The market outlook is brighter for U.S. architecture, engineering, and construction companies, with a majority of AEC firms reporting higher revenues, strong forecasts, and sound financial health, according to Building Design+Construction’s fourth annual Market Forecast Survey.

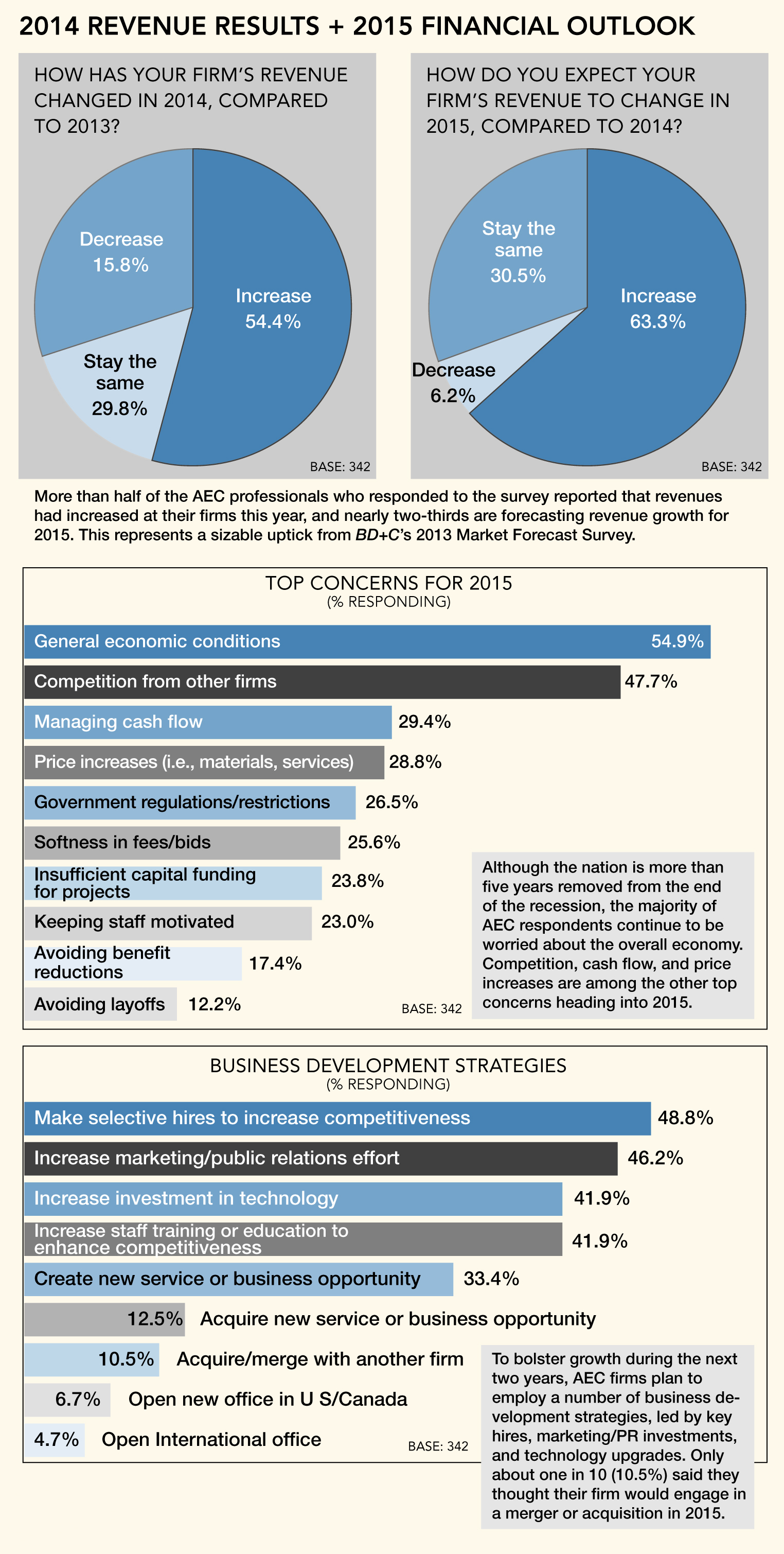

More than half (54.4%) of the 342 AEC professionals who responded to the survey reported that revenues had increased at their firms this year, and nearly two-thirds (63.4%) are forecasting revenue growth for 2015. This represents a sizable uptick from BD+C’s 2013 market forecast survey, in which 46.1% of respondents reported higher revenue for the year and 56.8% predicted growth for 2014.

Asked to rate their firms’ overall financial health, almost three-quarters (72.6%) responded either “good” (50.4%) or “very good” (22.2%), compared to just 55.5% in last year’s survey. Only 8.8% indicated that their firm is in a weakened state financially.

Firms are looking to sustain growth during the next two years through a variety of business development strategies, including strategic hires (48.8% rated it as a top tactic for growth), strengthened marketing/public relations efforts (46.2%), more staff training and education (41.9%), technology upgrades (41.9%), and launching a new service or business opportunity (33.4%).

Top concerns heading into 2015: general economic conditions (54.9% ranked it as a top concern), competition from other firms (47.7%), managing cash flow (29.4%), price increases in materials/services (28.8%), government regulations/restrictions (26.5%), and insufficient capital funding for projects (23.8%).

Healthcare keeps chugging, multifamily moves up

Survey respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale, from “excellent” to “very weak.” (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• For the second consecutive year, the healthcare sector ranked as one of the most active building sectors, with nearly two-thirds of respondents (63.6%) in the good/excellent category, compared to 62.5% in 2013 and 58.8% the previous year.

