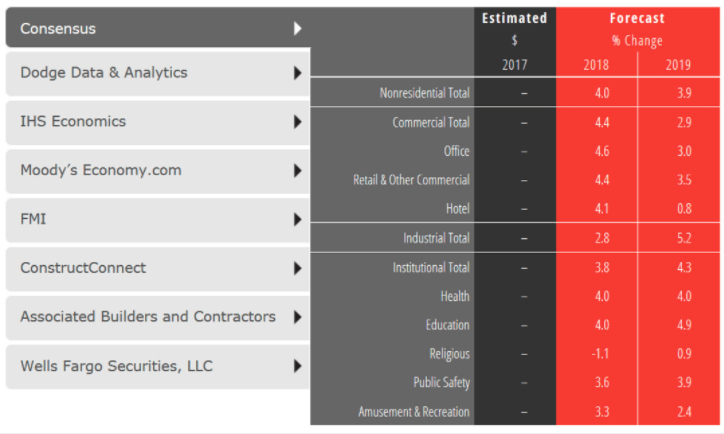

Despite labor shortages and rising material costs that continue to impact the construction sector, construction spending for nonresidential buildings is projected to increase 4.0% this year and continue at a 3.9% pace of growth through 2019.

The American Institute of Architects (AIA) semi-annual Consensus Construction Forecast indicates the commercial construction sectors will generate much of the expected gains this year, and by 2019 the industrial and institutional sectors will dominate the projected construction growth.

“Rebuilding after the record-breaking losses from natural disasters last year, the recently enacted tax reform bill, and the prospects of an infrastructure package are expected to provide opportunities for even more robust levels of activity within the industry,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “The Architecture Billings Index (ABI) and other major leading indicators for the industry also point to an upturn in construction activity over the coming year.”

CLICK TO VIEW INTERACTIVE CHART

CLICK TO VIEW INTERACTIVE CHART

Even eight and a half years into this current national economic cycle, the US economy remains on solid footings. Given the strong levels of business investment, economic growth is estimated to have been 2.2% to 2.3% range last year, easily topping the 1.5% growth from 2016. Over two million new payroll positions on net were added to the economy last year, the seventh straight year that payroll growth exceeded that level.

The national unemployment rate ended the year at 4.1%, its lowest level since 2000. And while low interest rates have helped to fuel this growth, rising stock prices have ensured that public companies have had access to capital to expand their operations. The Dow Jones industrial average increased almost 25% during the year.

However, in the face of a supportive economy, construction spending on nonresidential buildings disappointed last year. Overall spending on these facilities grew by only about 2.5%, with spending on manufacturing facilities seeing a steep double-digit decline.

The only sector achieving healthy growth was retail and other commercial facilities, an odd result given the numerous reports of failing shopping centers due to strong growth in e-commerce sales. However, much of the spending reported in the retail and other commercial facilities category was for distribution facilities and related logistic operations to support a more efficient e-commerce system.

Still, the slowdown in spending last year was sharper than expected. Annual 2015 increases were almost 16% across the entire nonresidential building category, with the office and lodging categories realizing strong gains, and the institutional categories posting increases of almost 8% overall.

Growth in activity eased in 2016, with overall spending on nonresidential buildings increasing by only 6% even though the office and lodging categories posted gains of nearly 25%. Spending on institutional facilities was disappointing, with increases totaling less than 2% in this category.

Related Stories

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

Contractors | Oct 1, 2024

Nonresidential construction spending rises slightly in August 2024

National nonresidential construction spending increased 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.22 trillion.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Contractors | Aug 21, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of July 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Contractors | Aug 1, 2024

Nonresidential construction spending decreased 0.2% in June

National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion. Nonresidential construction has expanded 5.3% from a year ago.