The market outlook is brighter for U.S. architecture, engineering, and construction companies, with a majority of AEC firms reporting higher revenues, strong forecasts, and sound financial health, according to Building Design+Construction’s fourth annual Market Forecast Survey.

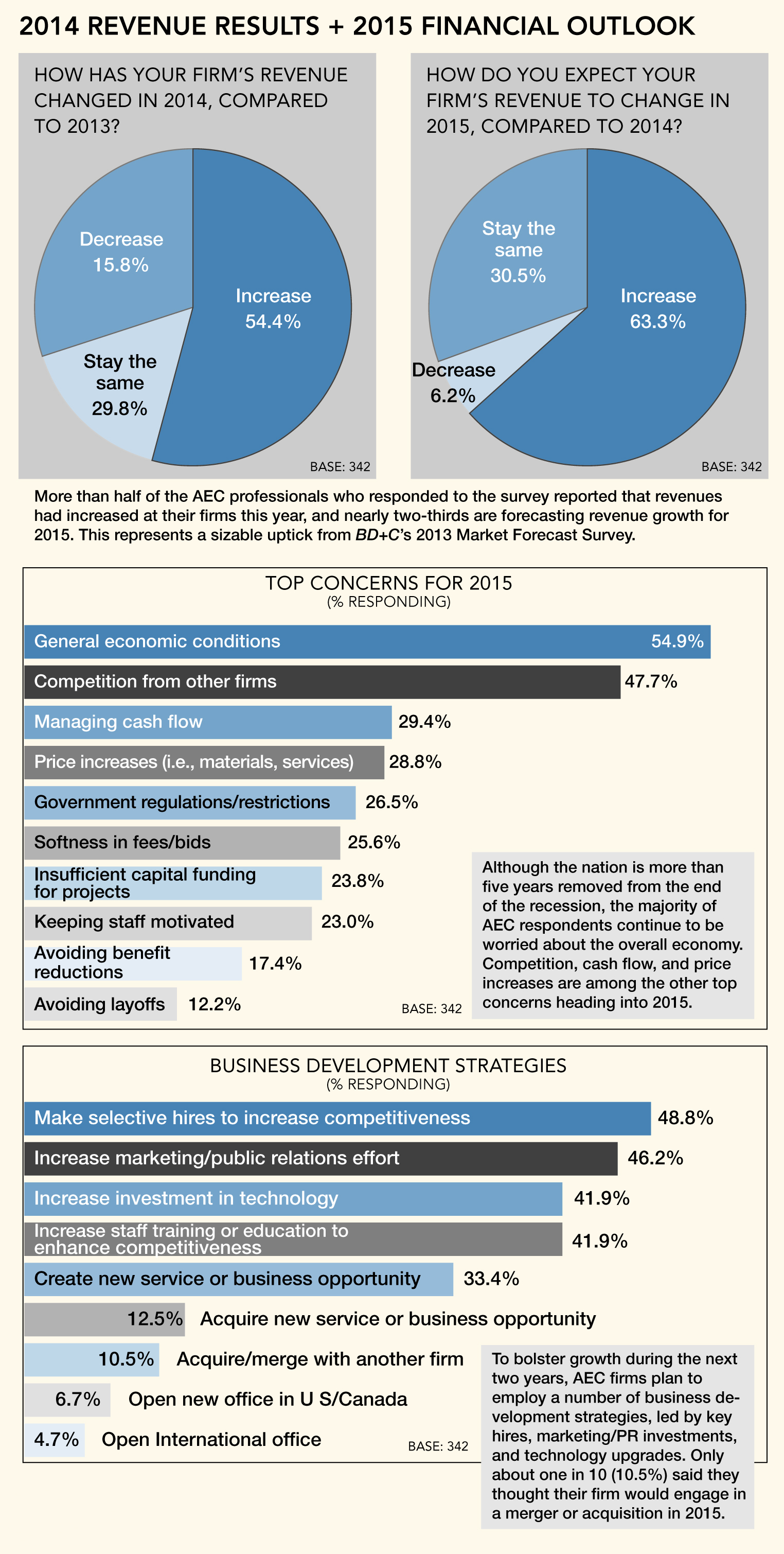

More than half (54.4%) of the 342 AEC professionals who responded to the survey reported that revenues had increased at their firms this year, and nearly two-thirds (63.4%) are forecasting revenue growth for 2015. This represents a sizable uptick from BD+C’s 2013 market forecast survey, in which 46.1% of respondents reported higher revenue for the year and 56.8% predicted growth for 2014.

Asked to rate their firms’ overall financial health, almost three-quarters (72.6%) responded either “good” (50.4%) or “very good” (22.2%), compared to just 55.5% in last year’s survey. Only 8.8% indicated that their firm is in a weakened state financially.

Firms are looking to sustain growth during the next two years through a variety of business development strategies, including strategic hires (48.8% rated it as a top tactic for growth), strengthened marketing/public relations efforts (46.2%), more staff training and education (41.9%), technology upgrades (41.9%), and launching a new service or business opportunity (33.4%).

