Despite what it describes as a “chaotic” year saddled with labor shortages and interest-rate creep, the American Institute of Architects (AIA) estimates that spending for nonresidential construction increased by nearly 8% in 2016. That growth is expected to continue for “another couple of years,” albeit somewhat more modestly.

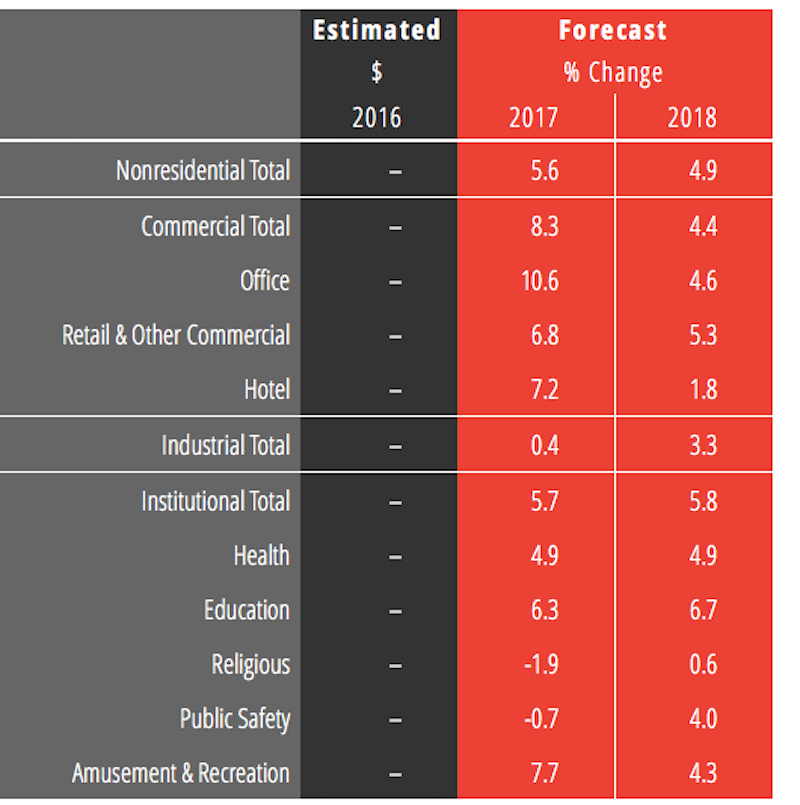

The AIA Consensus Forecast projects a 5.6% increase in nonres construction spending this year, and 4.8% in 2018, with commercial and industrial sectors growing at slower rates. (AIA did not include dollar amounts with its forecast.) And certain sectors, such as offices and hotels, are expected to cool considerably.

Offices, which increased by more than 20% in 2016, will grow 10.6% this year and by 4.6% in 2018, by AIA’s reckoning. Hotel spending, up 25% last year, should rise by 7.2% in 2017, but only by 1.8% the following year, according to AIA projections. Spending on healthcare building is expected to stay at nearly 5% growth this year and next.

Office construction spending is expected to stay relatively strong this year, with some fading in 2018. But hotel construction is expected to experience a significant decline. Image: AIA Consensus Construction Forecast.

AIA’s forecast is in line with other industry watchers, with the notable exception of a rosier portrait painted by Dodge Data and Analytics, which estimates that nonres spending, at $406.9 billion last year, will increase by 8.2% this year and by 7.3% in 2018. Dodge is far more bullish than AIA on office construction. But it also sees negative growth in the hotel sector in 2018.

On the flip side, FMI expects growth this year to be only 4.4%, and 4.1% in 2018, and foresees a weaker industrial sector than some of the other prognosticators.

Kermit Baker, Hon. AIA, AIA’s chief economist, addressed several issues affecting construction spending that could be impacted by the new Trump administration. For example, infrastructure spending, which is currently at about $1.2 trillion a year, could get a big boost if proposals to spend another $1 trillion over the next decade are realized.

The proposed repeal of the Affordable Care Act, and what would replace it are serious concerns for a construction industry where healthcare accounts for about 10% of total spending.

Trump has also promised “massive” regulatory rollbacks, especially on the environment front. Baker cites an NAHB study posted last May that attributes 24.3% of the price of a single-family home to government regulations. (Three-fifths of this is due to higher finished lot costs resulting from regulations.)

Baker also touches immigration restrictions that could “exacerbate an already serious labor problem” in a construction industry that is “most reliant on immigration for its workforce.”

On the whole, though, AIA is “quite positive” about the prospects for the construction sector, which it expects to outperform the broader economy over the next two years. However, AIA also see an industry “on the down side of this construction cycle.” The commercial sector is expected to show signs of slowing first, and AIA foresees its growth rate dropping from 17% in 2017, to 8% this year and just over 4% in 2018.

“Being this late in the cycle, the industry is more vulnerable to external disruptions, and the list of possibilities in this category is very long at present,” Baker writes.

Related Stories

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

Contractors | Oct 1, 2024

Nonresidential construction spending rises slightly in August 2024

National nonresidential construction spending increased 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.22 trillion.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Contractors | Aug 21, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of July 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Contractors | Aug 1, 2024

Nonresidential construction spending decreased 0.2% in June

National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion. Nonresidential construction has expanded 5.3% from a year ago.