The market outlook is brighter for U.S. architecture, engineering, and construction companies, with a majority of AEC firms reporting higher revenues, strong forecasts, and sound financial health, according to Building Design+Construction’s fourth annual Market Forecast Survey.

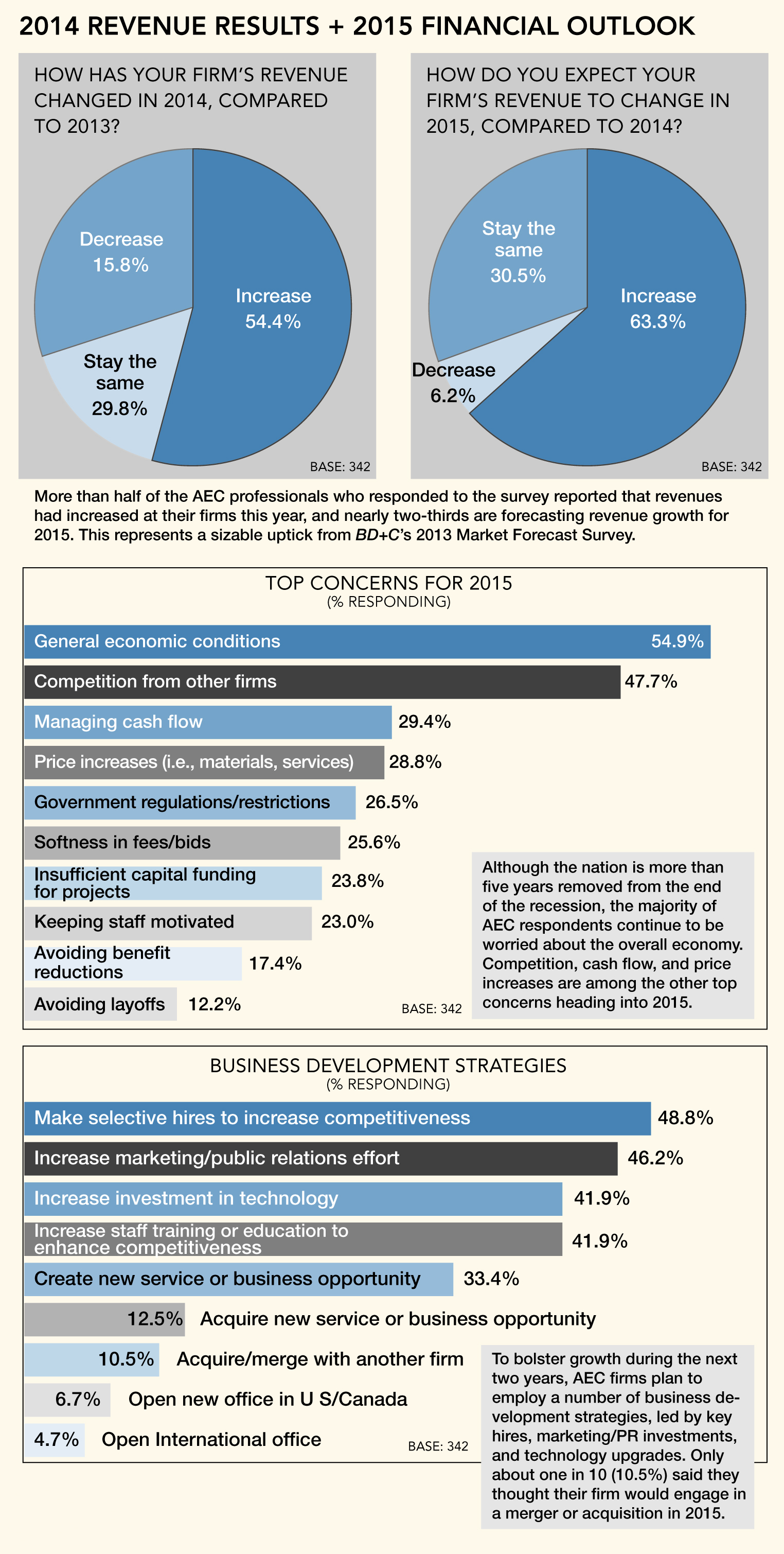

More than half (54.4%) of the 342 AEC professionals who responded to the survey reported that revenues had increased at their firms this year, and nearly two-thirds (63.4%) are forecasting revenue growth for 2015. This represents a sizable uptick from BD+C’s 2013 market forecast survey, in which 46.1% of respondents reported higher revenue for the year and 56.8% predicted growth for 2014.

Asked to rate their firms’ overall financial health, almost three-quarters (72.6%) responded either “good” (50.4%) or “very good” (22.2%), compared to just 55.5% in last year’s survey. Only 8.8% indicated that their firm is in a weakened state financially.

Firms are looking to sustain growth during the next two years through a variety of business development strategies, including strategic hires (48.8% rated it as a top tactic for growth), strengthened marketing/public relations efforts (46.2%), more staff training and education (41.9%), technology upgrades (41.9%), and launching a new service or business opportunity (33.4%).

Top concerns heading into 2015: general economic conditions (54.9% ranked it as a top concern), competition from other firms (47.7%), managing cash flow (29.4%), price increases in materials/services (28.8%), government regulations/restrictions (26.5%), and insufficient capital funding for projects (23.8%).

Healthcare keeps chugging, multifamily moves up

Survey respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale, from “excellent” to “very weak.” (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• For the second consecutive year, the healthcare sector ranked as one of the most active building sectors, with nearly two-thirds of respondents (63.6%) in the good/excellent category, compared to 62.5% in 2013 and 58.8% the previous year.

