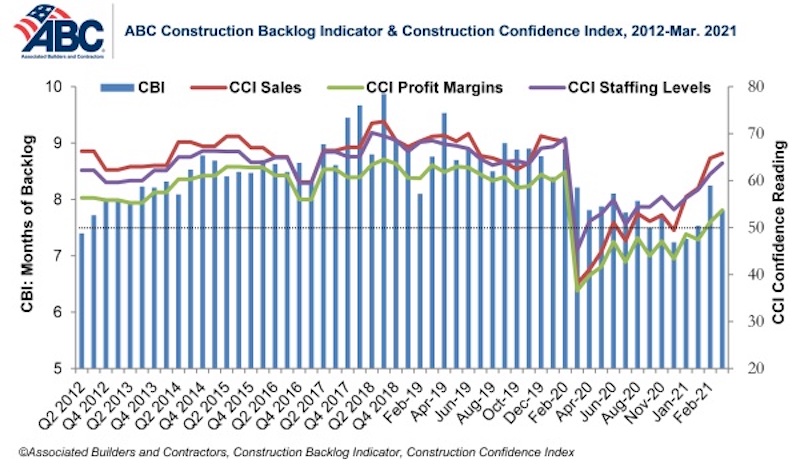

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 7.8 months in March, according to an ABC member survey conducted from March 22 to April 5, a decrease of 0.4 months from both the February 2021 and March 2020 readings.

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased in March. All three indices remain above the threshold of 50, indicating expectations of growth over the next six months.

“There are two countervailing forces influencing backlog,” said Basu. “On the one hand, design work on new projects declined during most of the pandemic. Some of this is attributable to the need to socially distance, risk aversion and the jarring effects of the crisis on commercial real estate. The result has been fewer projects presently available for bid, which is consistent with declining backlog.

“On the other hand, the surprisingly strong economic recovery has brought projects that seemed dead back to life,” said Basu. “The boom in e-commerce and other tech segments has also produced greater levels of demand for construction of fulfillment and data centers. The overall result is that backlog is roughly where it was six months ago. Given that contractors remain confident regarding sales, employment and profit margins over the balance of the year, the expectation is that more projects will enter the design phase, bidding opportunities are set to rise and at some point backlog will reestablish an upward trajectory.”

Click here for a short video from ABC’s chief economist to see what the latest survey data mean for the construction industry.

Related Stories

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.

Market Data | Jan 5, 2021

Barely one-third of metros add construction jobs in latest 12 months

Dwindling list of project starts forces contractors to lay off workers.