Associated Builders and Contractors Chief Economist Anirban Basu forecasts another strong year for construction sector performance, yet warns about inflationary pressures, according to a 2019 economic outlook.

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry. However, historically low unemployment has created a construction workforce shortage of an estimated 500,000 positions, which is leading to increased compensation costs.

“U.S. economic performance has been brilliant of late. Sure, there has been a considerable volume of negativity regarding the propriety of tariffs, shifting immigration policy, etc., but the headline statistics make it clear that domestic economic performance is solid,” said Basu. “Nowhere is this more evident than the U.S. labor market. As of July, there were a record-setting 6.94 million job openings in the United States, and construction unemployment reached a low of 3.6 percent in October.”

While the U.S. economy is thriving, Basu cited the potential long-term impact of rising interest rates and materials prices—up 7.9 percent on a year-over-year basis in October—on the U.S. construction market. In addition, the workforce shortage will continue to influence the market in the coming year.

That said, Basu stressed that a recession is unlikely in 2019, even with recent financial market volatility. Indicators such as the Conference Board’s Leading Economic Index, which often signals an economic downturn, have continued to tick higher, implying current momentum will continue for at least two to three more quarters. In addition, ABC’s Construction Backlog Indicator, which reflects the amount of work that will be performed by commercial and industrial contractors in the months ahead, reported a record backlog of 9.9 months in the second quarter of 2018.

While optimistic for next year, Basu warned that, “Contractors should be aware that recessions often follow within two years of peak confidence. The average contractor is likely to be quite busy in 2019, but beyond that, the outlook is quite murky.”

Related Stories

Market Data | Sep 3, 2019

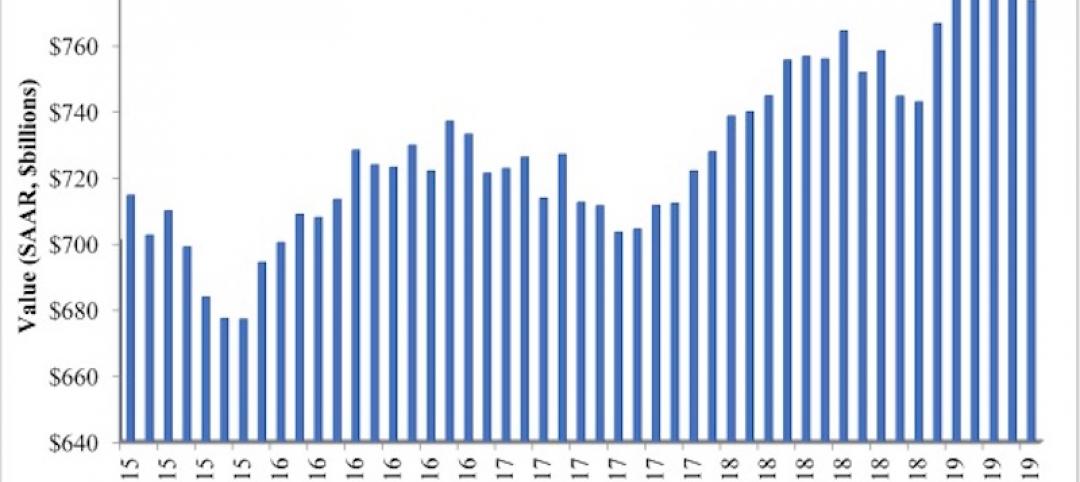

Nonresidential construction spending slips in July 2019, but still surpasses $776 billion

Construction spending declined 0.3% in July, totaling $776 billion on a seasonally adjusted annualized basis.

Industry Research | Aug 29, 2019

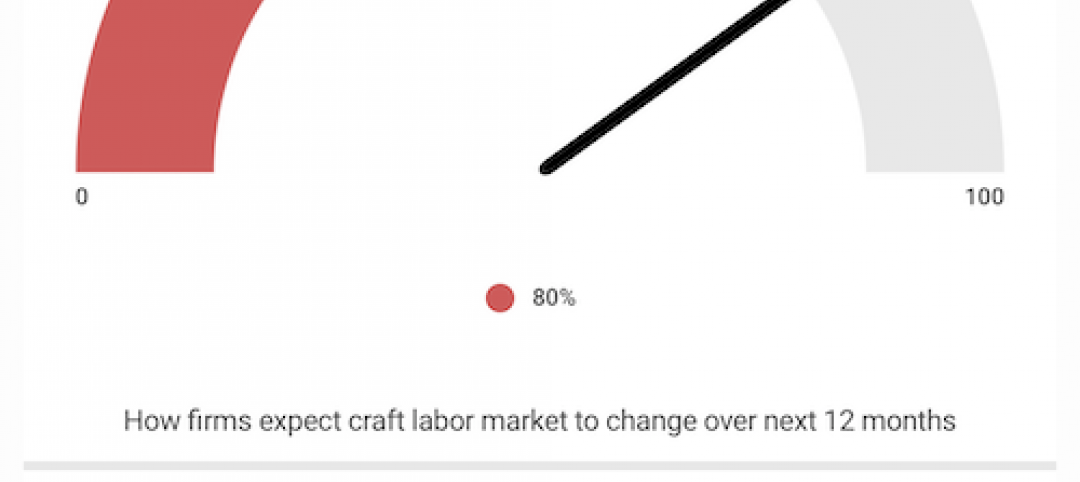

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.

Market Data | Aug 21, 2019

Architecture Billings Index continues its streak of soft readings

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Aug 19, 2019

Multifamily market sustains positive cycle

Year-over-year growth tops 3% for 13th month. Will the economy stifle momentum?

Market Data | Aug 16, 2019

Students say unclean restrooms impact their perception of the school

The findings are part of Bradley Corporation’s Healthy Hand Washing Survey.

Market Data | Aug 12, 2019

Mid-year economic outlook for nonresidential construction: Expansion continues, but vulnerabilities pile up

Emerging weakness in business investment has been hinting at softening outlays.

Market Data | Aug 7, 2019

National office vacancy holds steady at 9.7% in slowing but disciplined market

Average asking rental rate posts 4.2% annual growth.

Market Data | Aug 1, 2019

Nonresidential construction spending slows in June, remains elevated

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending.

Market Data | Jul 31, 2019

For the second quarter of 2019, the U.S. hotel construction pipeline continued its year-over-year growth spurt

The growth spurt continued even as business investment declined for the first time since 2016.

Market Data | Jul 23, 2019

Despite signals of impending declines, continued growth in nonresidential construction is expected through 2020

AIA’s latest Consensus Construction Forecast predicts growth.