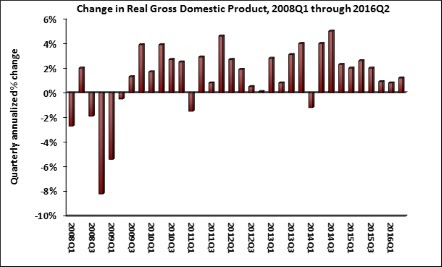

Real gross domestic product (GDP) expanded 1.2% (seasonally adjusted annual rate) during 2016’s second quarter according to according to an analysis of Bureau of Economic Analysis data released by Associated Builders and Contractors (ABC).

This modest figure follows a 0.8% annualized rate of output growth registered during the year’s first quarter.

Nonresidential fixed investment, a category closely tied to construction and other forms of business investment, fell for a third consecutive quarter, slipping 2.2% from the first quarter, with investment in structures declining 7.9%. Residential investment fell for the first time since the first quarter of 2014. Nonresidential investment in equipment fell 3.5% for the quarter, while nonresidential fixed investment in intellectual property expanded 3.5% and has now expanded for 12 consecutive quarters.

“Construction industry stakeholders should not have been anticipating a solid GDP report given previous weak construction spending and employment numbers that were recently released and they did not get one,” said Anirban Basu, ABC’s chief economist. “Today’s report suggests that construction activity has stalled a bit more than thought, largely due to slowing residential investment growth and low levels of public sector investment. With apartment rents no longer rising in a number of markets, the nation’s apartment building boom has taken a bit of a pause.

“Only those who sell directly to consumers and certain technology firms are likely to glean some sense of satisfaction from today’s release,” said Basu. “The balance of the economy continues to disappoint, though the lack of inventory building during the second quarter may help position the economy for a bounce-back during the third. It will be interesting to see if ABC’s Construction Backlog Indicator begins to show that average nonresidential construction firm backlog is now in decline, though many contractors continue to indicate that they remain busy due to previously secured work.

“It should be noted that the 7.9% decline in spending on structures during the second quarter transpired despite some very positive economic circumstances,” said Basu. “For instance, interest rates remain shockingly low, foreign investment continues to pour into U.S. commercial real estate, and there are positive wealth effects being generated by both housing and equity markets. However, it appears that even these conditions are no longer enough to support growing demand for construction spending. One could theorize that uncertainty originating from the current presidential election cycle is partially responsible.”

The following highlights emerged from today’s second quarter GDP release. All growth figures are seasonally adjusted annual rates:

- Personal consumption expenditures expanded 4.2% on an annualized basis during the second quarter of 2016 after growing 1.6% during the first quarter of 2016.

- Spending on goods rose 6.8% during the first quarter after expanding by 1.2% during the previous quarter.

- Real final sales of domestically produced output increased 2.4% in the second quarter after increasing 1.2% in the first.

- Federal government spending inched down by 0.2% in the year’s second quarter after contracting 1.5% in the first quarter of 2016.

- Nondefense government spending increased by 3.9% for the quarter following an increase of 0.9% in the first.

- National defense spending fell by 3% during the second quarter after registering a 3.2% decline in the previous quarter.

- State and local government spending fell by 1.3% in the second quarter after expanding 3.5% in the first quarter.

