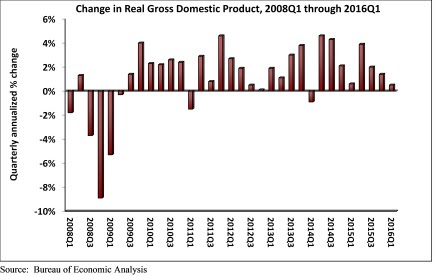

Real gross domestic product (GDP) expanded only 0.5% on a seasonally adjusted annual rate during 2016's first quarter according to an analysis of Bureau of Economic Analysis data released today by Associated Builders and Contractors (ABC). This disappointing figure follows a 1.4% annualized rate of economic output expansion during the fourth quarter of 2015.

Nonresidential fixed investment struggled with a 5.9% decline during the year's first three months after falling 2.1% during 2015's final quarter. Nonresidential fixed investment in structures fared particularly poorly, declining 10.7% during the first quarter on an annualized basis while nonresidential investment in equipment fell 8.6%.

"Aside from consumer spending growth, state and local government spending growth and residential building, very little expanded in America during the first three months of 2016," said ABC Chief Economist Anirban Basu. "It is quite conceivable that the current U.S. economic expansion will end before the economy registers a 3% or better rate of growth for a single calendar year. The last time the U.S. economy expanded more than 3% was in 2005, when the economy expanded 3.4%."

"Corporate profitability has been slipping in recent quarters and the mergers and acquisition marketplace has heated up, an unfavorable sign for nonresidential contractors," said Basu. "Many corporate CEOs continue to use available cash to purchase competitors either to gain access to product pipelines, thereby diminishing required product development expenses, or to generate cost savings by eliminating duplicative functions. The result is a lack of business investment generally and a slowing pace of private nonresidential construction spending growth. If it not for an enormous amount of foreign money coming to our shores, private nonresidential construction growth would have been even softer in early 2016. While falling energy-related investment and seasonal factors represent important parts of the story, there are indications of a broader malaise."

The following segments highlight the first quarter GDP release:

- Personal consumption expenditures rose 1.9% on an annualized basis during the first quarter of 2016 after growing 2.4% during the fourth quarter of 2015.

- Spending on goods inched 0.1% higher during the first quarter after expanding by 1.6% during the fourth quarter.

- Real final sales of domestically produced output increased 0.9% in the first quarter after rising 1.6% in the fourth.

- Federal government spending fell by 1.6% in the year's first quarter after expanding 2.3% in the fourth quarter of 2015.

- Nondefense spending increased by 1.5% in both the first quarter of 2016 and the fourth quarter of 2015.

- National defense spending fell by 3.6% in the fourth quarter after registering a 2.8% increase in the previous quarter.

- State and local government spending increased by 2.9% in the first quarter after falling 1.2% during the prior quarter.

Related Stories

Market Data | Jan 16, 2019

AIA 2019 Consensus Forecast: Nonresidential construction spending to rise 4.4%

The education, public safety, and office sectors will lead the growth areas this year, but AIA's Kermit Baker offers a cautious outlook for 2020.

Market Data | Dec 19, 2018

Brokers look forward to a commercial real estate market that mirrors 2018’s solid results

Respondents to a recent Transwestern poll expect flat to modest growth for rents and investment in offices, MOBs, and industrial buildings.

Market Data | Dec 19, 2018

When it comes to economic clout, New York will far outpace other U.S. metros for decades to come

But San Jose, Calif., is expected to have the best annual growth rate through 2035, according to Oxford Economics’ latest Global Cities report.

Market Data | Dec 19, 2018

Run of positive billings continues at architecture firms

November marked the fourteenth consecutive month of increasing demand for architectural firm services.

Market Data | Dec 5, 2018

ABC predicts construction sector will remain strong in 2019

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry.

Market Data | Dec 4, 2018

Nonresidential spending rises modestly in October

Thirteen out of 16 subsectors are associated with year-over-year increases.

Market Data | Nov 20, 2018

Construction employment rises from October 2017 to October 2018 in 44 states and D.C.

Texas has biggest annual job increase while New Jersey continues losses; Iowa, Florida and California have largest one-month gains as Mississippi and Louisiana trail.

Market Data | Nov 15, 2018

Architecture firm billings continue to slow, but remain positive in October

Southern region reports decline in billings for the first time since June 2012.

Market Data | Nov 14, 2018

A new Joint Center report finds aging Americans less prepared to afford housing

The study foresees a significant segment of seniors struggling to buy or rent on their own or with other people.

Market Data | Nov 12, 2018

Leading hotel markets in the U.S. construction pipeline

Projects already under construction and those scheduled to start construction in the next 12 months, combined, have a total of 3,782 projects/213,798 rooms and are at cyclical highs.