Top concerns heading into 2015: general economic conditions (54.9% ranked it as a top concern), competition from other firms (47.7%), managing cash flow (29.4%), price increases in materials/services (28.8%), government regulations/restrictions (26.5%), and insufficient capital funding for projects (23.8%).

Healthcare keeps chugging, multifamily moves up

Survey respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale, from “excellent” to “very weak.” (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• For the second consecutive year, the healthcare sector ranked as one of the most active building sectors, with nearly two-thirds of respondents (63.6%) in the good/excellent category, compared to 62.5% in 2013 and 58.8% the previous year.

• Multifamily saw a nice bump in activity over last year, thanks primarily to the nation’s continued rental housing boom. More than six in 10 respondents (62.3%) gave the sector a good or excellent rating, up from 56.1% in the 2013 survey.

• As more Baby Boomers leave the workforce and enter their retirement years, the demand for senior and assisted living facilities is expected to spike. This trend is reflected in the survey results, with 59.2% of respondents indicating good/excellent prospects for this sector in 2015—down a bit from the 2013 survey (66.0%), but up strongly from the previous year (50.5%).

• The data center sector continues to be a powerhouse market for AEC firms, as data center providers, corporations, institutions, and government agencies rush to keep pace with the boom in mobile and cloud computing. The majority of respondents (58.2%) had either good or excellent prospects for the sector in 2015, up from 56.0% in 2013 and 45.2% the year before.

• The industrial/warehouse and office building sectors saw the largest year-over-year jump in activity among the respondent firms. Nearly half (43.3%) ranked the industrial sector in the good/excellent category, up from 33.0% last year, while 35.4% said they were upbeat about the office sector, versus 26.9% the previous year.

• Other sectors with sizable YoY percentage growth: retail (up 6.5 points, to 37.9%), multifamily (up 6.2 points, to 62.3%), K-12 schools (up 5.9 points, to 36.8%), and office interiors/fitouts (up 5.6 points, to 57.7%). The senior/assisted living sector was the only market to see a significant YoY percentage decline, but it still ranked as one of the industry’s most active sectors, according to the survey.

Uptick in BIM/VDC adoption

Following three years of relatively stagnant growth in the adoption of BIM/VDC software tools among BD+C readers, this segment saw modest growth in 2014. Eighty percent of respondents said their firm uses BIM/VDC tools on at least some of their projects, up slightly from 77.3% in the 2013 survey. The number of BIM power users increased, as well: 17.3% indicated that their firm uses BIM on more than 75% of projects, up from 12.2% last year.

The respondent breakdown by profession: architect/designer (45.3%), contractor (19.0%), engineer (16.7%), owner/developer (7.0%), consultant (4.1%), facility manager (3.8%), other (4.1%).

Related Stories

| Feb 15, 2011

Iconic TWA terminal may reopen as a boutique hotel

The Port Authority of New York and New Jersey hopes to squeeze a hotel with about 150 rooms in the space between the old TWA terminal and the new JetBlue building. The old TWA terminal would serve as an entry to the hotel and hotel lobby, which would also contain restaurants and shops.

| Feb 15, 2011

New Orleans' rebuilt public housing architecture gets mixed reviews

The architecture of New Orleans’ new public housing is awash with optimism about how urban-design will improve residents' lives—but the changes are based on the idealism of an earlier era that’s being erased and revised.

| Feb 15, 2011

LAUSD commissions innovative prefab prototypes for future building

The LA Unified School District, under the leadership of a new facilities director, reversed course regarding prototypes for its new schools and engaged architects to create compelling kit-of-parts schemes that are largely prefabricated.

| Feb 15, 2011

New 2030 Challenge to include carbon footprint of building materials and products

Architecture 2030 has just broadened the scope of its 2030 Challenge, issuing an additional challenge regarding the climate impact of building products. The 2030 Challenge for Products aims to reduce the embodied carbon (meaning the carbon emissions equivalent) of building products 50% by 2030.

| Feb 15, 2011

New Urbanist Andrés Duany: We need a LEED Brown rating

Andrés Duany advocates a "LEED Brown" rating that would give contractors credit for using traditional but low cost measures that are not easy to quantify or certify. He described these steps as "the original green," and "what we did when we didn't have money." Ostensibly, LEED Brown would be in addition to the current Silver, Gold and Platinum ratings.

| Feb 15, 2011

AIA on President Obama's proposed $1 billion investment in energy conservation

The President’s budget increases the value of investment in energy conservation in commercial buildings by roughly $1 billion, reports AIA 2011 President Clark Manus, FAIA. The significant increase from the current tax deduction of $1.80 per sq. ft. now on the books is an increase for which the AIA has been advocating in order to encourage energy conservation.

| Feb 14, 2011

Sustainable Roofing: A Whole-Building Approach

According to sustainability experts, the first step toward designing an energy-efficient roofing system is to see roof materials and systems as an integral component of the enclosure and the building as a whole. Earn 1.0 AIA/CES learning units by studying this article and successfully completing the online exam.

| Feb 11, 2011

Four Products That Stand Up to Hurricanes

What do a panelized wall system, a newly developed roof hatch, spray polyurethane foam, and a custom-made curtain wall have in common? They’ve been extensively researched and tested for their ability to take abuse from the likes of Hurricane Katrina.