• Multifamily saw a nice bump in activity over last year, thanks primarily to the nation’s continued rental housing boom. More than six in 10 respondents (62.3%) gave the sector a good or excellent rating, up from 56.1% in the 2013 survey.

• As more Baby Boomers leave the workforce and enter their retirement years, the demand for senior and assisted living facilities is expected to spike. This trend is reflected in the survey results, with 59.2% of respondents indicating good/excellent prospects for this sector in 2015—down a bit from the 2013 survey (66.0%), but up strongly from the previous year (50.5%).

• The data center sector continues to be a powerhouse market for AEC firms, as data center providers, corporations, institutions, and government agencies rush to keep pace with the boom in mobile and cloud computing. The majority of respondents (58.2%) had either good or excellent prospects for the sector in 2015, up from 56.0% in 2013 and 45.2% the year before.

• The industrial/warehouse and office building sectors saw the largest year-over-year jump in activity among the respondent firms. Nearly half (43.3%) ranked the industrial sector in the good/excellent category, up from 33.0% last year, while 35.4% said they were upbeat about the office sector, versus 26.9% the previous year.

• Other sectors with sizable YoY percentage growth: retail (up 6.5 points, to 37.9%), multifamily (up 6.2 points, to 62.3%), K-12 schools (up 5.9 points, to 36.8%), and office interiors/fitouts (up 5.6 points, to 57.7%). The senior/assisted living sector was the only market to see a significant YoY percentage decline, but it still ranked as one of the industry’s most active sectors, according to the survey.

Uptick in BIM/VDC adoption

Following three years of relatively stagnant growth in the adoption of BIM/VDC software tools among BD+C readers, this segment saw modest growth in 2014. Eighty percent of respondents said their firm uses BIM/VDC tools on at least some of their projects, up slightly from 77.3% in the 2013 survey. The number of BIM power users increased, as well: 17.3% indicated that their firm uses BIM on more than 75% of projects, up from 12.2% last year.

The respondent breakdown by profession: architect/designer (45.3%), contractor (19.0%), engineer (16.7%), owner/developer (7.0%), consultant (4.1%), facility manager (3.8%), other (4.1%).

Related Stories

| Mar 23, 2011

AIA adds 13 new contract documents to Documents-on-Demand service

Web-based solution adds 13 popular Architect’s Scope of Services Documents to AIA Documents-on-Demand, providing easy access to documents anytime, anywhere.

| Mar 23, 2011

After 60 years of student lobbying, new activity center opens at University of Texas

The new Student Activity Center at the University of Texas campus, Austin, is the result of almost 60 years of students lobbying for another dedicated social and cultural center on campus. The 149,000-sf facility is designed to serve as the "campus living room," and should earn a LEED Gold certification, a first for the campus.

| Mar 23, 2011

Architecture Billings Index shows nominal increase

The American Institute of Architects (AIA) reported the February Architecture Billings Index score was 50.6, up slightly from a reading of 50.0 the previous month. This score reflects a modest increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.4, compared to a mark of 56.5 in December.

| Mar 22, 2011

The American National Standards Institute accredits Stantec for greenhouse gas verification

Stantec Consulting Ltd.’s Atmospheric Environment Group has been awarded accreditation by the American National Standards Institute (ANSI) for verification of assertions related to greenhouse gas (GHG) emissions. The Scope of Accreditation is for verification of emissions and removals at the organizational level for Group 1 – General.

| Mar 22, 2011

Mayor Bloomberg unveils plans for New York City’s largest new affordable housing complex since the ’70s

Plans for Hunter’s Point South, the largest new affordable housing complex to be built in New York City since the 1970s, include new residences for 5,000 families, with more than 900 in this first phase. A development team consisting of Phipps Houses, Related Companies, and Monadnock Construction has been selected to build the residential portion of the first phase of the Queens waterfront complex, which includes two mixed-use buildings comprising more than 900 housing units and roughly 20,000 square feet of new retail space.

| Mar 21, 2011

RATIO Architects announces merger with Cherry Huffman Architects

RATIO Architects, Inc. with studios in Indianapolis and Champaign, Ill., recently announced it has merged with prominent Raleigh, N.C., firm Cherry Huffman Architects.

| Mar 18, 2011

Universities will compete to build a campus on New York City land

New York City announced that it had received 18 expressions of interest in establishing a research center from universities and corporations around the world. Struggling to compete with Silicon Valley, Boston, and other high-tech hubs, officials charged with developing the city’s economy have identified several city-owned sites that might serve as a home for the research center for applied science and engineering that they hope to establish.

| Mar 17, 2011

Perkins Eastman launches The Green House prototype design package

Design and architecture firm Perkins Eastman is pleased to join The Green House project and NCB Capital Impact in announcing the launch of The Green House Prototype Design Package. The Prototype will help providers develop small home senior living communities with greater efficiency and cost savings—all to the standards of care developed by The Green House project.

| Mar 17, 2011

Hospitality industry turns to HTS Texas for ‘do not disturb’ air conditioned comfort

Large resort hotels and hospitality properties throughout the Southwest have been working with local contractors, engineers and HTS Texas for the latest innovations in quiet heating, ventilating and air conditioning (HVAC) equipment. The company has completed 12+ projects throughout Texas and the Southwestern U.S. over the past 18 to 24 months, and is currently working on six more hotel projects throughout the region.