Related Stories

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

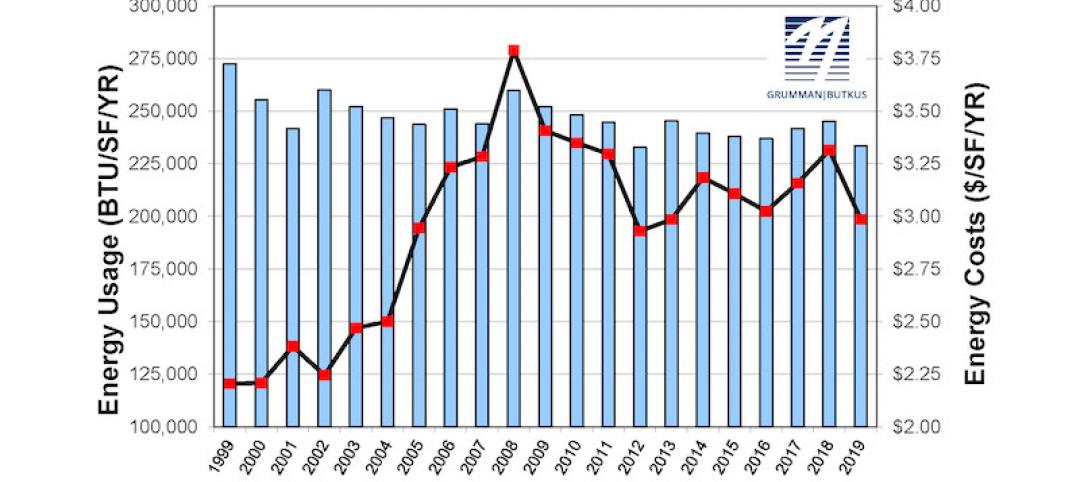

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

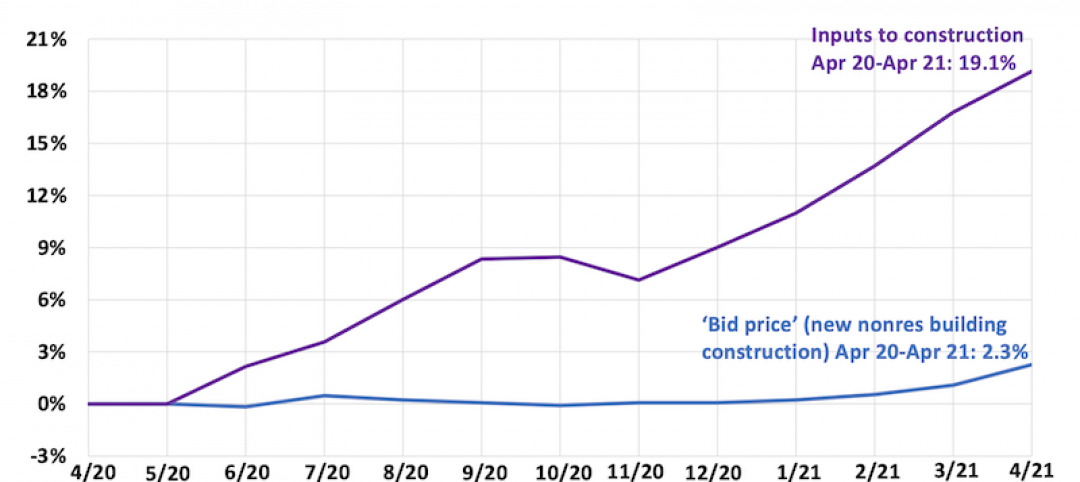

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

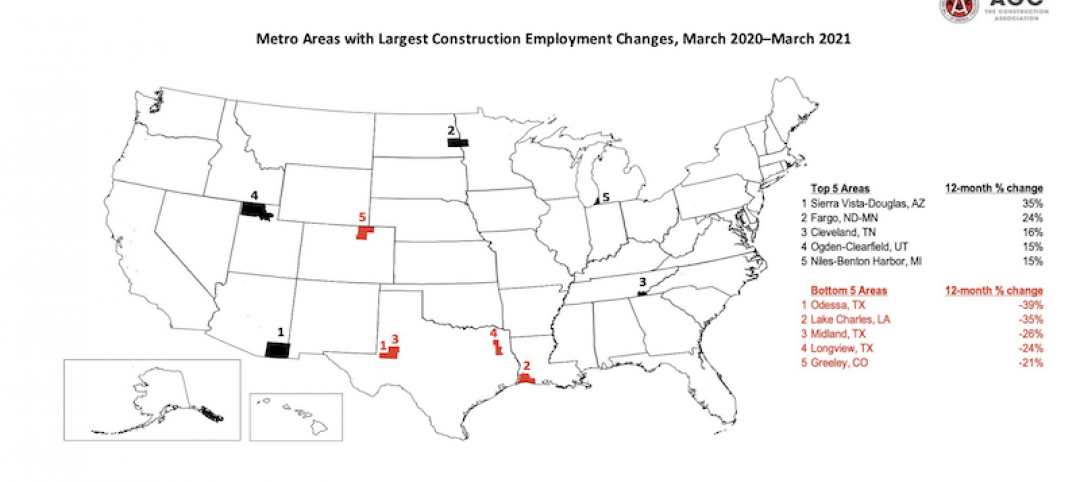

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.