Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year. This followed the 8.0 NPMI in the 4th Quarter of 2022, which marked the lowest level since the final quarter of 2020 and the second-lowest NPMI recorded in the last 10 years.

PSMJ President Greg Hart noted that the 1st quarter results are a pleasant surprise, especially since data was collected after the Silicon Valley Bank collapse and amid continuing interest rate hikes and recession predictions. “I don’t think anybody expected this kind of recovery,” he said. “But inflation is cooling and there are some positive signs in the housing market, so maybe we’ve found the bottom.”

First quarter results have historically been the strongest throughout the history of the QMF survey, which may play some part in the jump in project opportunities. In the last 10 years, the first quarter NPMI averaged 45.2, with the results weakening in subsequent quarters. The average NPMI for the 2nd quarter since 2013 is 36.5, with the third and fourth quarters averaging 29.0 and 25.7, respectively. Year-over-year, the NPMI for the first three months of 2023 was down substantially from a near-record NPMI of 60.2 reported in the first quarter of 2022.

PSMJ’s proprietary NPMI is the difference between the percentage of respondents who say that proposal opportunities are growing and those reporting a decrease. In addition to overall activity, the QMF surveys A/E/C firm leaders about their proposal activity experience in 12 major markets and 58 submarkets.

Private Sector Construction Markets Struggle, Publics Thrive

Firms working in private-sector markets continue to report historically low levels of proposal activity, while those in the public sector perform better, as the chart below indicates. Environmental topped all 12 major markets with an NPMI of 71.4, followed by Water/Wastewater at 70.8. Transportation continues to thrive, aided by the Infrastructure Investment and Jobs Act (IIJA), with an NPMI of 65.5. Energy/Utilities remains solid, repeating its fourth-place finish from the prior quarter and a near-exact NPMI of 55.1 (down from 55.2).

Since the 1st quarter of 2019, the Energy/Utilities market has been out of the top five only once (the 2nd quarter of 2021), and the Water/Wastewater market has missed the top five just twice.

The biggest surprise of the 1st Quarter may be that Education was the fifth-strongest among the major markets with an NPMI of 42.2. This is the first time that Education hit the top five since the 2nd quarter of 2018. The Higher Education (NPMI of 45.3) and K-12 (42.3) submarkets drove the resurgence.

Related Stories

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

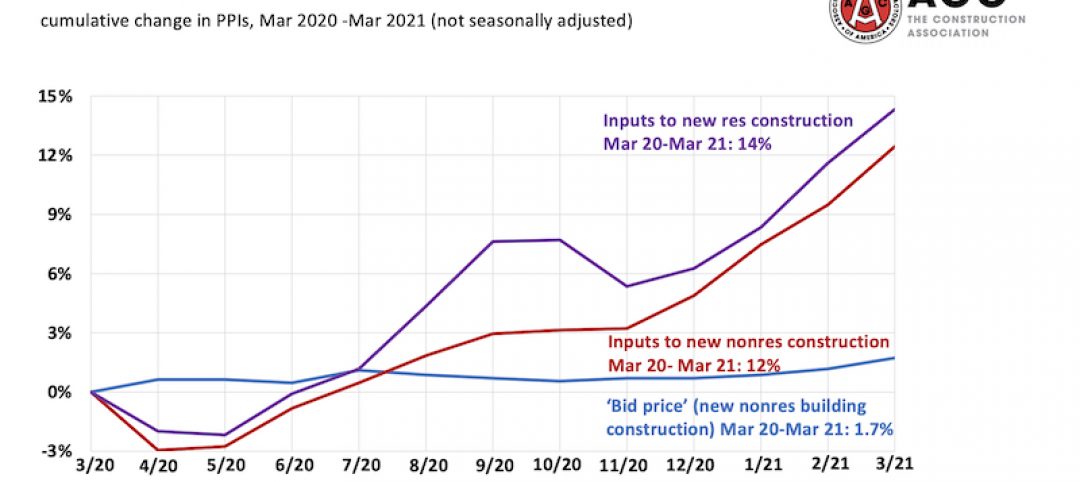

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

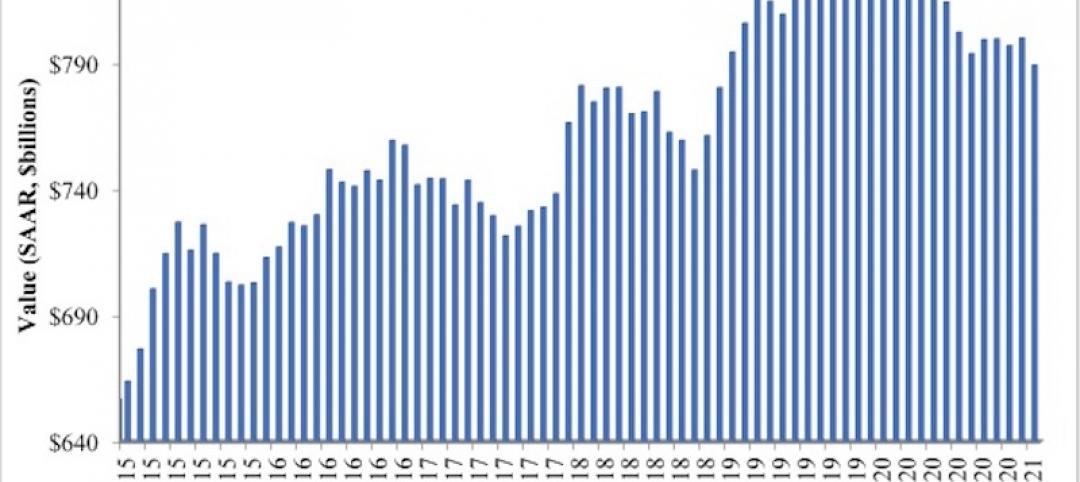

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.