Between January 2021 and February 2022, nearly 57 million people in the U.S quit their jobs. The average quit rate between August and December of last year was 4-4.1 million per month. In the construction sector alone, the quit rate during those five months ranged from 138,000 to 208,000 per month, according to Census Bureau estimates.

The so-called Great Resignation “was a wakeup call, in one sense” for America’s businesses and economy that continues to resonate. However, AEC firms have tended to respond to this phenomenon instead of measuring its impact.

That’s the assessment of Karl Feldman, a partner with Hinge Marketing, a research-based branding and marketing firm headquartered in Reston, Va. Hinge has been tracking employee satisfaction, and its latest study explores why people leave their jobs, based on responses to a poll of AEC workers at different career levels from 120 firms with combined revenue of over $8 billion. The polling was conducted between late August and late November 2022.

Forty-four percent of respondents were “mid career,” and another 28 percent were at “leadership” levels, such as directors or vice presidents. More than half of the respondents worked for firms with at least 200 employees each.

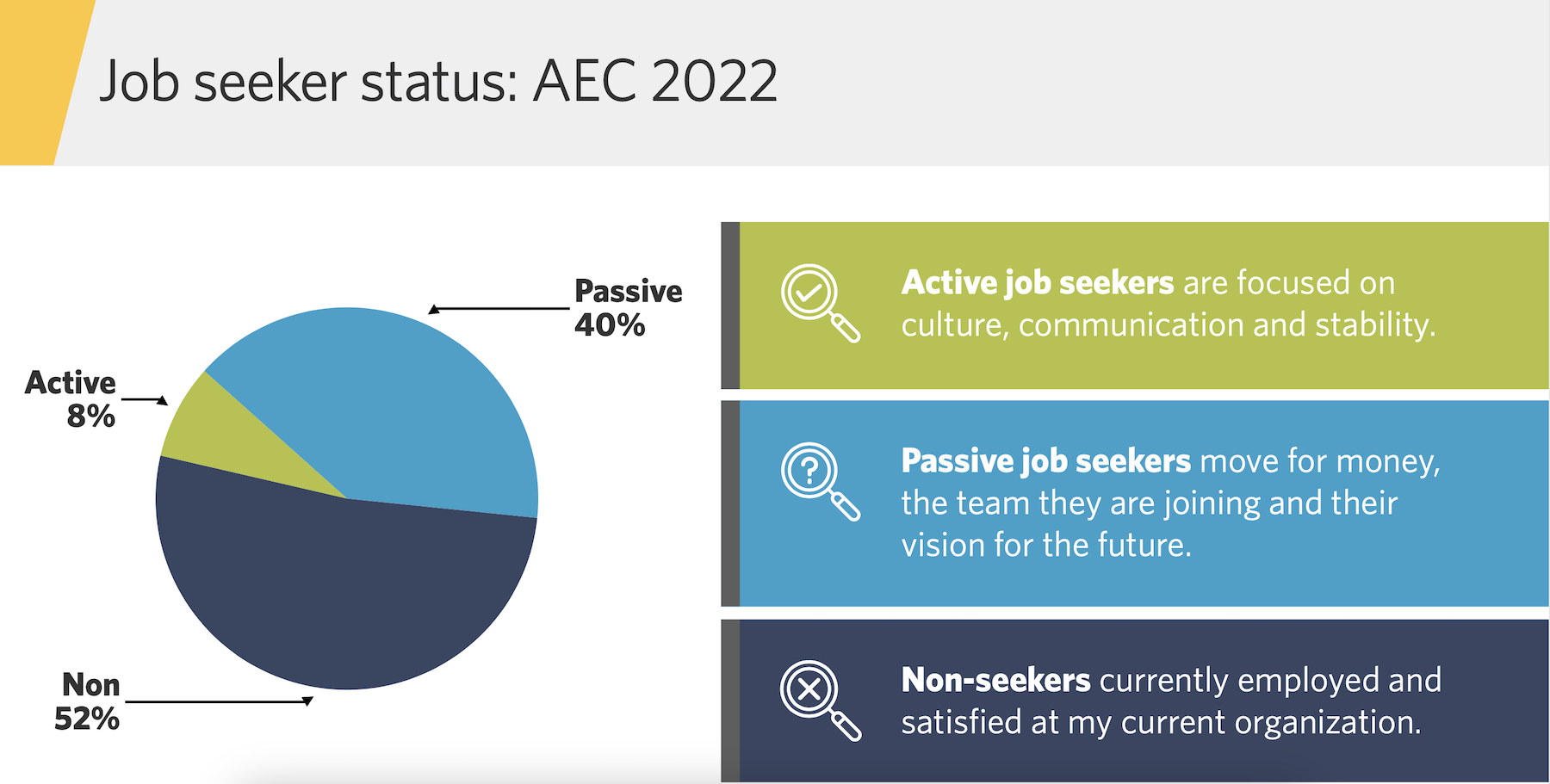

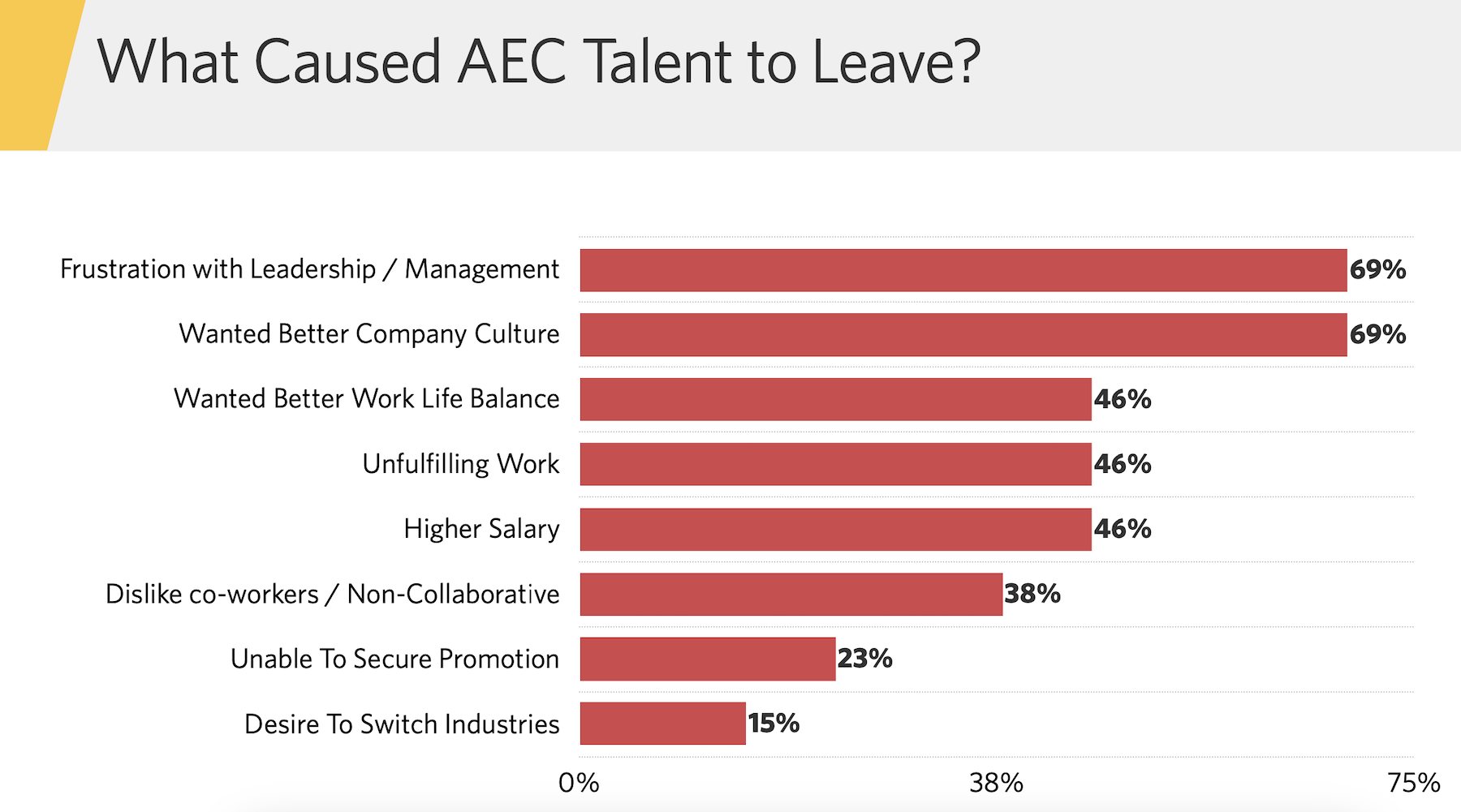

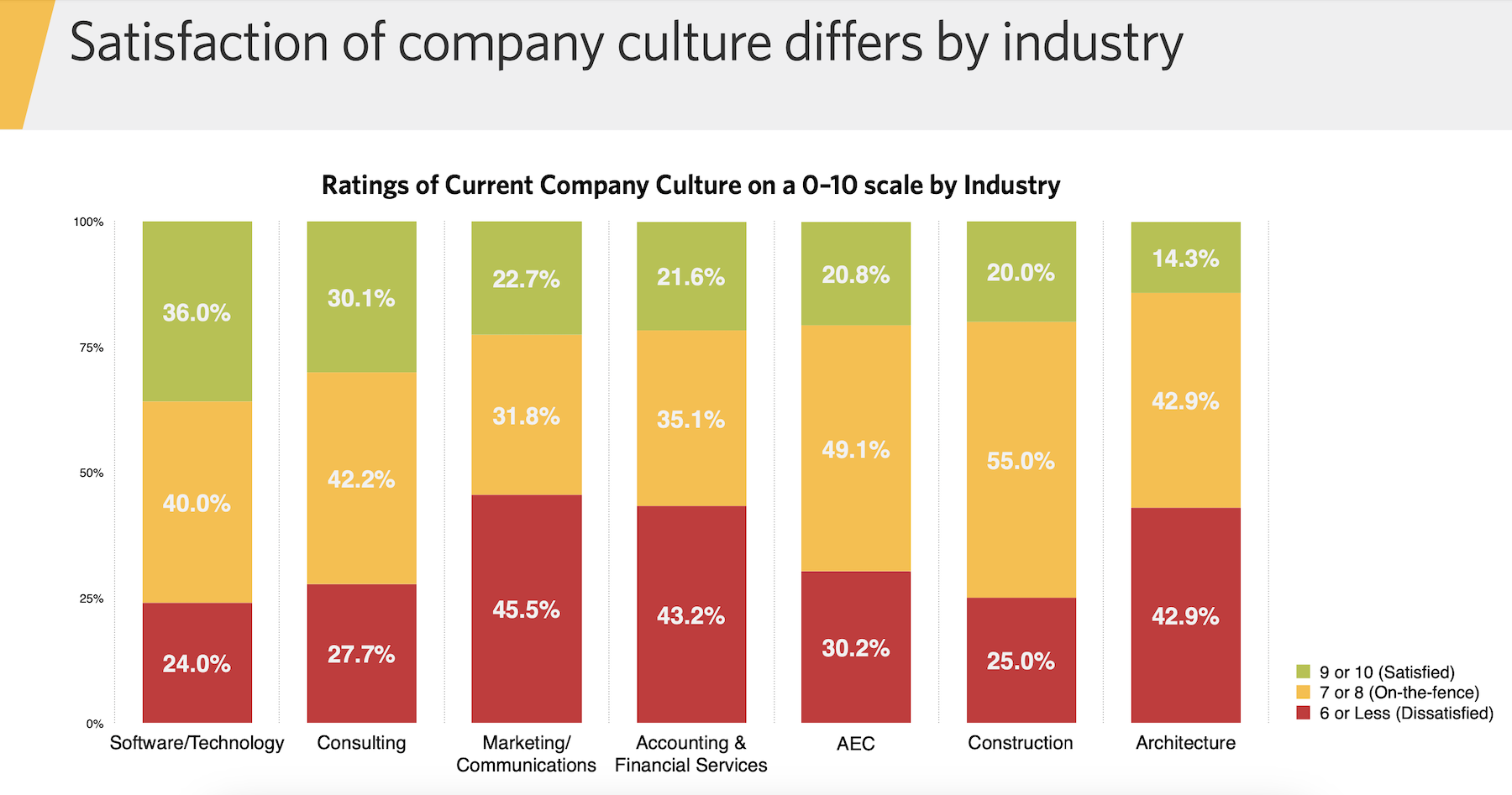

The survey found that only a relatively small percentage of workers is actively looking for a new job. But the survey also found that talent is most likely to start coveting greener pastures in mid-career, three to five years into their current jobs. Nearly half of AEC employees are on the fence about their companies, neither satisfied nor dissatisfied; however, more than half of AEC workers who had quit in the previous 12 months cited two factors—a poor company culture or frustration with its leadership—among their reasons for bolting.

Feldman observes that many businesses still perceive “culture” as sounding “fluffy.” But, he explains, culture is essentially about how a company gets things done. “That’s the question that talent is asking about companies,” he says, and the answers better be “genuine.”

Show and tell

Feldman says that technology and organizational support are the “great equalizers” in corporate America. “The days of rainmakers are gone,” he believes. That being said, Feldman observes that employees expect their companies to invest in their “brands,” in ways that burnish their reputations and visibility. “Folks who stand out from the ‘beige’ are going to have an edge.”

The problem with the AEC sector, says Feldman, is that it’s still behind the curve using automation tools that can aggregate data to understand what employees expect and want. He wonders, for example, how many AEC firms can describe what their ideal job candidate are? Or how many firms are set up to tutor younger-generation employees who, Feldman says, are eager to learn from mentors?

The survey found that mid-career and leadership employees alike want to feel confident that their voices are being listened to. But on a range of what’s important to them, mid-career workers aren’t keen on wearing too many job hats, whereas leaders require the option and tools to work efficiently from remote locations.

