The market outlook is brighter for U.S. architecture, engineering, and construction companies, with a majority of AEC firms reporting higher revenues, strong forecasts, and sound financial health, according to Building Design+Construction’s fourth annual Market Forecast Survey.

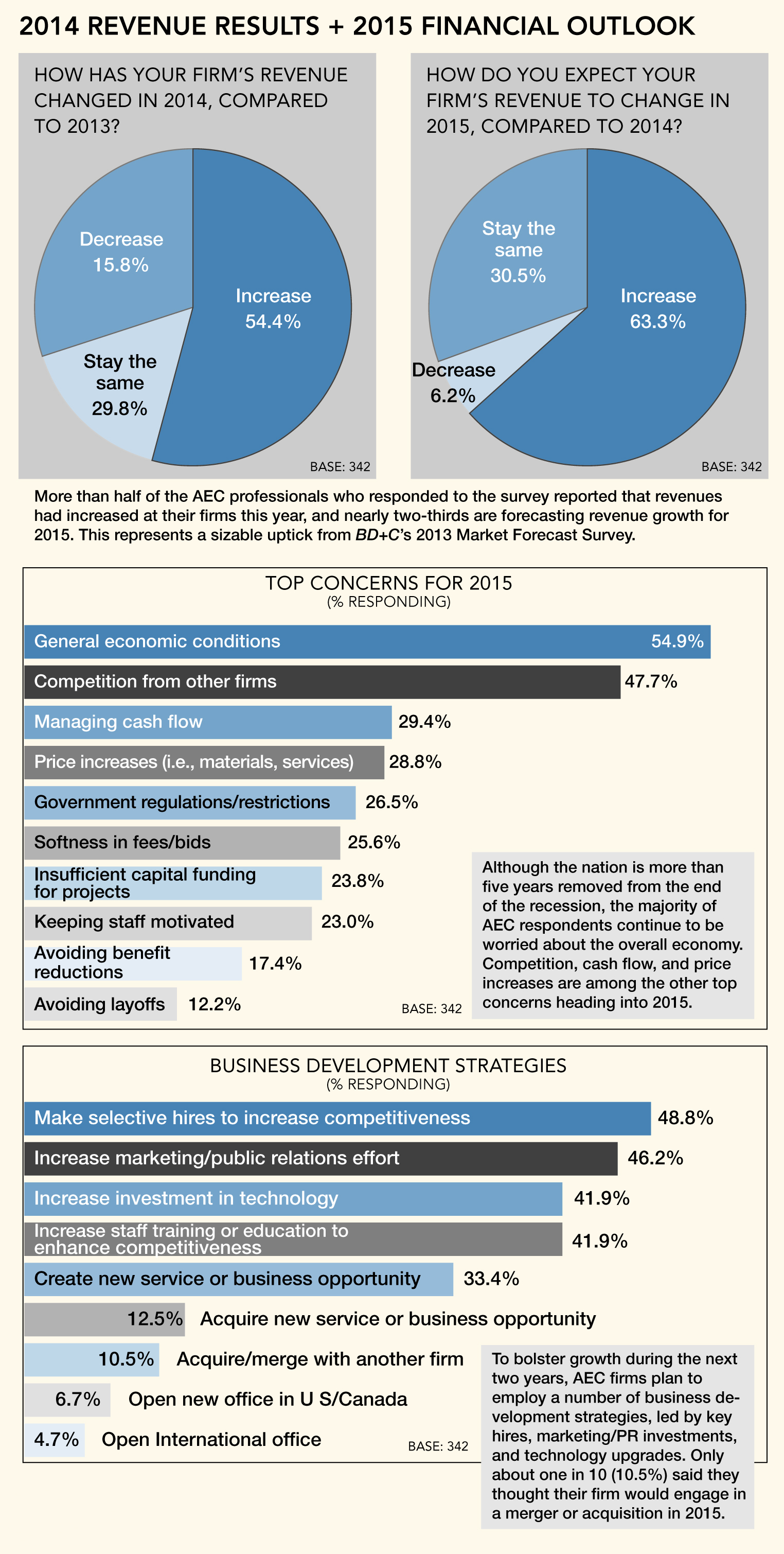

More than half (54.4%) of the 342 AEC professionals who responded to the survey reported that revenues had increased at their firms this year, and nearly two-thirds (63.4%) are forecasting revenue growth for 2015. This represents a sizable uptick from BD+C’s 2013 market forecast survey, in which 46.1% of respondents reported higher revenue for the year and 56.8% predicted growth for 2014.

Asked to rate their firms’ overall financial health, almost three-quarters (72.6%) responded either “good” (50.4%) or “very good” (22.2%), compared to just 55.5% in last year’s survey. Only 8.8% indicated that their firm is in a weakened state financially.

Firms are looking to sustain growth during the next two years through a variety of business development strategies, including strategic hires (48.8% rated it as a top tactic for growth), strengthened marketing/public relations efforts (46.2%), more staff training and education (41.9%), technology upgrades (41.9%), and launching a new service or business opportunity (33.4%).

Top concerns heading into 2015: general economic conditions (54.9% ranked it as a top concern), competition from other firms (47.7%), managing cash flow (29.4%), price increases in materials/services (28.8%), government regulations/restrictions (26.5%), and insufficient capital funding for projects (23.8%).

