overall outlook remains murky," Basu said. "The global economy remains weak, and domestic corporate profitability has been slipping. The U.S. economic recovery continues to be under-diversified, with consumers continuing to lead the way. If corporate profitability continues to struggle, given falling exports and a general lack of confidence among CEOs, the pace of employment growth will slow over the course of 2016. That will presumably affect consumer spending, which is already being hampered by rising health care costs. That, in turn, could jeopardize the ongoing economic recovery, now on its way to completing its seventh year."

Spending increased in January on a monthly basis in 10 of 16 nonresidential construction sectors:

- Spending in the highway and street category expanded 14.6% from December 2015 and is 33.9 higher than in January 2015.

- Sewage and waste disposal-related spending expanded 4% for the month and 1.4% from the same time last year.

- Spending in the amusement and recreation category climbed 0.7% on a monthly basis and 16.9% on a year-over-year basis.

- Conservation and development-related spending is 10% higher on a monthly basis and 1.6% higher on a yearly basis.

- Lodging-related spending is up 6.3% for the month and is up 34.8% on a year-ago basis.

- Spending in the religious category grew 4.2% for the month and 0.2% from January 2015.

- Manufacturing-related spending expanded 4.2% on a monthly basis and is up 11.3% on a yearly basis.

- Spending in the power category expanded 2.9% from December 2015 and is 8.1% higher than in January 2015.

- Water supply-related spending expanded 2% on a monthly basis but fell 7.9% on a yearly basis.

- Spending in the office category grew 0.2% from December 2015 and is up 19.6% from January 2015.

Spending in six of the nonresidential construction subsectors fell in January on a monthly basis:

- Commercial-related construction spending fell 4.3% for the month but grew 0.8% on a year-over-year basis.

- Educational-related construction spending fell 1.1% on a monthly basis, but expanded 12.1% on a yearly basis.

- Transportation-related spending fell 2.5% month-over-month, but expanded 0.6% year-over-year.

- Health care-related spending fell 0.1% month-over-month but is up 1.8% year-over-year.

- Public safety-related spending is down 1.5% for the month and 3.2% from the same time one year ago.

- Communication-related spending fell by 4.2% month-over-month but expanded 27.2% year-over-year.

Related Stories

Market Data | Jan 5, 2021

Barely one-third of metros add construction jobs in latest 12 months

Dwindling list of project starts forces contractors to lay off workers.

Market Data | Jan 4, 2021

Nonresidential construction spending shrinks further in November

Many commercial projects languish, even while homebuilding soars.

Market Data | Dec 29, 2020

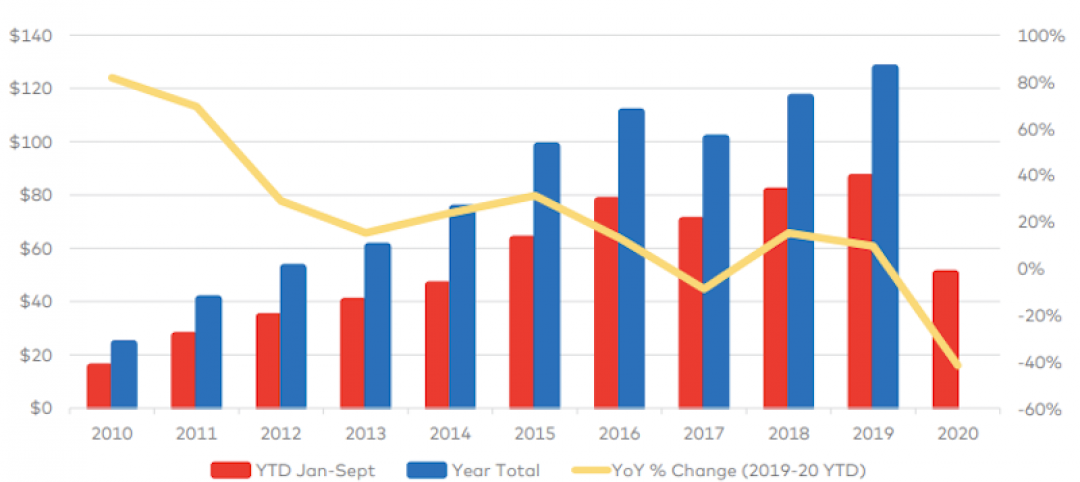

Multifamily transactions drop sharply in 2020, according to special report from Yardi Matrix

Sales completions at end of Q3 were down over 41 percent from the same period a year ago.

Market Data | Dec 28, 2020

New coronavirus recovery measure will provide some needed relief for contractors coping with project cancellations, falling demand

Measure’s modest amount of funding for infrastructure projects and clarification that PPP loans may not be taxed will help offset some of the challenges facing the construction industry.

Market Data | Dec 28, 2020

Construction employment trails pre-pandemic levels in 35 states despite gains in industry jobs from October to November in 31 states

New York and Vermont record worst February-November losses, Virginia has largest pickup.

Market Data | Dec 16, 2020

Architecture billings lose ground in November

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5.

AEC Tech | Dec 8, 2020

COVID-19 affects the industry’s adoption of ConTech in different ways

A new JLL report assesses which tech options got a pandemic “boost.”

Market Data | Dec 7, 2020

Construction sector adds 27,000 jobs in November

Project cancellations, looming PPP tax bill will undercut future job gains.

Market Data | Dec 3, 2020

Only 30% of metro areas add construction jobs in latest 12 months

Widespread project postponements and cancellations force layoffs.

Market Data | Dec 2, 2020

New Passive House standards offers prescriptive path that reduces costs

Eliminates requirement for a Passive House consultant and attendant modeling.