Associated Builders and Contractors Chief Economist Anirban Basu forecasts another strong year for construction sector performance, yet warns about inflationary pressures, according to a 2019 economic outlook.

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry. However, historically low unemployment has created a construction workforce shortage of an estimated 500,000 positions, which is leading to increased compensation costs.

“U.S. economic performance has been brilliant of late. Sure, there has been a considerable volume of negativity regarding the propriety of tariffs, shifting immigration policy, etc., but the headline statistics make it clear that domestic economic performance is solid,” said Basu. “Nowhere is this more evident than the U.S. labor market. As of July, there were a record-setting 6.94 million job openings in the United States, and construction unemployment reached a low of 3.6 percent in October.”

While the U.S. economy is thriving, Basu cited the potential long-term impact of rising interest rates and materials prices—up 7.9 percent on a year-over-year basis in October—on the U.S. construction market. In addition, the workforce shortage will continue to influence the market in the coming year.

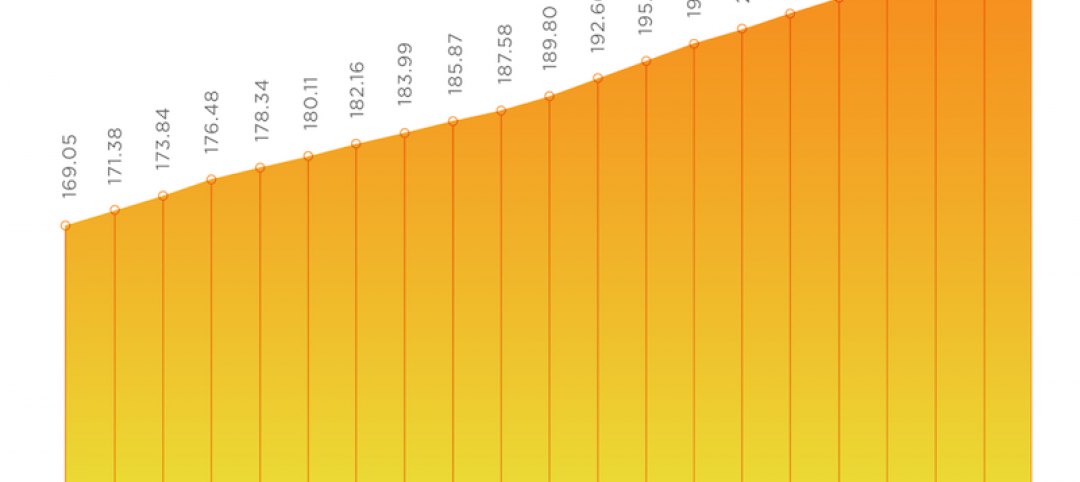

That said, Basu stressed that a recession is unlikely in 2019, even with recent financial market volatility. Indicators such as the Conference Board’s Leading Economic Index, which often signals an economic downturn, have continued to tick higher, implying current momentum will continue for at least two to three more quarters. In addition, ABC’s Construction Backlog Indicator, which reflects the amount of work that will be performed by commercial and industrial contractors in the months ahead, reported a record backlog of 9.9 months in the second quarter of 2018.

While optimistic for next year, Basu warned that, “Contractors should be aware that recessions often follow within two years of peak confidence. The average contractor is likely to be quite busy in 2019, but beyond that, the outlook is quite murky.”

Related Stories

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.