• Multifamily saw a nice bump in activity over last year, thanks primarily to the nation’s continued rental housing boom. More than six in 10 respondents (62.3%) gave the sector a good or excellent rating, up from 56.1% in the 2013 survey.

• As more Baby Boomers leave the workforce and enter their retirement years, the demand for senior and assisted living facilities is expected to spike. This trend is reflected in the survey results, with 59.2% of respondents indicating good/excellent prospects for this sector in 2015—down a bit from the 2013 survey (66.0%), but up strongly from the previous year (50.5%).

• The data center sector continues to be a powerhouse market for AEC firms, as data center providers, corporations, institutions, and government agencies rush to keep pace with the boom in mobile and cloud computing. The majority of respondents (58.2%) had either good or excellent prospects for the sector in 2015, up from 56.0% in 2013 and 45.2% the year before.

• The industrial/warehouse and office building sectors saw the largest year-over-year jump in activity among the respondent firms. Nearly half (43.3%) ranked the industrial sector in the good/excellent category, up from 33.0% last year, while 35.4% said they were upbeat about the office sector, versus 26.9% the previous year.

• Other sectors with sizable YoY percentage growth: retail (up 6.5 points, to 37.9%), multifamily (up 6.2 points, to 62.3%), K-12 schools (up 5.9 points, to 36.8%), and office interiors/fitouts (up 5.6 points, to 57.7%). The senior/assisted living sector was the only market to see a significant YoY percentage decline, but it still ranked as one of the industry’s most active sectors, according to the survey.

Uptick in BIM/VDC adoption

Following three years of relatively stagnant growth in the adoption of BIM/VDC software tools among BD+C readers, this segment saw modest growth in 2014. Eighty percent of respondents said their firm uses BIM/VDC tools on at least some of their projects, up slightly from 77.3% in the 2013 survey. The number of BIM power users increased, as well: 17.3% indicated that their firm uses BIM on more than 75% of projects, up from 12.2% last year.

The respondent breakdown by profession: architect/designer (45.3%), contractor (19.0%), engineer (16.7%), owner/developer (7.0%), consultant (4.1%), facility manager (3.8%), other (4.1%).

Related Stories

AEC Tech Innovation | Oct 8, 2024

New ABC technology report examines how AI can enhance efficiency, innovation

The latest annual technology report from Associated Builders and Contractors delves into how artificial intelligence can enhance efficiency and innovation in the construction sector. The report includes a resource guide, a case study, insight papers, and an essay concerning applied uses for AI planning, development, and execution.

Healthcare Facilities | Oct 8, 2024

Herzog & de Meuron completes Switzerland’s largest children’s hospital

The new University Children’s Hospital Zurich features 114 rooftop patient rooms designed like wooden cottages with their own roofs. The project also includes a research and teaching facility.

Mixed-Use | Oct 7, 2024

New mixed-use tower by Studio Gang completes first phase of San Francisco waterfront redevelopment

Construction was recently completed on Verde, a new mixed-use tower along the San Francisco waterfront, marking the end of the first phase of the Mission Rock development. Verde is the fourth and final building of phase one of the 28-acre project that will be constructed in several phases guided by design principles developed by a design cohort led by Studio Gang.

Brick and Masonry | Oct 7, 2024

A journey through masonry reclad litigation

This blog post by Walter P Moore's Mallory Buckley, RRO, PE, BECxP + CxA+BE, and Bob Hancock, MBA, JD, of Munsch Hardt Kopf & Harr PC, explains the importance of documentation, correspondence between parties, and supporting the claims for a Plaintiff-party, while facilitating continuous use of the facility, on construction litigation projects.

Glass and Glazing | Oct 7, 2024

Pattern language: An exploration of digital printing on architectural glazing

Architectural Glazing has long been an important expressive tool which, when selected and detailed thoughtfully, can contribute to the successful transformation of architectural concepts to reality.

University Buildings | Oct 4, 2024

Renovations are raising higher education campuses to modern standards

AEC higher ed Giants report working on a variety of building types, from performing arts centers and libraries to business schools. Hybrid learning is seemingly here to stay. And where possible, these projects address wellness and mental health concerns.

AEC Tech | Oct 3, 2024

4 ways AI impacts building design beyond dramatic imagery

Kristen Forward, Design Technology Futures Leader, NBBJ, shows four ways the firm is using AI to generate value for its clients.

Laboratories | Oct 2, 2024

Trends in scientific research environments: Q&A with Flad's Matt McCord

As part of an ongoing series, Matt McCord, AIA, NCARB, LEED AP BD+C, Associate Principal with Flad Architects, discusses the future of the scientific workplace.

Museums | Oct 1, 2024

UT Dallas opens Morphosis-designed Crow Museum of Asian Art

In Richardson, Tex., the University of Texas at Dallas has opened a second location for the Crow Museum of Asian Art—the first of multiple buildings that will be part of a 12-acre cultural district. When completed, the arts and performance complex, called the Edith and Peter O’Donnell Jr. Athenaeum, will include two museums, a performance hall and music building, a grand plaza, and a dedicated parking structure on the Richardson campus.

Data Centers | Oct 1, 2024

10 biggest impacts to the data center market in 2024–2025

While AI sends the data center market into the stratosphere, the sector’s accelerated growth remains impacted by speed-to-market demands, supply chain issues, and design innovation necessities.