Healthcare keeps chugging, multifamily moves up

Survey respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale, from “excellent” to “very weak.” (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• For the second consecutive year, the healthcare sector ranked as one of the most active building sectors, with nearly two-thirds of respondents (63.6%) in the good/excellent category, compared to 62.5% in 2013 and 58.8% the previous year.

• Multifamily saw a nice bump in activity over last year, thanks primarily to the nation’s continued rental housing boom. More than six in 10 respondents (62.3%) gave the sector a good or excellent rating, up from 56.1% in the 2013 survey.

• As more Baby Boomers leave the workforce and enter their retirement years, the demand for senior and assisted living facilities is expected to spike. This trend is reflected in the survey results, with 59.2% of respondents indicating good/excellent prospects for this sector in 2015—down a bit from the 2013 survey (66.0%), but up strongly from the previous year (50.5%).

• The data center sector continues to be a powerhouse market for AEC firms, as data center providers, corporations, institutions, and government agencies rush to keep pace with the boom in mobile and cloud computing. The majority of respondents (58.2%) had either good or excellent prospects for the sector in 2015, up from 56.0% in 2013 and 45.2% the year before.

• The industrial/warehouse and office building sectors saw the largest year-over-year jump in activity among the respondent firms. Nearly half (43.3%) ranked the industrial sector in the good/excellent category, up from 33.0% last year, while 35.4% said they were upbeat about the office sector, versus 26.9% the previous year.

• Other sectors with sizable YoY percentage growth: retail (up 6.5 points, to 37.9%), multifamily (up 6.2 points, to 62.3%), K-12 schools (up 5.9 points, to 36.8%), and office interiors/fitouts (up 5.6 points, to 57.7%). The senior/assisted living sector was the only market to see a significant YoY percentage decline, but it still ranked as one of the industry’s most active sectors, according to the survey.

Uptick in BIM/VDC adoption

Following three years of relatively stagnant growth in the adoption of BIM/VDC software tools among BD+C readers, this segment saw modest growth in 2014. Eighty percent of respondents said their firm uses BIM/VDC tools on at least some of their projects, up slightly from 77.3% in the 2013 survey. The number of BIM power users increased, as well: 17.3% indicated that their firm uses BIM on more than 75% of projects, up from 12.2% last year.

The respondent breakdown by profession: architect/designer (45.3%), contractor (19.0%), engineer (16.7%), owner/developer (7.0%), consultant (4.1%), facility manager (3.8%), other (4.1%).

Related Stories

| Mar 11, 2011

Community sports center in Nashville features NCAA-grade training facility

A multisport community facility in Nashville featuring a training facility that will meet NCAA Division I standards is being constructed by St. Louis-based Clayco and Chicago-based Pinnacle.

| Mar 11, 2011

Slam dunk for the University of Nebraska’s basketball arena

The University of Nebraska men’s and women’s basketball programs will have a new home beginning in 2013. Designed by the DLR Group, the $344 million West Haymarket Civic Arena in Lincoln, Neb., will have 16,000 seats, suites, club amenities, loge, dedicated locker rooms, training rooms, and support space for game operations.

| Mar 10, 2011

Steel Joists Clean Up a Car Wash’s Carbon Footprint

Open-web bowstring trusses and steel joists give a Utah car wash architectural interest, reduce its construction costs, and help green a building type with a reputation for being wasteful.

| Mar 10, 2011

How AEC Professionals Are Using Social Media

You like LinkedIn. You’re not too sure about blogs. For many AEC professionals, it’s still wait-and-see when it comes to social media.

| Mar 9, 2011

Hoping to win over a community, Facebook scraps its fortress architecture

Facebook is moving from its tony Palo Alto, Calif., locale to blue-collar Belle Haven, and the social network want to woo residents with community-oriented design.

| Mar 9, 2011

Winners of the 2011 eVolo Skyscraper Competition

Winners of the eVolo 2011 Skyscraper Competition include a high-rise recycling center in New Delhi, India, a dome-like horizontal skyscraper in France that harvests solar energy and collects rainwater, and the Hoover Dam reimagined as an inhabitable skyscraper.

| Mar 9, 2011

Igor Krnajski, SVP with Denihan Hospitality Group, on hotel construction and understanding the industry

Igor Krnajski, SVP for Design and Construction with Denihan Hospitality Group, New York, N.Y., on the state of hotel construction, understanding the hotel operators’ mindset, and where the work is.

| Mar 3, 2011

HDR acquires healthcare design-build firm Cooper Medical

HDR, a global architecture, engineering and consulting firm, acquired Cooper Medical, a firm providing integrated design and construction services for healthcare facilities throughout the U.S. The new alliance, HDR Cooper Medical, will provide a full service design and construction delivery model to healthcare clients.

| Mar 2, 2011

Design professionals grow leery of green promises

Legal claims over sustainability promises vs. performance of certified green buildings are beginning to mount—and so are warnings to A/E/P and environmental consulting firms, according to a ZweigWhite report.

| Mar 2, 2011

Cities of the sky

According to The Wall Street Journal, the Silk Road of the future—from Dubai to Chongqing to Honduras—is taking shape in urban developments based on airport hubs. Welcome to the world of the 'aerotropolis.'