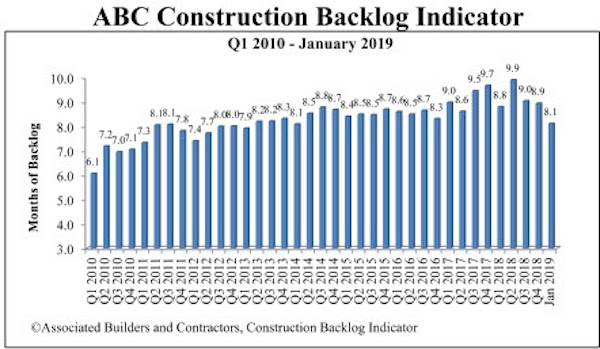

Associated Builders and Contractors recently reported that its Construction Backlog Indicator contracted to 8.1 months during January 2019, down 0.8 months or 9.3% compared to the fourth quarter 2018 reading of 8.9 months.

“This represents the latest in a number of indicators suggesting that U.S. economic momentum has begun to wane,” said Anirban Basu, ABC’s chief economist. “Other data tracking retail sales, employment growth and the trade deficit suggest that in contrast to 2018, this year will not be as strong from an economic growth perspective.

“January’s decline in nonresidential backlog was significant, slipping to levels last observed in 2014,” said Basu. “From an industry segment perspective, the decline in backlog was especially sharp in the infrastructure category, which may have been related to the federal shutdown in January.

“There was one meaningful exception in the Middle States, where backlog continues to rise,” said Basu. “This is potentially a result of stronger industrial production growth in 2017 and 2018, which has produced greater demand for modern industrial space. As with any January data release, weather may also have played a role in shaping the results. Accordingly, more clarity regarding contractual activity will arrive during the months ahead.”

Related Stories

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.