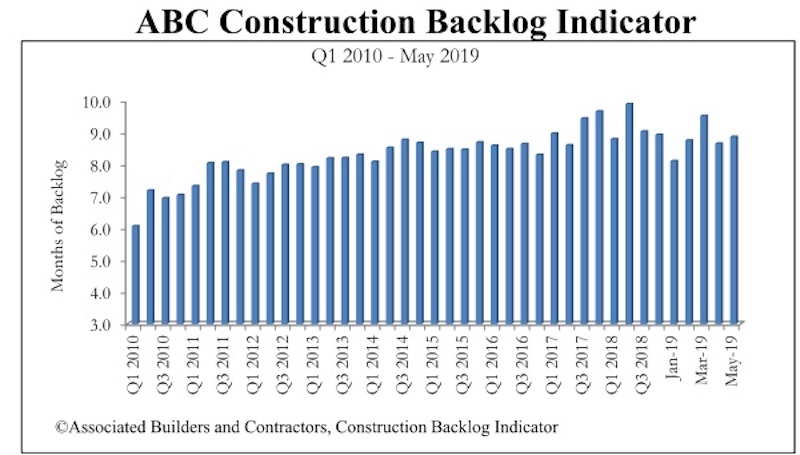

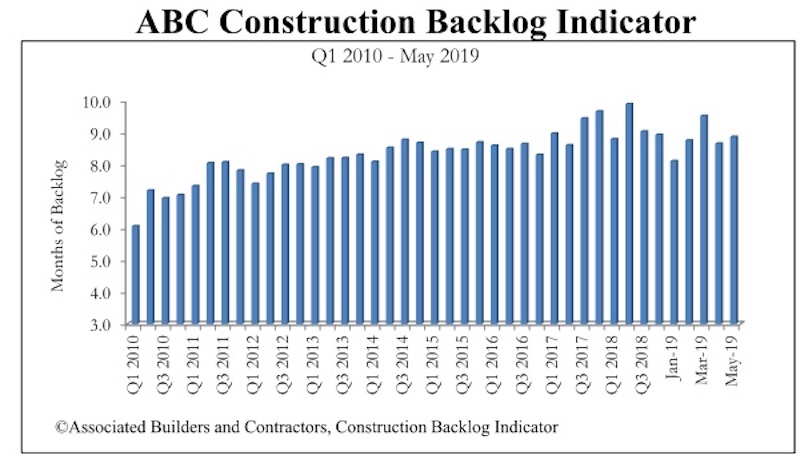

Associated Builders and Contractors reported today that its Construction Backlog Indicator expanded to 8.9 months in May 2019, up 0.2 months or 2.2% since April 2019, when CBI stood at 8.7 months.

“Nonresidential construction spending continues to be a significant source of economic strength in America, and the latest Construction Backlog Indicator strongly suggests that nonresidential construction spending will continue to be a major driver of business revenue growth and employment,” said ABC Chief Economist Anirban Basu. “Despite concerns about the rising costs of material prices and labor impacting construction contracts, demand for nonresidential construction services remains elevated for now.

“In general, nonresidential construction spending patterns lag the broader economy by 12-18 months,” said Basu. “While nonresidential construction doesn’t keep pace with other industry segments during the early stages of an economic recovery, it can continue to see robust growth during the late stages of an economic expansion. With the economy continuing to demonstrate momentum along the dimensions of financial market performance, job creation, income growth and consumer spending, contractors can expect several additional quarters of spending growth.

“That said, infrastructure backlog declined sharply in May, which is likely a statistical aberration,” said Basu. “The infrastructure category is dominated by several very large firms, and changes in their idiosyncratic backlog can have major impacts on the overall reading. There is little reason to expect a meaningful dip in infrastructure spending in the near term given the improving financial health of many states and localities across the nation. Moreover, backlog in the commercial/institutional and heavy industrial segments rose in May. Several construction firms specializing in heavy industrial construction in the Midwest report substantial increases in construction backlog.”

Related Stories

Hotel Facilities | Jan 13, 2016

Hotel construction should remain strong through 2017

More than 100,000 rooms could be delivered this year alone.

Market Data | Jan 6, 2016

Census Bureau revises 10 years’ worth of construction spending figures

The largest revisions came in the last two years and were largely upward.

Market Data | Jan 5, 2016

Majority of AEC firms saw growth in 2015, remain optimistic for 2016: BD+C survey

By all indications, 2015 was another solid year for U.S. architecture, engineering, and construction firms.

Market Data | Jan 5, 2016

Nonresidential construction spending falters in November

Only 4 of 16 subsectors showed gains

Market Data | Dec 15, 2015

AIA: Architecture Billings Index hits another bump

Business conditions show continued strength in South and West regions.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.