Construction industry leaders remained confident regarding nonresidential construction prospects in February 2019, according to the latest Construction Confidence Index released by Associated Builders and Contractors.

All three principal components measured by the survey—sales, profit margins, and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

Only 3.4% of contractors expect to reduce staffing levels over the next six months, and more than 70% of survey respondents expect their sales to increase through the initial half of 2019.

Still, 31.4% of contractors expect profit margins to remain unchanged, likely due in large measure to rising worker compensation costs.

Index breakdown:

• The CCI for sales expectations increased from 68.4 to 69.4 in February.

• The CCI for profit margin expectations increased from 60.6 to 63.3.

• The CCI for staffing levels increased from 68.2 to 68.5.

“Confidence seems to be making a comeback in America,” said ABC Chief Economist Anirban Basu. “There was a time when consumer, small business and investor confidence was falling. For now, that dynamic has evaporated, with job growth continuing and U.S. equity prices heading higher of late. Contractors understand the performance of the broader economy today helps shape the construction environment of tomorrow. Accordingly, with strong economic data like the Construction Backlog Indicator—which stood at 8.8 months in February 2019—and nonresidential construction spending, which increased 4.8% year over year, contractor confidence remains elevated.

“That said, contractors continue to wrestle with ever-larger skilled workforce shortfalls, which are making it more difficult to deliver construction services on time and on budget,” said Basu. “This helps explain why the CCI reading for profit margins remains meaningfully lower than the corresponding reading for sales expectations. Despite expanding compensation costs, contractors expect to significantly increase staffing levels going forward, an indication that many busy contractors expect to get busier. The fact that the profit margin reading remains above 50 also suggests that contractors enjoy a degree of pricing power and are able to pass at least some of their higher costs along to customers. Slower growth in construction materials prices relative to last year represents another likely factor shaping survey results.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

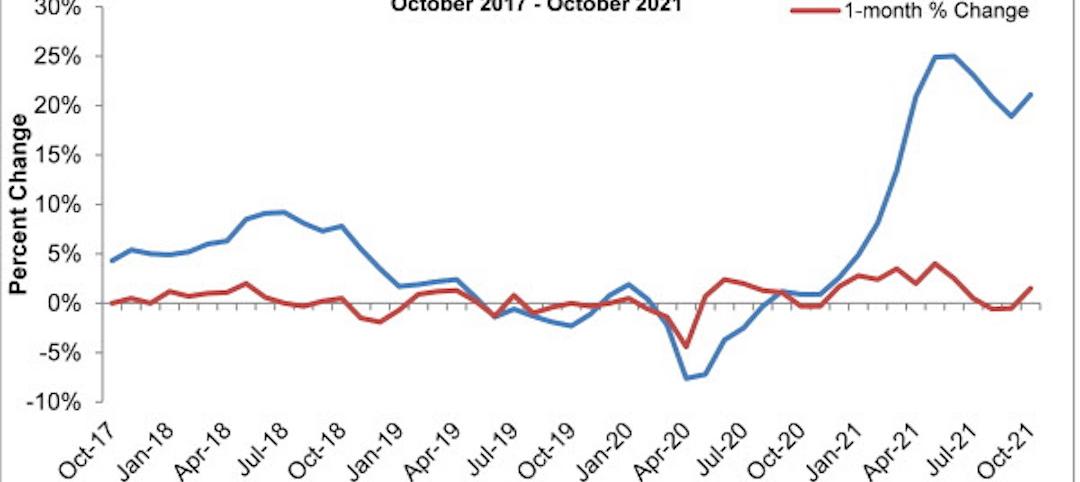

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

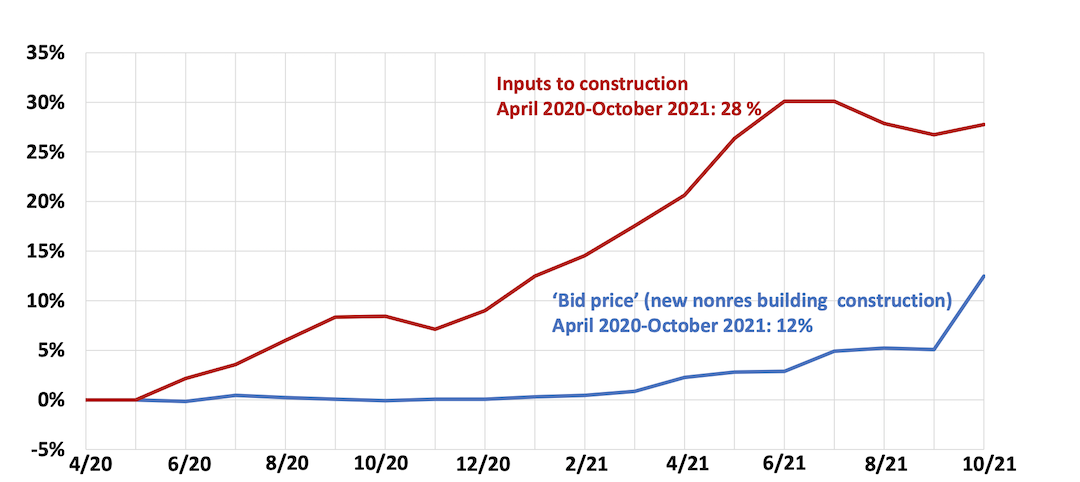

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.