Associated Builders and Contractors Chief Economist Anirban Basu forecasts another strong year for construction sector performance, yet warns about inflationary pressures, according to a 2019 economic outlook.

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry. However, historically low unemployment has created a construction workforce shortage of an estimated 500,000 positions, which is leading to increased compensation costs.

“U.S. economic performance has been brilliant of late. Sure, there has been a considerable volume of negativity regarding the propriety of tariffs, shifting immigration policy, etc., but the headline statistics make it clear that domestic economic performance is solid,” said Basu. “Nowhere is this more evident than the U.S. labor market. As of July, there were a record-setting 6.94 million job openings in the United States, and construction unemployment reached a low of 3.6 percent in October.”

While the U.S. economy is thriving, Basu cited the potential long-term impact of rising interest rates and materials prices—up 7.9 percent on a year-over-year basis in October—on the U.S. construction market. In addition, the workforce shortage will continue to influence the market in the coming year.

That said, Basu stressed that a recession is unlikely in 2019, even with recent financial market volatility. Indicators such as the Conference Board’s Leading Economic Index, which often signals an economic downturn, have continued to tick higher, implying current momentum will continue for at least two to three more quarters. In addition, ABC’s Construction Backlog Indicator, which reflects the amount of work that will be performed by commercial and industrial contractors in the months ahead, reported a record backlog of 9.9 months in the second quarter of 2018.

While optimistic for next year, Basu warned that, “Contractors should be aware that recessions often follow within two years of peak confidence. The average contractor is likely to be quite busy in 2019, but beyond that, the outlook is quite murky.”

Related Stories

Market Data | Jun 21, 2017

Design billings maintain solid footing, strong momentum reflected in project inquiries/design contracts

Balanced growth results in billings gains in all sectors.

Market Data | Jun 16, 2017

Residential construction was strong, but not enough, in 2016

The Joint Center for Housing Studies’ latest report expects minorities and millennials to account for the lion’s share of household formations through 2035.

Industry Research | Jun 15, 2017

Commercial Construction Index indicates high revenue and employment expectations for 2017

USG Corporation (USG) and U.S. Chamber of Commerce release survey results gauging confidence among industry leaders.

Market Data | Jun 2, 2017

Nonresidential construction spending falls in 13 of 16 segments in April

Nonresidential construction spending fell 1.7% in April 2017, totaling $696.3 billion on a seasonally adjusted, annualized basis, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors.

Industry Research | May 25, 2017

Project labor agreement mandates inflate cost of construction 13%

Ohio schools built under government-mandated project labor agreements (PLAs) cost 13.12 percent more than schools that were bid and constructed through fair and open competition.

Market Data | May 24, 2017

Design billings increasing entering height of construction season

All regions report positive business conditions.

Market Data | May 24, 2017

The top franchise companies in the construction pipeline

3 franchise companies comprise 65% of all rooms in the Total Pipeline.

Industry Research | May 24, 2017

These buildings paid the highest property taxes in 2016

Office buildings dominate the list, but a residential community climbed as high as number two on the list.

Market Data | May 16, 2017

Construction firms add 5,000 jobs in April

Unemployment down to 4.4%; Specialty trade jobs dip slightly.

Multifamily Housing | May 10, 2017

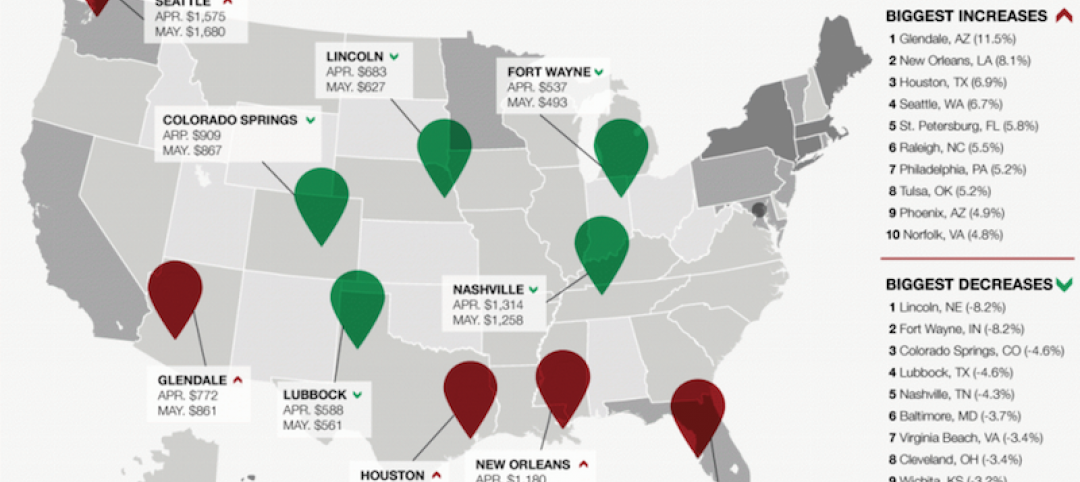

May 2017 National Apartment Report

Median one-bedroom rent rose to $1,012 in April, the highest it has been since January.