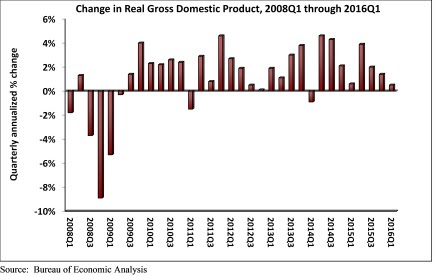

Real gross domestic product (GDP) expanded only 0.5% on a seasonally adjusted annual rate during 2016's first quarter according to an analysis of Bureau of Economic Analysis data released today by Associated Builders and Contractors (ABC). This disappointing figure follows a 1.4% annualized rate of economic output expansion during the fourth quarter of 2015.

Nonresidential fixed investment struggled with a 5.9% decline during the year's first three months after falling 2.1% during 2015's final quarter. Nonresidential fixed investment in structures fared particularly poorly, declining 10.7% during the first quarter on an annualized basis while nonresidential investment in equipment fell 8.6%.

"Aside from consumer spending growth, state and local government spending growth and residential building, very little expanded in America during the first three months of 2016," said ABC Chief Economist Anirban Basu. "It is quite conceivable that the current U.S. economic expansion will end before the economy registers a 3% or better rate of growth for a single calendar year. The last time the U.S. economy expanded more than 3% was in 2005, when the economy expanded 3.4%."

"Corporate profitability has been slipping in recent quarters and the mergers and acquisition marketplace has heated up, an unfavorable sign for nonresidential contractors," said Basu. "Many corporate CEOs continue to use available cash to purchase competitors either to gain access to product pipelines, thereby diminishing required product development expenses, or to generate cost savings by eliminating duplicative functions. The result is a lack of business investment generally and a slowing pace of private nonresidential construction spending growth. If it not for an enormous amount of foreign money coming to our shores, private nonresidential construction growth would have been even softer in early 2016. While falling energy-related investment and seasonal factors represent important parts of the story, there are indications of a broader malaise."

The following segments highlight the first quarter GDP release:

- Personal consumption expenditures rose 1.9% on an annualized basis during the first quarter of 2016 after growing 2.4% during the fourth quarter of 2015.

- Spending on goods inched 0.1% higher during the first quarter after expanding by 1.6% during the fourth quarter.

- Real final sales of domestically produced output increased 0.9% in the first quarter after rising 1.6% in the fourth.

- Federal government spending fell by 1.6% in the year's first quarter after expanding 2.3% in the fourth quarter of 2015.

- Nondefense spending increased by 1.5% in both the first quarter of 2016 and the fourth quarter of 2015.

- National defense spending fell by 3.6% in the fourth quarter after registering a 2.8% increase in the previous quarter.

- State and local government spending increased by 2.9% in the first quarter after falling 1.2% during the prior quarter.

Related Stories

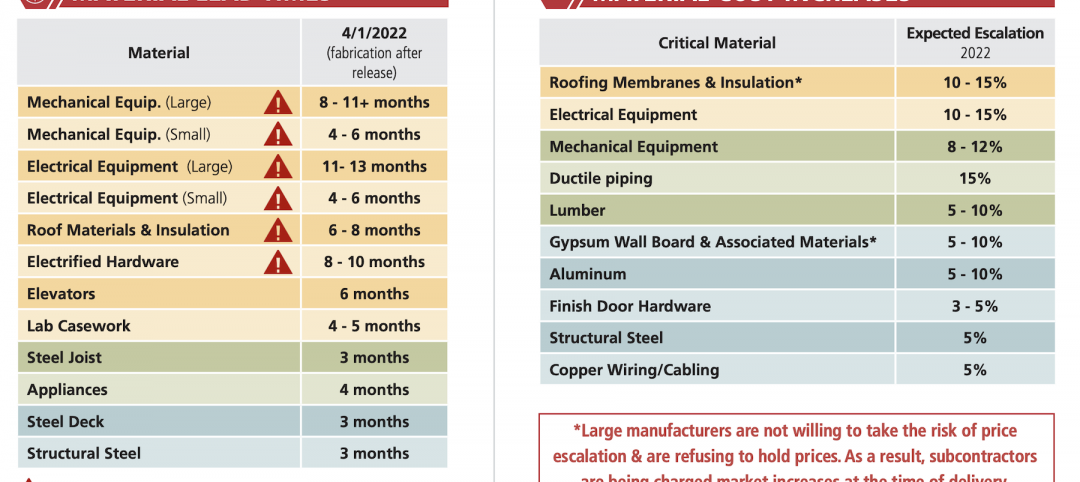

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment