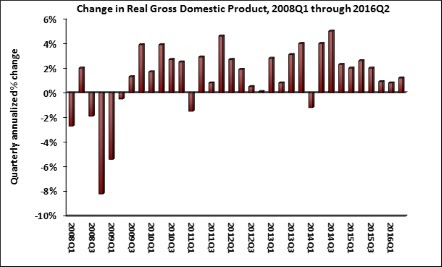

Real gross domestic product (GDP) expanded 1.2% (seasonally adjusted annual rate) during 2016’s second quarter according to according to an analysis of Bureau of Economic Analysis data released by Associated Builders and Contractors (ABC).

This modest figure follows a 0.8% annualized rate of output growth registered during the year’s first quarter.

Nonresidential fixed investment, a category closely tied to construction and other forms of business investment, fell for a third consecutive quarter, slipping 2.2% from the first quarter, with investment in structures declining 7.9%. Residential investment fell for the first time since the first quarter of 2014. Nonresidential investment in equipment fell 3.5% for the quarter, while nonresidential fixed investment in intellectual property expanded 3.5% and has now expanded for 12 consecutive quarters.

“Construction industry stakeholders should not have been anticipating a solid GDP report given previous weak construction spending and employment numbers that were recently released and they did not get one,” said Anirban Basu, ABC’s chief economist. “Today’s report suggests that construction activity has stalled a bit more than thought, largely due to slowing residential investment growth and low levels of public sector investment. With apartment rents no longer rising in a number of markets, the nation’s apartment building boom has taken a bit of a pause.

“Only those who sell directly to consumers and certain technology firms are likely to glean some sense of satisfaction from today’s release,” said Basu. “The balance of the economy continues to disappoint, though the lack of inventory building during the second quarter may help position the economy for a bounce-back during the third. It will be interesting to see if ABC’s Construction Backlog Indicator begins to show that average nonresidential construction firm backlog is now in decline, though many contractors continue to indicate that they remain busy due to previously secured work.

“It should be noted that the 7.9% decline in spending on structures during the second quarter transpired despite some very positive economic circumstances,” said Basu. “For instance, interest rates remain shockingly low, foreign investment continues to pour into U.S. commercial real estate, and there are positive wealth effects being generated by both housing and equity markets. However, it appears that even these conditions are no longer enough to support growing demand for construction spending. One could theorize that uncertainty originating from the current presidential election cycle is partially responsible.”

The following highlights emerged from today’s second quarter GDP release. All growth figures are seasonally adjusted annual rates:

- Personal consumption expenditures expanded 4.2% on an annualized basis during the second quarter of 2016 after growing 1.6% during the first quarter of 2016.

- Spending on goods rose 6.8% during the first quarter after expanding by 1.2% during the previous quarter.

- Real final sales of domestically produced output increased 2.4% in the second quarter after increasing 1.2% in the first.

- Federal government spending inched down by 0.2% in the year’s second quarter after contracting 1.5% in the first quarter of 2016.

- Nondefense government spending increased by 3.9% for the quarter following an increase of 0.9% in the first.

- National defense spending fell by 3% during the second quarter after registering a 3.2% decline in the previous quarter.

- State and local government spending fell by 1.3% in the second quarter after expanding 3.5% in the first quarter.

Related Stories

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.