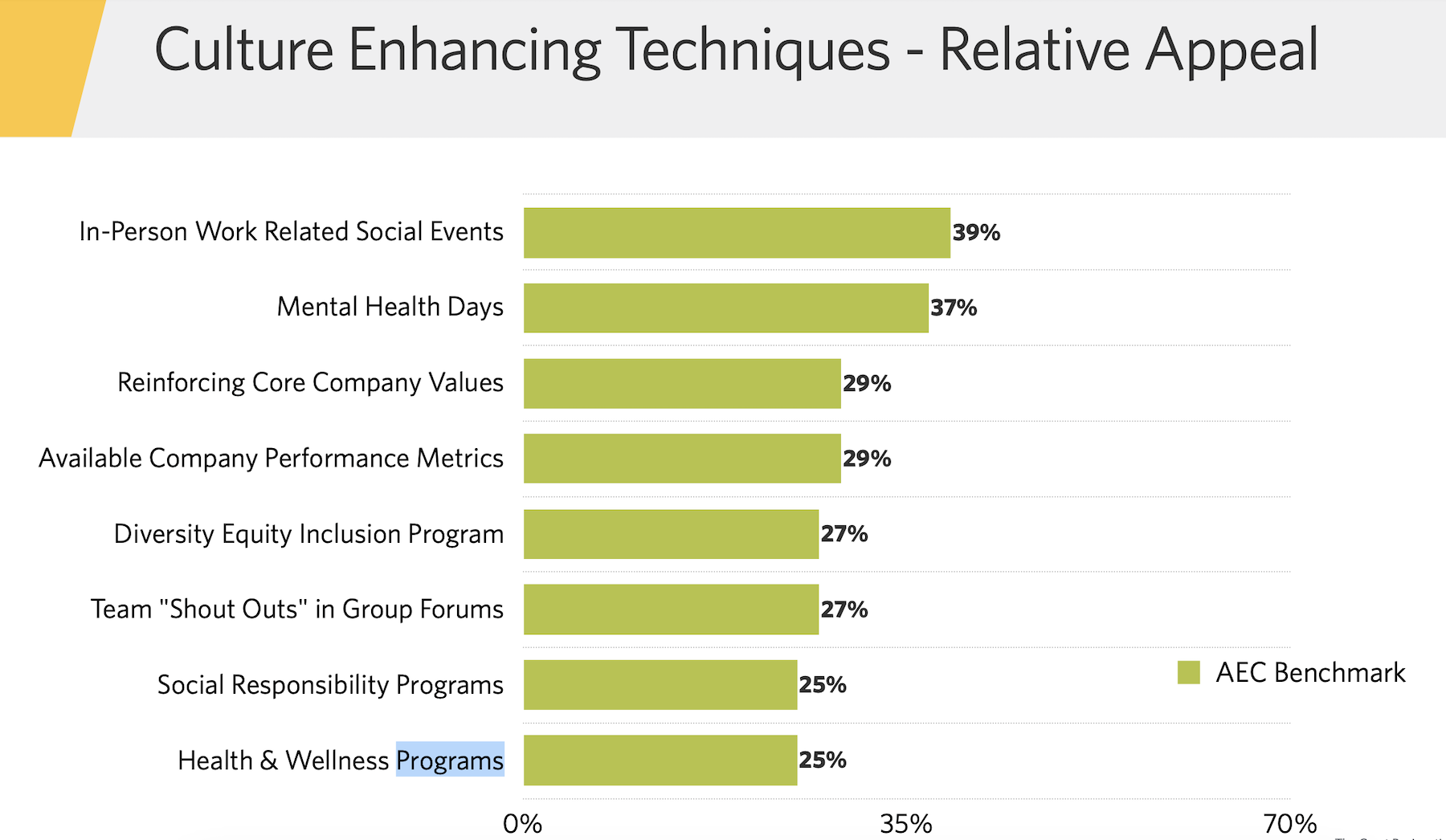

Hinge’s study offers AEC firms six strategies for keeping talent corralled. The first advises them to get to know their employees better at their mid-career levels. Companies should also conduct self-assessments of their brands, “tune” and communicate their cultures, showcase their employees’ expertise, introduce job candidates to their teams, and secure whatever “accelerants” a company needs to retain and expand their talent.

