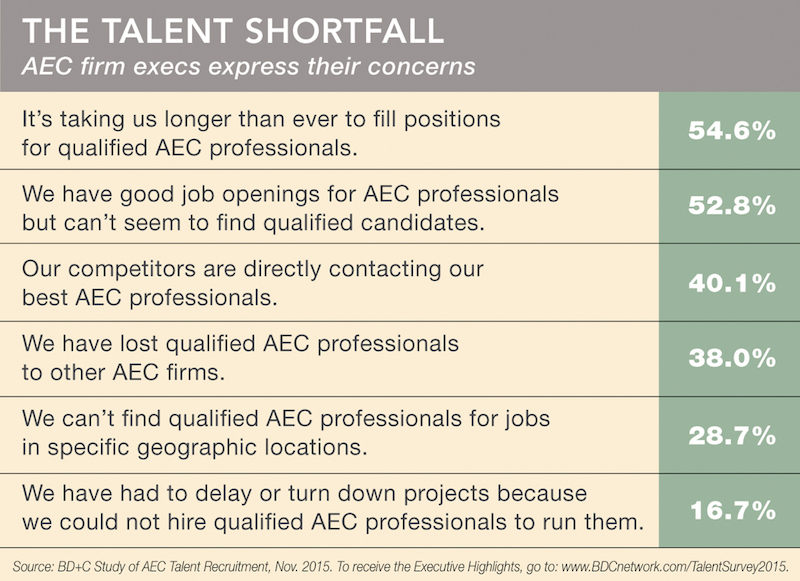

U.S. architecture, engineering, and construction firms are being stymied by the shortage of experienced design and construction professionals and project managers, according to an exclusive Building Design+Construction survey of 133 C-suite executives and human resources directors at AEC firms.

“Finding good qualified people with experience in running projects is a challenge” is how one respondent summarized the AEC field’s shortage of so-called “seller-doers.”

Download a PDF of the survey findings (registration required)

Another industry executive worried about the AEC sector’s changing demographics, said: “There are not many young people entering the profession, and there is an extreme lack of talented people in the 10+ years’ level of experience,” said this respondent. “We have no problem hiring college graduates, but keeping them after five years is difficult, and then we start over with a new hire.”

KEY FINDINGS FROM THE SURVEY

- Four out of five respondents (81.7%) said they anticipate their firms will add at least 5% to their professional staffs over the next two years.

- “AEC professionals with 6–10 years’ experience” was cited by 24.2% of respondents as the staff category that is more than usually difficult to recruit or hire, followed by “AEC professionals with more than 10 years’ experience” (17.1%).

- Project managers were deemed the third most unusually difficult position to fill, at 16.3%.

- Bringing up the rear: “AEC professionals with 3–5 years’ experience,” at 13.3%.

The majority of respondents said the hiring process for key professionals is taking longer than ever (54.6%). Less than one in five respondents (18.5%)

The majority of respondents said the hiring process for key professionals is taking longer than ever (54.6%). Less than one in five respondents (18.5%)

said their firms have not had serious problems hiring qualified professionals.

- “Specialty staff (IT, BIM/VDC, Revit, CAD, etc.)” were determined to be unusually difficult to recruit by 10.0% of respondents.

- Nearly six of 10 respondents (58.1%) said it has taken their firms four months or more to place their most difficult positions to fill.

- More than six in ten respondents (61.1%) said “flexible work hours” was offered as an incentive to attract qualified AEC professionals.

- Nearly seven in ten respondents (69.4%) stated that they used “word of mouth” (not specifically defined) as a recruiting tool. Nearly a quarter of respondents (23.2%) cited “word of mouth” as their firms’ most effective recruitment tool.

- The majority of respondents (54.6%) agreed with the statement, “It’s taking us longer than ever to fill positions for qualified AEC professionals.”

- More than four in five respondents (81.5%) reported one problem or other in their firms’ efforts to recruit and hire the right professionals.

Perhaps most startling of all was the finding that one in six respondents (16.7%) said their firms had delayed or turned down projects because they could not hire qualified AEC professionals to run them.

Respondents offered possible remedies for the talent shortfall. “Competition for talent is high,” said one respondent. “Focus by the entire team, including talent recruitment professionals, hiring managers, and company leadership, is key to success.”

“Firms need to realize that to attract and retain talent you cannot keep operating your company the same way they have been for the last few decades,” said another respondent. “You need to offer more vacation time, flexible hours, good insurance, a good salary. The firms that do this well do not seem to have issues with attraction and retention. Also, we have to be cognizant that these peak times will soon enough swing downward: they always do.”

Download a PDF of the survey findings (registration required).

Related Stories

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Industry Research | Dec 15, 2022

4 ways buyer expectations have changed the AEC industry

The Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry—detailing the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services.

Multifamily Housing | Dec 13, 2022

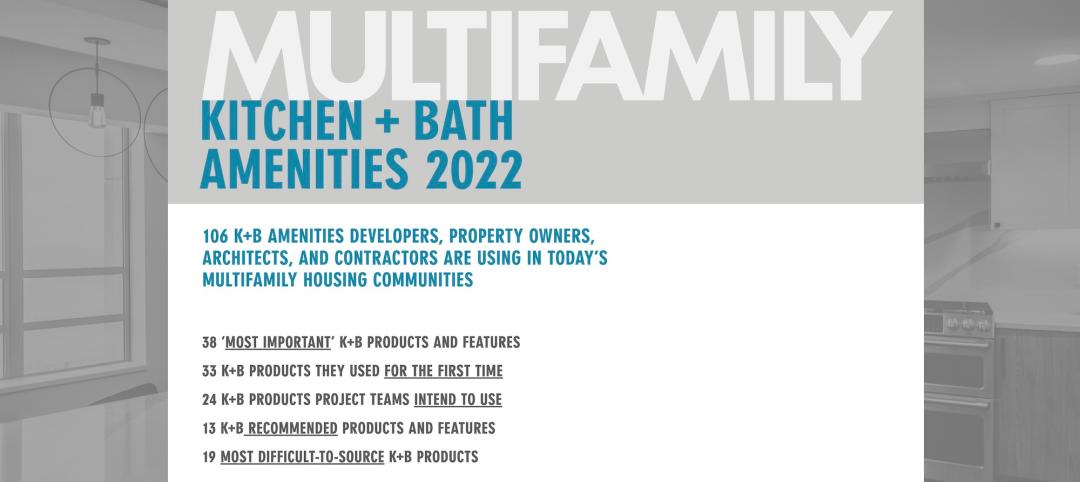

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Contractors | Nov 30, 2022

Construction industry’s death rate hasn’t improved in 10 years

Fatal accidents in the construction industry have not improved over the past decade, “raising important questions about the effectiveness of OSHA and what it would take to save more lives,” according to an analysis by Construction Dive.