“Mid-level leadership is looking for a good home, but also wants to grow,” says Feldman. What companies need to ask themselves is “will we be more visible and credible” to retain employees they want to keep?

Related Stories

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

Global forces push construction prices higher

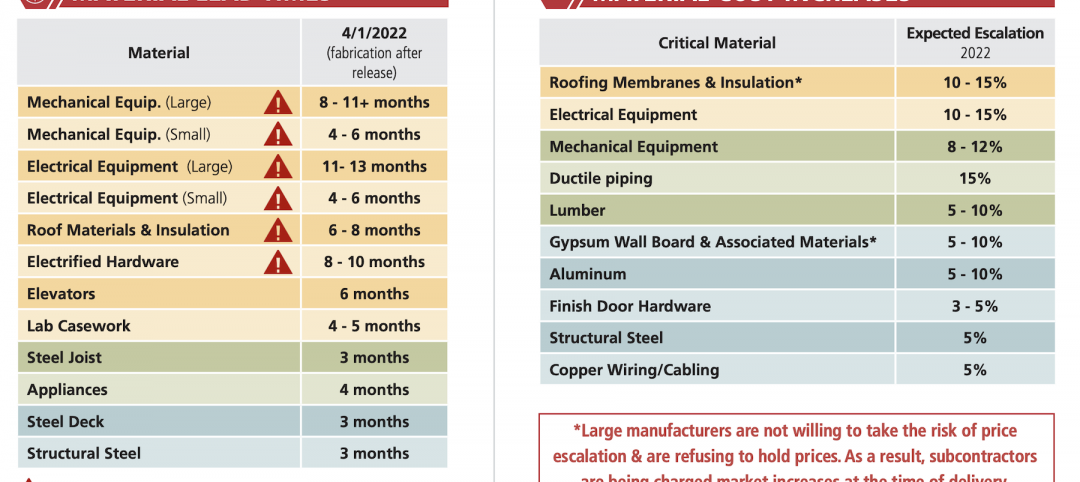

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.